Introduction

A cybersecurity company operating in the fast-evolving domain of Application Detection and Response (ADR) needed a better way to monitor its competitive landscape. With a lean team and rapidly shifting market dynamics, they needed to monitor fast-evolving product developments, messaging shifts, events, and publications across niche segments, including runtime security, WAF, AppSec, CNAPP, API security, and network security.

Before Contify, their competitive intelligence was inconsistent, based on scattered anecdotes, and took a lot of time, which meant business and product marketing teams lacked timely, role-specific insights to make informed decisions.

After deploying Contify’s AI-powered M&CI platform to automate monitoring, organize intelligence through a custom taxonomy, and deliver curated, role-based insights via live dashboards, battlecards, competitor profiles, and product benchmarking features. This single source of truth enabled the organization to track competitor moves in real time, eliminate noise, and distribute intelligence efficiently across teams.

As a result, the cybersecurity company accelerated product positioning decisions, improved go-to-market planning, and reduced manual research time, enabling teams to focus on strategic actions rather than data collection.

About the company

The company is a fast-growing cybersecurity provider focused on securing modern applications and cloud environments. Operating in the highly competitive global security market, it delivers advanced solutions across runtime security, WAF, AppSec, CNAPP, API security, and network security. With a customer base spanning enterprises and digital-first organizations, the company’s mission is to protect critical applications and cloud workloads against evolving threats while enabling secure innovation at scale.

The challenge

In the fast-changing cybersecurity landscape, staying ahead of competitors is crucial for creating successful products and messaging. For this cybersecurity company, tracking rivals in runtime security, WAF, AppSec, CNAPP, API security, and network security had become increasingly complex and inefficient.

The existing approach relied heavily on manual research that involved scouring news sites, press releases, blogs, event listings, and social media updates. This was not only time-intensive but also prone to gaps and inconsistencies. Intelligence was scattered across different sources, making it hard to connect the dots or validate insights.

As competitors launched new products, adjusted their go-to-market narratives, and expanded into adjacent segments, the cybersecurity company found it challenging to keep track of all the changes and support informed decisions.

Their key challenges included:

- Unstructured Intelligence Flow: Intelligence was dispersed across teams, channels, and formats, making it hard to build a shared understanding of the market landscape and competitor activity.

- Lack of Thematic Analysis: Without a standard taxonomy aligned with their focus areas (e.g., CNAPP, Runtime Security, API Security), it was difficult to analyze and act on relevant insights.

- Inefficient Manual Research: Gathering insights on competitors’ messaging, features, and event strategies often consumed hours of valuable time.

- Information Silos: Updates were delivered sporadically to inboxes or Slack threads, lacking a central hub for easy access and collaboration.

- Market Readiness Gaps: Sales and leadership lacked consistently updated, source-backed battlecards or briefing notes for competitor discussions.

Without a centralized M&CI capability, teams risked reacting late to competitive moves, missing opportunities to differentiate, and duplicating research efforts across the organization. They were looking for a solution that could deliver centralized, automated, and contextually organized intelligence, tailored to the needs of different stakeholders.

The solution

To address these challenges, the cybersecurity company implemented Contify’s AI-powered Market & Competitive Intelligence platform, configured specifically for the cybersecurity domain. The goal was to centralize all relevant intelligence, automate monitoring, and deliver role-specific insights, focusing first on product marketers and CI professionals.

At the core was Contify’s Curated Newsfeed, a single source where updates from vetted external and internal sources were aggregated and automatically categorized according to their custom taxonomy. This eliminated the need for manual aggregation and ensured all stakeholders operated with a unified view of the competitive landscape.

