Executive Summary

The company, a global veterinary diagnostics leader, struggled with manual competitor and industry tracking across 200+ players and emerging markets. A single strategist created monthly newsletters for 450+ stakeholders, relying on ad hoc research, fragmented sources, and limited global visibility. The process was time-consuming, limited in scope, and left critical gaps in coverage of emerging competitors, especially small or non-English players.

Contify’s Market & Competitive Intelligence (M&CI) platform transformed these workflows with automated monitoring, multilingual coverage, and configurable taxonomies aligned to the company’s focus areas. Intelligence was consolidated into automated newsletters, alerts, dashboards, and dynamic competitor profiles, eliminating manual processes.

As a result, the company scaled delivery of insights across business lines, enhanced leadership decision-making with timely and actionable intelligence, and freed its strategy team to focus on higher-value analysis and global expansion priorities, not repetitive data gathering.

About the Company

The organization is a global leader in veterinary diagnostics and animal health solutions, serving veterinary professionals, laboratories, and research institutions worldwide. With a diverse portfolio spanning diagnostic instruments, rapid assays, reference laboratories, and digital health solutions, the company operates across all major markets. Its corporate strategy team drives competitive and market intelligence to inform leadership decisions, enable global expansion, and strengthen its position in the fast-evolving veterinary diagnostics industry.

Business Challenge

Manual Processes Consuming Strategic Time: Competitive intelligence was managed almost entirely by one strategist, who manually monitored competitor websites, trade shows, news feeds, and emails to gather updates. Insights were compiled into a monthly newsletter distributed to more than 450 internal stakeholders. This manual process was inefficient, repetitive, and left little time for deeper analysis.

Coverage Gaps in Global and Emerging Markets: The company operated across all major global markets but had limited visibility into small, non-English, and fast-emerging competitors. Many new entrants originated in human diagnostics before moving into veterinary health, while smaller Chinese firms were often acquired by larger players. Manual methods made it difficult to detect these early signals.

Fragmented Delivery of Intelligence: Without a centralized platform, intelligence was scattered across emails, spreadsheets, and SharePoint. Ad hoc updates were frequently sent to leadership and line-of-business heads, but this approach lacked structure and scalability. Teams often depended on the strategist as a “traffic controller” rather than having direct access to intelligence.

Leadership Mandate for Automation: With a new leader pushing for greater efficiency and global visibility, the corporate strategy team recognized the need to automate intelligence-gathering. The goal was to move from manual processes toward scalable, structured delivery of timely insights, freeing capacity for higher-value analysis and supporting expansion into Europe, Asia, and other growth regions.

Solution

Contify’s Market & Competitive Intelligence (M&CI) platform was configured to directly address the organization’s intelligence challenges. The implementation focused on automating manual tasks, expanding global coverage, and creating scalable delivery mechanisms that empowered leadership and functional teams.

- Automating Manual Research: Instead of relying on one strategist to manually track hundreds of players, Contify automated sourcing from 1M+ global news, company websites, LinkedIn, and trade show portals. Multilingual auto-translation ensured updates from non-English markets were delivered in English, giving the company visibility into competitors that were previously inaccessible.

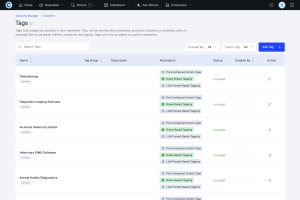

- Expanding Coverage with Custom Taxonomies: To avoid missing emerging players, Contify configured bespoke industry and topic taxonomies aligned with veterinary diagnostics. Segments such as teleradiology, diagnostic imaging software, veterinary PIMS, hematology and chemistry analyzers, rapid assays, and reference labs were tracked automatically, surfacing new companies and unknown players across geographies.

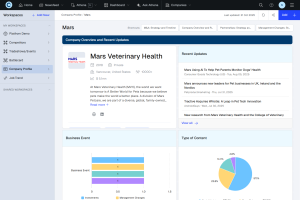

- Centralized Competitor Intelligence: Competitor profiles were created as one-stop hubs, consolidating leadership moves, partnerships, acquisitions, hiring signals, and product updates. This gave stakeholders contextual, ready-to-use intelligence without relying on manual compilation.

