Let us test the effectiveness of Google Alerts as a market intelligence tool for organizations.

G oogle Alerts remains one of the most popular news monitoring services. It is free and incredibly easy to set-up. Users have been creative in defining the use-cases that range from tracking companies, business and political leaders, significant events, interesting topics, and more. From a business perspective, there are two major use-cases in particular:

1. Media monitoring: Usually done by the PR functions to measure the impact and reach of their content. The end-goal is to monitor all mentions of a brand or company by casting a wide net and fetch all results that match search strings, irrespective of duplicates.

2. Company tracking: Usually done by strategy or marketing teams, senior executives, and individuals who want to keep themselves aware of news related to their business environment, industry, and functions. In this case, users expect to receive unique and important updates Market and Competitive Intelligence, leaving out all irrelevant and duplicate information.

This is a uniquely difficult position to balance, even for Google, given the two use cases are at opposite ends of the spectrum. Google Alerts has attempted to address this situation by introducing an option to choose all results versus the most important results. However, our analysis shows the effectiveness of this option is limited.

Clearly, Google Alerts don’t work for media monitoring. This is evident from a long list of Google Alerts alternatives that have become fairly popular.

However, there is little to no analysis available on how Google Alerts perform when it comes to the second use-case, i.e. tracking companies and topics of interest (without duplicates). This might be because unlike media and market intelligence

monitoring, there aren’t many effective tools that filter out the junk and deliver only strategic information to users. And hence, no comparisons are readily available.

While keeping aside the reasons for lack of such market intelligence tools, we undertook a study to qualitatively and quantitatively evaluate how effective Google Alerts is in getting unique and relevant information on companies regularly.

Study Design

This study aimed to evaluate the content delivered by Google Alerts on companies for strategic news and updates. To do this, we selected a random sample of 148 companies from the list of Fortune 1000. For each of these companies, we set-up a Google Alert by configuring the volume to ‘only the best results’. We chose a period of three midweek days to observe the content because on these days the content volume is highest.

For each alert of a company, we observed the volume (number of stories), relevance, and coverage, when compared to an independent search and populated them in a spreadsheet for summary analysis.

Results

Detailed below are the results from a quantitative perspective with a focus on content volume, relevance, and coverage. In the discussion section, we have elaborated on the challenges that a user faces and have touched on qualitative aspects with anecdotal examples.

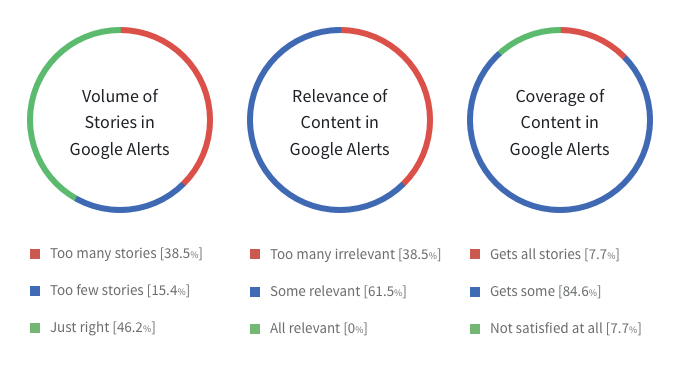

1. Content Volume: During the study period, we received updates from Google Alert for 136 out of 148 companies (92%). For these 136 companies, Google Alerts delivered a total of 2,024 updates with an average of ~9 updates per company. Please note that as a separate concurrent study, we also observed the alerts using the “All Results” setting in Google Alerts. With this setting, we received a total of 5,687 updates for 136 companies.

2. Content Relevance: As a next step, we evaluated the 2,024 updates provided by Google Alerts with the “Only the Best Results” setting. The criteria of the evaluation were to mark the stories which were either not about the company (just mention of the keyword), market stories (stock calls, etc.) or were duplicates. We found that only 211 updates were business-relevant (an average of ~10%). Note that most of the noise came from stories that were not about the company.