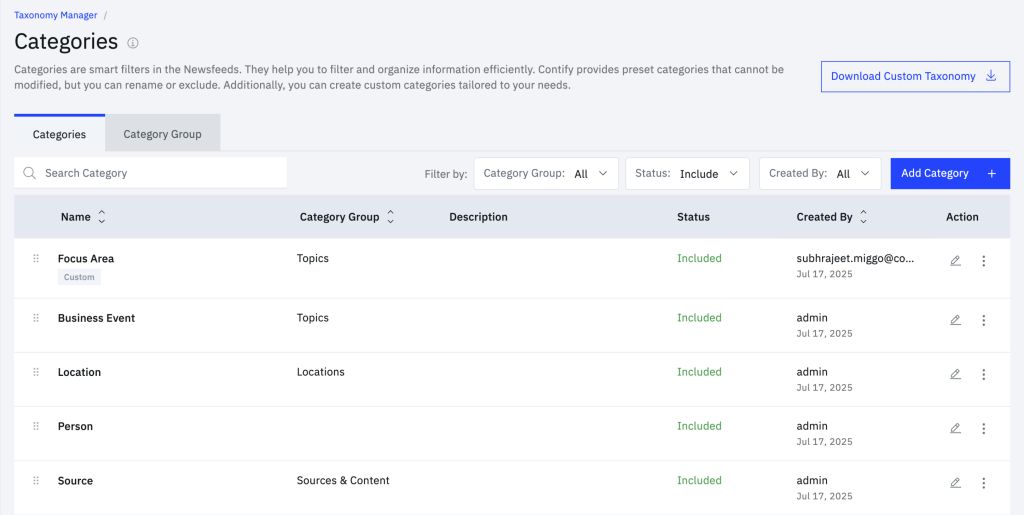

1. Custom Cybersecurity Taxonomy

Contify built a bespoke classification system that was aligned with the cybersecurity company’s focus areas, which included runtime security, WAF, AppSec, CNAPP, API security, and network security. This taxonomy powered the entire intelligence platform for the company, including automatic classification of updates, enabling stakeholders to filter by precise, business-relevant themes and get actionable answers to their intelligence questions.

2. Competitor Profiles

Custom competitor profiles compiled key intelligence such as leadership changes, partnership strategies, recent acquisitions, and LinkedIn themes from executives. These profiles served as one-stop reference hubs, enabling deeper contextual understanding of each player’s evolving strategy and market posture.

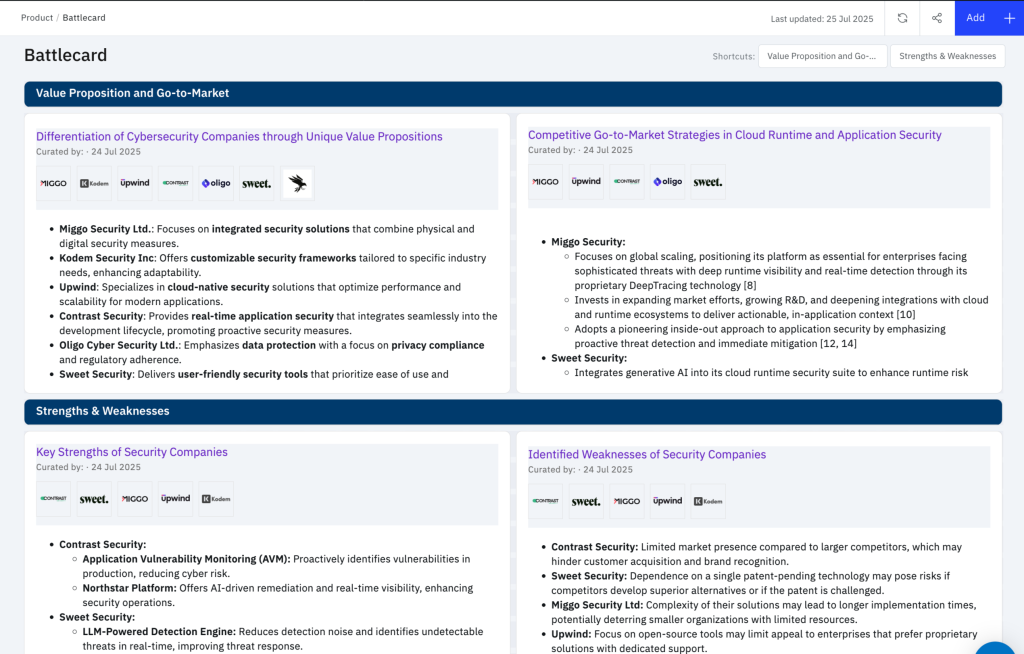

3. Dynamic Battlecards

Contify’s battlecards offered dynamic, side-by-side comparisons of competitors’ value propositions, go-to-market strategies, and core messaging.Each section covered everything from product strengths to positioning statements and was automatically updated with links to sources. These battlecards helped teams prepare for executive reviews and sharpen differentiation strategies in real time.

4. Conference and Event Tracker

This module highlighted recent and upcoming industry events where competitors were exhibiting or speaking. By mapping participation types and locations, the cybersecurity company could better plan its presence, analyze where influence was being built, and draw insights into competitors’ GTM focus areas.

![]()

5. Key Product Offerings

A curated view of core product capabilities across domains — including Network Security, API Security, AppSec, CNAPP, and Runtime Defense — helped the team understand how competitors were positioning themselves functionally and where the messaging emphasis lay. This was instrumental in shaping product marketing content and sales enablement material.

