Background

U ntil around five years back, the workflow of Market Intelligence (MI) teams was more or less clear. They primarily would do competitive landscape analysis by collecting data from news and metrics on their competitors, suppliers, partners, and industry stakeholders from company websites, news, and other information products. Occasionally, they supplemented these competitive insights with primary research through their network. They summarized information in presentations, spreadsheets, and documents and shared them with the leadership.

But then came waves of technology developments that ruffled the once placid waters of the Market Intelligence teams and changed their workflows significantly. One of these developments was data analytics. The widespread uptake of analytics demanded that the MI teams start integrating the internal data in ERPs into the external data they collected.

This pushed Market and Competitive Intelligence professionals to understand enterprise datasets better and to sometimes crunch numbers with their Business Intelligence counterparts. As a result, their market analysis was now well-rounded. Another disrupting technology was the cloud. As the cloud became ubiquitous, the way information was stored and delivered for consumption to internal clients changed. The information on PPTs started giving way to dashboards. And emails with document attachments were replaced with a shared storage on the cloud. The Market and Competitive intelligence professionals had to quickly get good at adjusting to these workflow changes to ensure seamless deliveries.

And then came social media. In the last few years, social found its revenue model for B2C advertising and companies started using it to engage with customers. But another important thing that happened almost gradually was that companies started to use social media as a corporate mouthpiece. They started posting all types of corporate announcements and marketing messages on social media. And of course, marketing messages made the bulk of the volume. For market intelligence teams to monitor this intelligence source, they had to cut through the noise created by the marketing department of companies. And that was difficult. Also, because most companies were still using traditional media to distribute information, an effort to tame social for market intelligence purposes was questionable. And the question remains to date.

The Question

In the last few years, one study after the other reported an ever-increasing use of social media for news consumption by the masses. The latest one was from the Pew Research Institute and it showed that social media has now become a key channel for news consumption (30% of the US adults consume news on Facebook, 11% on Youtube, and 8% on Twitter).

However, only a sporadic few articles were published on the relevance and importance of social for strategic business information. This was even though an increasing number of companies globally had started using social as a channel to communicate with their customers, investors, and the market. In April 2016, The Public Relations Society of America published an article citing the reasons why social is a suitable channel for business announcements. The reasons were:

1. Social media is versatile, whereas traditional media, once published, is set in stone.

2. Social media is immediate, while traditional can be delayed due to press times.

3. Social media is a two-way conversation, and traditional is one-way.

The original article published by PRSA postulated that both media social and traditional are important and will co-exist. But they missed to address a few important questions:

1. Why do they need to coexist?

2. Are these two media publishing the same information?

3. Which of these two media will be preferred by companies to broadcast for specific types of corporate information?

There was no study in popular and academic which provided these answers, and hence, we decided to find out ourselves.

Study

Premise:

Early this year, we decided to run a small study in a real-time environment to observe the coverage of market intelligence and business information by social and traditional media and see if there were meaningful differences. And if differences existed, know their nature.

Study design:

We took a sample of 50 global companies each from two popular lists of companies — The Fortune 1000 and the Inc. 5000 and tracked them for updates on both media. Some important notes on our study design are:

1. Fortune 1000 includes the top 1000 companies in the world ranked by market cap. This was to serve as a sample of large and established companies with most of the public.

2. The other list, i.e., Inc. 5000 is an annual list of fastest-growing companies (most of them private, small, and mid-sized companies).

3. Between these lists, we took a random sample of 100 companies and tracked their news in traditional media, and their updates on social media (Twitter, Facebook, Google+, and Youtube) for a week (Fortune 1000) and for a month (Inc. 5000).

4. We took a longer time frame for Inc. 5000 with a hypothesis that private companies are not as active as public companies when it comes to broadcasting information (which later proved correct) and a longer observation period might be needed to answer some questions with more confidence.

5. When evaluating their updates we filtered the content marketing updates and focused on actual business updates (product launches, events, change in management, funding, etc.)

Results and Insights

With tracking in place and manual evaluation of each story for the study period, we received some expected results and some eye-opening observations. Here are the key takeaways.

Coverage in traditional media

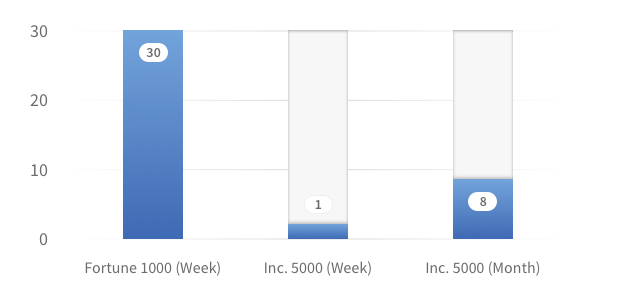

During a period of one week, 30 out of 50 Fortune 1000 companies had coverage in traditional media with at least one business update. However, only 1 of 50 the Inc. 5000 companies had any coverage in traditional media. Even with extended observation for a month, we found that only 8 of 50 Inc. 5000 companies were covered in traditional media.

