Introduction

Rare disease markets are unforgiving. Small patient populations, few approved therapies, and sudden shifts in the competitive landscape mean that every licensing deal, clinical milestone, or acquisition can change the game overnight. For strategy leaders, staying ahead is less about collecting more information and more about making sense of it quickly and sharing it across the organization.

One US-based biopharma company, focused on cholestatic liver diseases such as Alagille Syndrome and PFIC, was feeling this pressure. Their insights team was lean, essentially one full-time lead and an analyst, yet they were expected to keep corporate development, global brand, and commercial teams informed about everything from competitor pipelines to M&A signals.

When Ipsen acquired Albireo, the only other IBAT inhibitor player in their space, the urgency became clear: the company needed a more structured and scalable competitive intelligence program to support both current assets and a growing pipeline.

The challenge

Before Contify, intelligence was pieced together manually:

- Analysts were tracking regulatory filings, clinical updates, job postings, and competitor news by hand.

- Insights were consolidated into a monthly CI deck that fed into global brand meetings but lacked real-time coverage.

- As new assets entered the portfolio, the workload multiplied while resources remained the same.

The risk was obvious that the company could miss early signals of competitive moves or market access shifts, and decisions would lag behind the pace of the market.

Contify's solution

The company onboarded the Contify M&CI platform, and it delivered a comprehensive intelligence transformation through these core capabilities:

