Problems associated with the drug discovery and development process

Drug discovery is the process of identifying new potential medicine, and a lengthy process at that. It has several stages such as preclinical research, clinical development, review by the regulatory bodies, and post-market safety monitoring. According to the Tufts Center for the Study of Drug Development, the average cost of developing a new drug is ~USD 2.6 Billion, and in general, it takes approximately 12 years for a new drug to hit the market.

Even after these significant expenses of time and money, it is hard to ascertain whether the drug will be launched in the market. Clinical trials for gene therapy is one such example. Several gene therapies have faced clinical hold or have been withdrawn in the past few years. It has caused losses that run into millions of dollars leaving some of the companies bankrupt. Plus, some companies have reprioritized their gene therapy program’s pipeline. Here are some examples:

– AstraZeneca was conducting clinical trials to cut heart risks among patients with mixed dyslipidemia using Epanova. The company took an immediate $100 million write-down on the program and later the drug was removed from the pipeline listing

– Opdivo, a PD-1 inhibitor manufactured by Bristol-Myers Squibb was unable to improve on progression-free survival (PFS) for glioblastoma multiforme and the CheckMate-548 trial was discontinued

– Astellas Pharma was developing gene therapy for a rare and fatal neuromuscular condition known as X-linked myotubular myopathy. The trial was halted after the deaths of the first three recipients, and later, the dose was lowered. However, in December 2020, the company had to pause it again after tests showed abnormal liver function in the fourth recipient

These events are a result of the adverse effects observed in clinical studies, as well as regulatory complexities. Thus to protect the significant investments and to manage risks involved in the process of drug discovery and development, deeper market & competitive insights are required.

Pharma companies partnering with AI to avoid losses in the drug discovery and development process

With increasing competition, pricing pressure, and highly uncertain clinical trial outcomes with gene therapies, pharma companies are investing a lot of money to find novel molecules using new technologies such as AI-based platforms. In the past 3 years, a substantial number of pharma companies have partnered with AI-based platforms to catapult their drug discovery program. Here are some examples:

– A multi-year partnership was announced in September 2019 between Novartis and Microsoft. Novartis will leverage data and Artificial Intelligence to transform the discovery, development, and commercialization of drugs. The strategic collaboration will focus on two core objectives: AI Empowerment and AI Exploration

– In 2019, a partnership was announced by Pfizer with Concreto HealthAI, to advance the work in Precision Oncology by deploying AI and real-world data and AI Exploration.

– Janssen announced a collaboration with a French startup in order to develop an AI-powered drug design system in 2019. The AI startup will evolve an in-silico system, based on neural network models called deep generative models.

How can Market & Competitive Intelligence help Pharma companies?

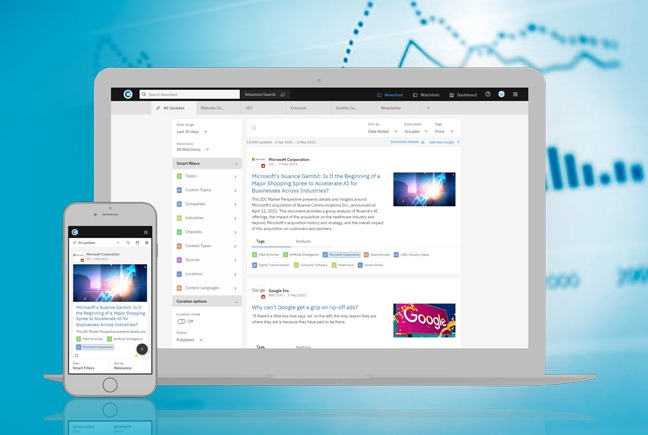

Adding market & competitive intelligence to this already established synergy of Pharma and AI can have remarkable results for Pharma companies. AI-powered Market and Competitive Intelligence platforms such as Contify can help pharmaceutical companies at each stage throughout the drug discovery and development process in the following ways:

1. Early development

a. Intelligence required to influence early “Go or No Go” decisions

b. Intelligence required to design future clinical studies

c. Tracking details of clinical development by competitors

2. Pre-launch (Before FDA approval)

a. Intelligence required to create/modify positioning and messaging, as well as marketing collateral for a successful launch

b. Tracking competitor messaging, changes in positioning/messaging, promotional material, etc.

3. Post-launch (Market defense)

a. Intelligence required to defend market position from competitors (direct, indirect or emerging)

b. Informing patent litigation efforts, generic manufacturing details, etc.

In addition to the above-mentioned uses, an M&CI platform helps in monitoring things such as competitors attracting new funding for research and development purposes, management changes, operational challenges, expansion strategies, new regulatory policies, drug approvals, etc. Further, it can also help to analyze the events participations, job postings, partnership activities, etc. undertaken by the competitors.

How large pharma companies are leveraging Contify's M&CI platform?

M&CI practices at larger pharma organizations often occur in silos and lack a robust intelligence-sharing mechanism. This inadvertently leads to duplication of information, leading to productivity, quality, and efficiency issues. In addition to the use-cases mentioned above, Pharma companies are using Contify in the following ways:

– Keeping track of competitors’ failures (negative news), preventing them from making the same mistakes, thus saving resources

– Staying on top of the current breakthrough therapies and trials, and giving pharma companies enough time to re-calibrate drug development plans

– Staying on top of their competitor’s drug approvals and drug launch dates

– Anticipating the response of regulatory authorities to their new initiatives

– Deep-diving into the details of clinical trials, scattered across conferences, news, publications, and national registries

– Finding gaps and unmet needs through the analysis of competitors’ activities

– Validating their strategic plans and commercial decisions

Contify provides users with access to all the actionable intelligence, across departments and geographies, in one place. Information is collected from various sources such as company press releases, presentations, marketing materials, news articles, and most important, regulatory updates, among others. Instant alerts of important updates can be sent in order to keep the clients informed.

To learn how Contify helped a US-based, leading pharma company in achieving its strategic objectives, read this case study: How a Pharma Company Leverages Competitive Intelligence Solution to Create Custom Intelligence Newsletters