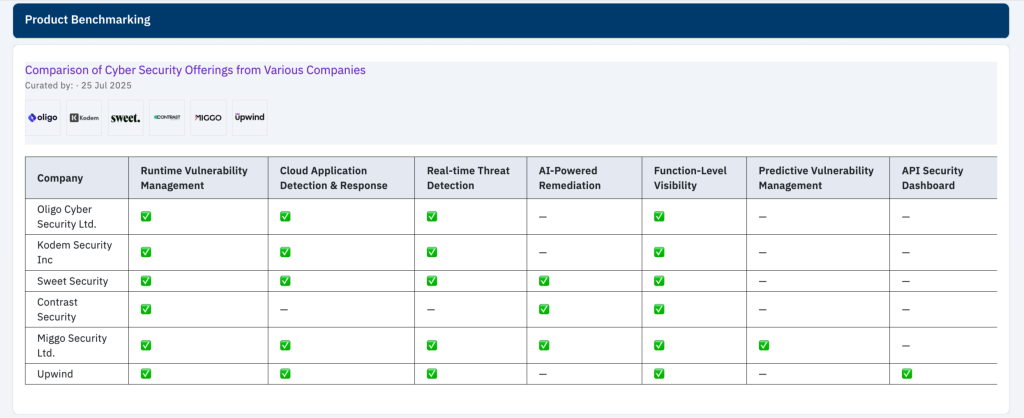

6. Product Benchmarking

A benchmarking dashboard compared cybersecurity features across competitors, such as real-time threat detection, AI remediation, API dashboards, and runtime vulnerability management. This side-by-side view helped the team identify product gaps, validate differentiation, and anticipate future development priorities.

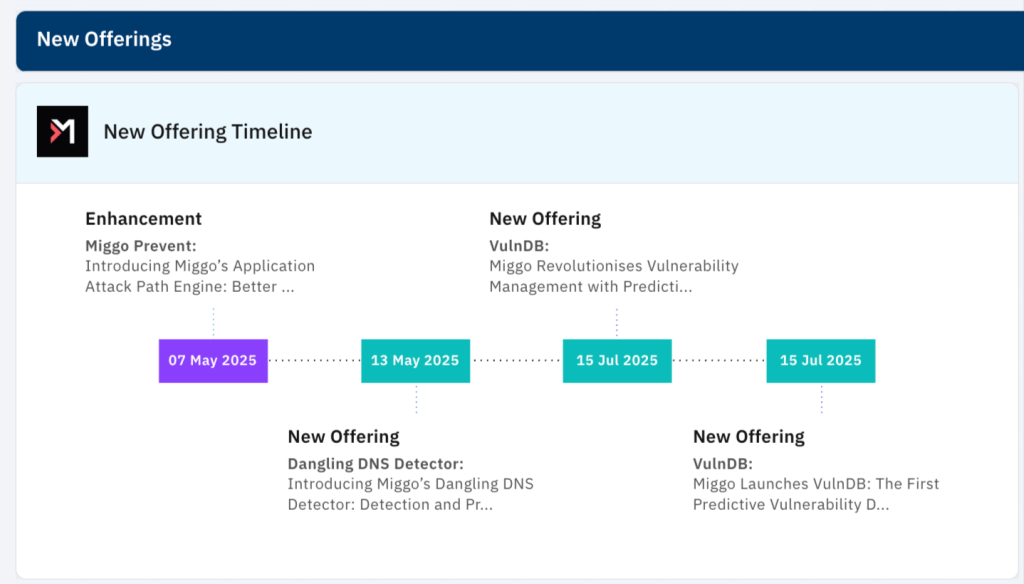

7. Tracking Innovation

This visual product release timeline showcased when key competitors rolled out new offerings or enhancements. It made it easy to spot release cadences, monitor innovation, and time their announcements more strategically.

8. Role-Based Intelligence Delivery

Insights were distributed via customized dashboards, email alerts, and newsletters, ensuring that all stakeholders received information most relevant to their decisions without wading through irrelevant noise.

These modules were backed by Contify Athena, the platform’s AI assistant, which synthesized updates into summaries, key points, and thematic insights, all accessible from interactive dashboards.

From onboarding to rollout, the configuration was completed in under two weeks. The client team began using the system in real-time discussions around roadmap alignment, competitor feature gaps, and messaging differentiation, turning Contify into a central hub for strategic intelligence.

The impact

Implementing Contify’s M&CI platform transformed the cybersecurity company’s approach to competitive intelligence from a fragmented, manual process into a unified, automated operation. The following results were observed across multiple dimensions:

- Faster time-to-insight: AI-powered monitoring and automated classification reduced the time spent on intelligence gathering by over 60%. Instead of manually searching across sources, teams used curated, real-time updates in one centralized hub, allowing quicker responses to competitor actions and market changes.

- Single Source of Truth for Market & Competitive Intelligence: All stakeholders accessed the same validated intelligence repository. Dashboards, battlecards, and competitor profiles enabled seamless sharing of insights across product, marketing, and executive teams. This reduced duplication, enhanced alignment, and maintained consistency in competitive messaging and strategic decisions.