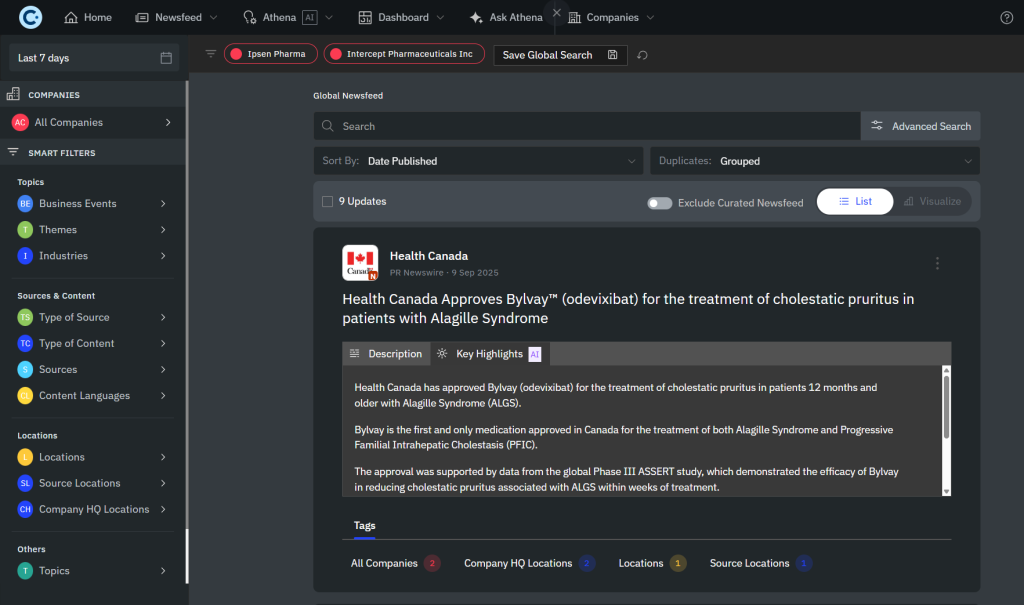

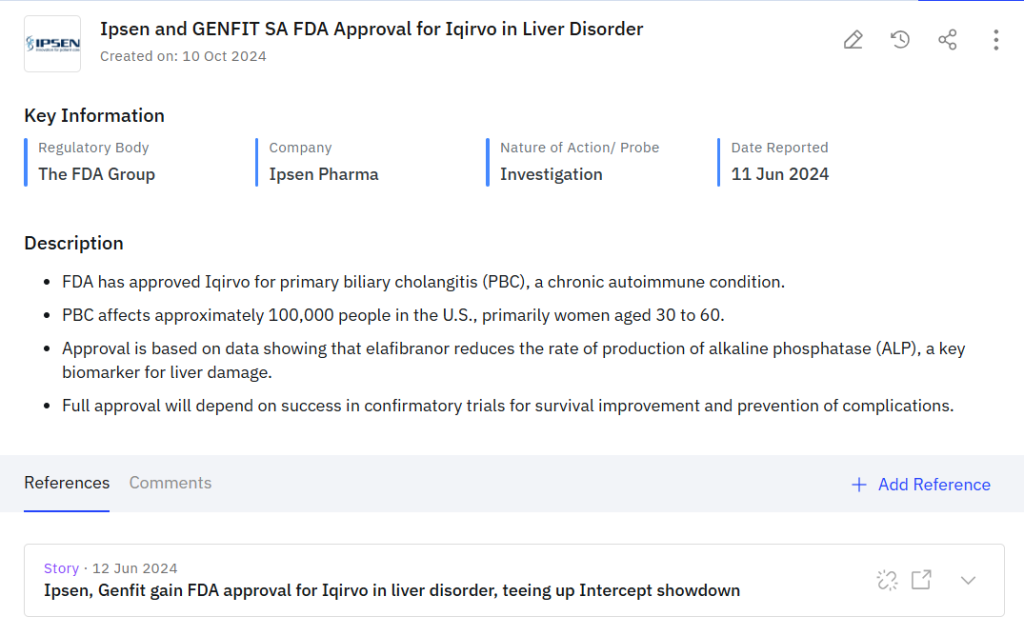

- Comprehensive competitor monitoring across Ipsen, Intercept, Genfit, CymaBay, and X4, tracking regulatory portals (FDA, EMA), clinical trial registries, publications, conferences, analyst reports, and social media.

- Thematic focus on cholestatic liver diseases, bile acid synthesis disorders, and related rare conditions.

- Multi-channel insight delivery through web dashboards, email alerts, newsletters, and Microsoft Teams integration, serving 2 power users, 30+ end users, and unlimited newsletter recipients, including corporate affairs.’

- Automated data extraction that continuously scanned regulatory filings, clinical updates, and competitor announcements to extract structured intelligence on drug approvals, partnerships, funding, and leadership changes without manual effort.

- Connected real-time insights that linked clinical trial developments with regulatory submissions and partnership activities, providing a comprehensive competitive context instead of isolated data points.

- Self-updating dashboards powered by AI that maintain current competitor profiles, battlecards, and market landscapes while automatically answering Key Intelligence Questions using Contify’s proprietary knowledge graph.

- Natural language querying through “Ask Athena,” enabling instant information retrieval with conversational questions that returned contextually relevant, source-verified answers.

A dedicated Contify analyst worked closely with the team to simplify dashboard setup and initial handholding, ensuring successful adoption.

What changed

Within weeks, the impact was clear:

- Time back to the team: Instead of spending days consolidating news and filings, the insights lead could focus on analysis and storytelling.

- Scalable coverage: As pipeline assets like Elixabat came into focus, adding coverage was a matter of clicks, not extra headcount.

- Faster reactions: Licensing and M&A signals were picked up early, critical in a market where US-China licensing deals jumped from just two in 2023 to 14 deals worth $18.3B in H1 2025.

- Alignment across teams: With dashboards and newsletters going out regularly, commercial, medical, and leadership teams were consuming the same intelligence in real time.

Why it matters for pharma leaders

This case reflects a broader industry reality. The U.S. still drives over half of global pharma sales and 55% of global biopharma R&D, and more than 1,100 strategy and BD leaders are active in U.S. pharma alone. Competitive intelligence has shifted from a niche function to a boardroom requirement, with 70% of pharma companies now using AI-driven tools for CI.

For companies in rare diseases, where competitors are few but moves are decisive, the stakes are even higher. Missing one deal or trial update can mean being outmaneuvered for years.

Looking ahead

By moving from fragmented monitoring to a structured, signal-first intelligence program, this pharma company gave its strategy leaders exactly what they needed: clarity, speed, and the ability to scale intelligence as the pipeline grows.

The lesson is simple but powerful: in rare diseases, competitive advantage doesn’t come from having the biggest team, it comes from giving a small team the right tools to move faster and smarter than the competition.