Content Coverage: Our next evaluation was to understand content coverage. For this, we used two sources:

1. Google search for news on the company in the study period

2. Business relevant content on the company website and social web pages.

At the end of this exercise, we found 115 stories that were not covered for 136 companies. This amounts to ~40% of business content being missed in Google Alerts. Possible reasons for this include lack of indexing of company websites and social networks in Google News.

To round-up these observations, we conducted a survey of Market Intelligence professionals, who use Google Alerts, and analyzed their opinions on the three parameters listed above. Here are the results based on the responses provided by 230 respondents, of which 60% were from North America and 40% from Asia-Oceania.

Discussion

This study on Google Alerts and the previous evaluation of unique business content posted by companies on social has delivered some market insightful data points for discussion. While the quantitative summary has been captured in the previous section, a note on the qualitative aspects is warranted:

We believe that while Google Alerts does a good job of deduplicating stories, however, it struggles in solving the question of aboutness and hence delivers information based on keywords alone.

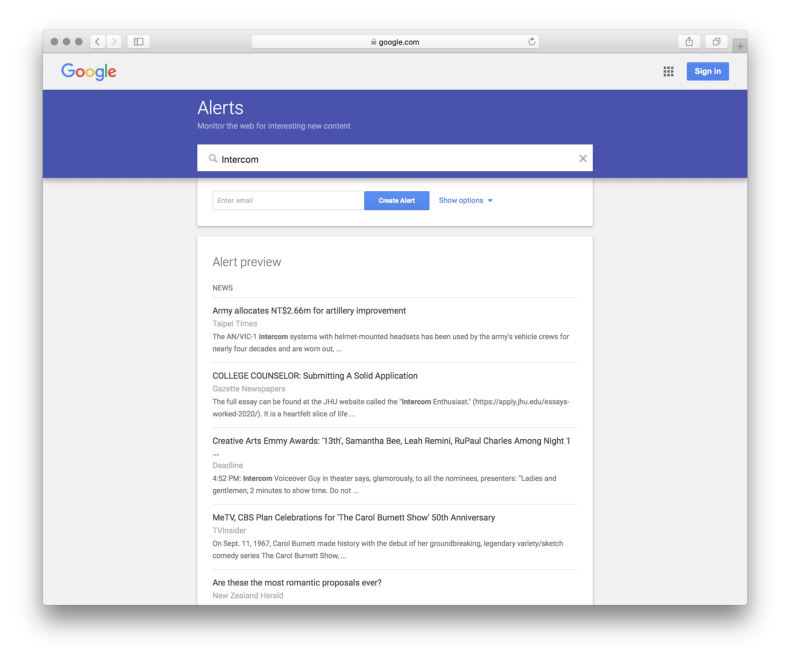

For example, we created a sample alert on the customer engagement company Intercom. Google Alerts gave us updates that mention the keyword Intercom, but they weren’t about the company Intercom.

Further, our observation is that Google Alerts has only a broad level of categorization for all kinds of industry insights like stock quotes for listed companies, news, blogs, etc. It is also missing out on social media which has become a source of a certain type of unique information for companies.

In our opinion, Google Alerts is a commendable free service to get started with general-purpose monitoring and notifications, but for business professionals, this may present the need for discipline and effort to sift through a lot of noise to find relevant content.

This could sometimes be dissuading for a user, given we already live in an environment of information overdose. Further, the cost of missing out on an important information piece could be seriously damaging. For a business user, with a need and an eye for information, Google Alerts may fall short on expectations. Read more on how does Google Alerts work and why it doesn’t

.

As far as Google alerts alternatives go, they are limited and we have tried to make a few recommendations: For free tools, users may try using Owler. For enterprise databases, users may evaluate Factiva. For custom Competitive Intelligence tools, users prefer Contify to get effective competitive intelligence research results. Take a 7-day free trial of Contify’s Market and Competitive Intelligence Platform >>