- Dynamic Battlecards: Product benchmarking, analysis of key offerings, and competitor profiles provided product marketing teams with the context and data needed to refine differentiation and quickly update sales enablement assets. In fast-paced competitive bids, this speed and accuracy can be the difference between winning and losing deals.

- Improved Go-to-Market Planning: With visibility into competitor launch timelines, event participation, and thematic messaging, the GTM team could better anticipate competitive pushes, plan campaigns, and time announcements for maximum impact.

- Strategic Roadmap Alignment: Product managers used launch timelines and event trackers to understand competitors’ development focus and plan their roadmap priorities accordingly.

- Role-Based, Actionable Insights: Customized taxonomy enabled custom dashboards, newsletters, and personalized alerts, which delivered only the most relevant updates to each team, reducing information overload and increasing effectiveness of the intelligence provided.

| Before Contify | After Contify |

| Time-intensive manual research across multiple fragmented sources | Automated competitor monitoring with AI-powered classification in a single platform |

| Inconsistent, incomplete intelligence scattered across teams | Single source of truth with validated, role-specific insights |

| Delayed awareness of competitor product launches and GTM moves | Real-time alerts and visual timelines for launches, events, and market shifts |

| Difficult to track niche segments like CNAPP and runtime security | Custom taxonomy enabling focused, noise-free tracking by product area |

| Generic, one-size-fits-all updates sent to all stakeholders | Tailored dashboards, newsletters, and alerts for each role |

“The product launch timelines, website changes, and conference tracking have been game-changers for us. We can now anticipate their announcements and gain a deeper understanding of their go-to-market strategies, all from a single platform.” – Head of Product, Cybersecurity Company

Overall, Contify helped the cybersecurity company build a scalable and sustainable M&CI function. The shift was more than operational; it gave the company the agility to make quicker, more informed decisions in a competitive landscape.

Conclusion

By adopting Contify’s AI-powered Market & Competitive Intelligence platform, the cybersecurity company replaced fragmented, manual research with a centralized, automated intelligence system purpose-built for the cybersecurity market. The result was a single source of truth that empowered product marketing, product management, and leadership to make faster decisions with confidence.

From tracking runtime security and CNAPP competitors in real time to delivering curated, role-based insights across the organization, Contify enabled the company to strengthen product positioning, sharpen GTM strategies, and respond to competitive moves with agility.

In an industry where threats and opportunities emerge continuously, the ability to cut through noise and act on trusted intelligence is a decisive advantage.

Learn how Contify can help your CI efforts.

Whether you’re looking to streamline your competitive tracking, sharpen your go-to-market strategy, or empower cross-functional teams with actionable intelligence, Contify’s M&CI platform is built for you. Visit Contify.com or book a demo to explore what’s possible.

FAQs

How can AI-powered competitive intelligence benefit cybersecurity companies?

AI-powered competitive intelligence uses advanced analytics to automatically track, categorize, and deliver relevant updates on competitors and the market. For organizations aiming to be recognized among the best cybersecurity companies, this means faster, more accurate insights that directly support product strategy, messaging, and go-to-market execution.

Why is competitor monitoring in cybersecurity essential for success?

Competitor monitoring in cybersecurity enables organizations of all sizes, from startups to established consulting firms and leading companies in the USA, to stay informed about product launches, partnerships, acquisitions, and shifts in messaging. With robust cybersecurity competitive intelligence, they can anticipate market changes and respond strategically.

How does product benchmarking in cybersecurity support innovation and differentiation?

Product benchmarking in cybersecurity compares offerings against competitors across features such as runtime security, CNAPP, and API protection. This process helps identify gaps, validate differentiation, and accelerate innovation, which is key to staying ahead in a field dominated by the best cybersecurity companies.

What makes role-based intelligence dashboards valuable in a Contify competitive intelligence case study?

In a Contify competitive intelligence case study, role-based intelligence dashboards shine because they deliver targeted, automated competitive insights to specific teams. When paired with real-time competitor tracking, these dashboards ensure that every stakeholder, from leadership to product teams, can act quickly on the intelligence most relevant to their goals.

How can cybersecurity competitive intelligence give companies an edge in a constantly evolving market?

Cybersecurity competitive intelligence equips organizations with real-time insights into competitor strategies, product developments, and market trends. By consolidating this information into a single source of truth, companies can spot threats and opportunities earlier, refine their go-to-market strategies, and benchmark their offerings against the best cybersecurity companies. This proactive approach ensures they stay ahead of shifting market dynamics, emerging technologies, and evolving customer needs, which are critical factors in maintaining a competitive edge in the fast-moving cybersecurity industry.