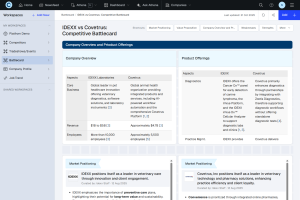

- Sharpening Competitive Positioning: Dynamic battlecards provided side-by-side comparisons of competitors’ product strengths, value propositions, and go-to-market strategies. Unlike static decks, these were continuously updated with new intelligence and source links, enabling commercial and strategy teams to respond with confidence in reviews and planning sessions.

- Scaling Knowledge Sharing Across the Enterprise: Contify’s automated newsletter builder eliminated manual formatting, allowing the strategist to compile, edit, and distribute tailored intelligence to 450+ recipients in minutes. Distribution lists, AI-generated highlights, and customizable templates ensured leadership, product, and commercial teams received structured, relevant updates. Dashboards and alerts complemented newsletters by offering self-service access to intelligence on-demand.

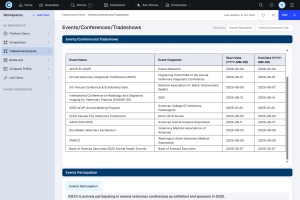

- Tracking Market Signals Beyond Competitors: The platform also flagged competitor participation in conferences and trade shows, helping the company analyze where influence was being built and plan its own presence strategically.

Results & Impact

Contify’s solution delivered measurable improvements across speed, coverage, and scalability of intelligence. The transformation can be clearly seen in the “Before vs After” comparison below:

| Challenge Area | Before Contify | After Contify |

|---|---|---|

|

Competitor Tracking Scale & discovery risk |

Manual, brittle

|

Automated, global

|

|

Insights Distribution Reach & cadence |

Manual newsletter

|

Automated & targeted

|

|

Source Coverage Breadth & language |

Narrow scope

|

Expanded & translated

|

|

Information Access Discoverability |

Fragmented

|

Centralized & searchable

|

|

Strategist Productivity Focus & impact |

Overloaded

|

High-value focus

|

With Contify, we’ve moved from manually piecing together competitor updates to having a single source of truth for global intelligence. Automated newsletters and dashboards save hours of work, and leadership now has timely, actionable insights at their fingertips. This has allowed our team to focus less on gathering data and more on shaping strategy.”

– Corporate Strategy Leader, Veterinary Diagnostics

Conclusion

Core Use Case Solved: Automated competitor and industry monitoring in veterinary diagnostics, replacing manual workflows.

Coverage Expanded: Broader visibility into global and emerging competitors, including small players and non-English sources.

Scalable Delivery: Automated newsletters, dashboards, and alerts reached 450+ stakeholders consistently and efficiently.

Strategic Impact: Leadership gained timely, actionable intelligence while the strategy team refocused on high-value analysis and expansion priorities.

Learn how Contify can automate your competitive intelligence workflows. Visit contify.com or book a demo to explore how you can scale global CI across your enterprise.

FAQs

Q1. How does Contify support competitive intelligence automation in life sciences?

Contify automates sourcing from global news, websites, regulatory portals, and trade shows. It tags updates using configurable taxonomies tailored to life sciences, ensuring teams can track competitors, products, and industry trends without manual effort.

Q2. Can the platform help in automating competitor tracking in animal health?

Yes. With custom taxonomies for veterinary diagnostics including chemistry analyzers, hematology analyzers, rapid assays, and reference labs, the platform continuously monitors both known and emerging players in animal health.

Q3. What makes Contify the best choice for competitive intelligence automation for life sciences companies?

Unlike tools built for sales enablement, Contify is designed for corporate strategy and market intelligence teams. It offers multilingual coverage, self-service dashboards, competitor profiles, and automated newsletters that scale intelligence across global teams.

Q4. How does Contify provide strategic intelligence for corporate strategy leaders?

Corporate strategy leaders gain timely insights through newsletters, dashboards, and battlecards. These modules consolidate competitor activity, industry trends, and emerging signals, equipping leadership to make faster, evidence-backed decisions.