Takeaway 01: Small companies have lower coverage in traditional media

Coverage in social media

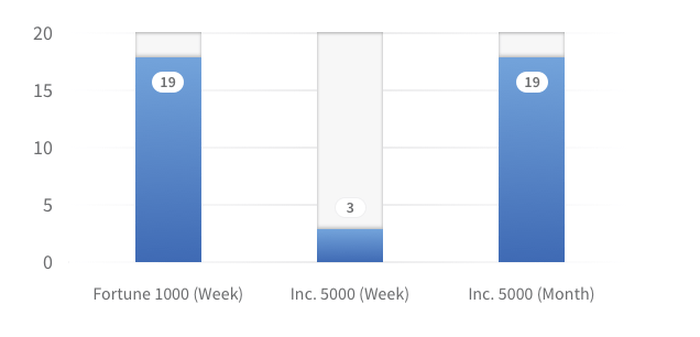

Observed for a week, we found that 19 out of 50 Fortune 1000 companies shared a business-relevant update on their social media websites, however, just 3 of 50 Inc. 5000 companies shared an important business update. When observed for a month, 19 of 50 Inc. 5000 companies had a business-relevant update to share.

Takeaway 02: For a given period, small companies have fewer business updates to share, as compared to large companies. However, small companies are more likely to announce an important business update on social rather than release press releases in traditional media.

Overlap and differentiation

From the first two points, it is clear that for large companies, traditional media has broader coverage than social. However, for small companies, it appears that social is used more than traditional media to share information in the public domain.

Next, we wanted to check the level of overlap of stories in two media and if there are any underlying trends, and here are the results:

Exclusivity:

1. When observed for a month, of the 19 Inc. 5000 companies that had an update on social media, 15 had no coverage in traditional media.

2. On the other hand, eight Inc. 5000 companies that had an update available in traditional media when observed for a month, four had no updates in social media.

3. Analysis of the Fortune 1000 companies yielded that of the total 50 companies, two had intelligence only in social, 35 had in both media, and 13 had exclusively in traditional media.

4. This indicates that the exclusivity of the content for small companies is high in social media (15) as compared to traditional media (four) and vice versa for large companies.

Content Analysis:

With the coverage and overlap problem solved, our last analysis was focused on the type of content that is exclusive to social media, i.e. the updates for which the companies preferred to use social media as a channel. We did a quick competitive market analysis and found that most of the exclusive content on social was related to event participation, awards received and management changes. Some samples include:

We are proud to be #1024 on the Inc. 5000 list for 2016!

— BrandXads

We are so excited to announce Andie Biederman as our newest account director!

— Fish Consulting

Look out for our CEO and founder, @tlanthier, at the #CDHA Future Colleagues Conferences in California this weekend, Feb. 25 & 26!

— DentalPost

This is however an area, which demands a more exhaustive study for statistically significant results.

Discussion/Conclusion

We found that traditional media works just fine for tracking large companies. However, when it comes to identifying early warning signals, tracking social media for fast-growing startups is important. For this kind of tracking, social media trumps the traditional media.

In our experience, not many Market Intelligence Teams are tracking social media. Intuitively, they feel that there could be a few relevant market and competitive insights, but it will be too much work to extract them from the excessive marketing noise in social media. At the same time, we also found that most Market and Competitive Intelligence professionals are concerned about the threats from new disrupting companies and technologies than traditional large competitors.

To see what Market Intelligence professionals think about this issue, we did a survey and asked them about their social media usage for strategic information on companies. Here are some of the responses:

Yes, we currently track social media:

“Launch of new initiatives and then we get to company websites for details” — Big 4 Consultant

“Product offering and launches, executive changes, open positions and new hires, new clients, strategic partnerships, new market entry, strategy changes and insights about company strategy.” — Management Consultant

“While there is plenty of information on top companies, these services help alert me to smaller company press releases, social posts, and news mentions.” — Industry Thought Leader on Intelligence

No, we do not monitor social:

“We work on project-basis” — Competitive Intelligence Professional

“I no longer track Information on social media because it is already available through news media”— Education Industry Professional

While a majority of professionals indicated that they do not track social for market and competitive insights, it was great to see that some of them do. We believe that this will only increase in the times to come as social gains more prominence as an information broadcasting channel for companies.