Overview

Founded in 1995, this global telecommunications provider has presence in 50+ countries, covering Europe, APAC, the Americas, and Africa. It has 200,000+ employees in 50+ countries worldwide, and generates a revenue of over $70 Billion. It offers fixed-network/broadband, mobile communications, Internet, and IPTV products and services for consumers, and information and communication technology (ICT) solutions for business and corporate customers.

Key Challenges

With digital transformation leading to innovation and disruption in almost every major industry, the company decided to digitally transform its processes, products and assets before it is too late. The objective was to enhance efficiency, increase customer value, manage risk and navigate through new revenue generation opportunities.

In order to do that, however, they required competitive intelligence on their competitors, diverse industry segments and a multitude of strategic topics. The state of their market and competitive intelligence program was such that all intelligence lay scattered across various internal systems and distributed across multiple geographies. Although the company had subscribed to several research providers to inform their teams about market trends, their reports lay unused. It was a challenge to extract the relevant data from these reports without first reading all the reports. Also, it was even difficult to find the right report due to a lack of a centralized repository for market and competitive intelligence. The stakeholders were spending valuable time trying to find relevant information, having to search multiple research platforms to access said reports, which they found cumbersome.

Thus, a centralized repository for market and competitive intelligence which could be accessed by their stakeholders in various departments, across different functions and geographies was an important requirement. API integration with the research reports providers into the centralized CI repository for easy information discovery was another.

In addition, they wanted to track industry topics such as Energy Generation and Management, Digital Supply Chain, Gaming, TV, 5G, Smartphones, Cloudification, Digital Workplace, Edge Services, Industry Platforms, Analytics & AI, Chipsets, Modems, EdTech, Network Service Evolution, Consumer IoT & Smart Home, and many others. Due to the absence of a common taxonomy, tracking these topics was difficult for stakeholders despite their access to premium research reports, as each research report had its own taxonomy.

Another requirement was a powerful and intuitive dashboard module/feature that could provide a broad overview of these topics, competitor analysis, analysis of events and trends, word clouds, updates, as well as reports.

In order to accomplish this herculean task, the company began looking for an automated competitive intelligence tool or platform that met all of these requirements. After evaluating 36 providers, 3 were selected in the final round. After adequate due diligence, Contify, a leading M&CI platform, was selected.

Contify’s Solution

Contify developed a thorough understanding of the company’s strategic objectives and requirements, subsequently configuring a customized version of its competitive and market intelligence platform. This configuration comprised of:

-

Sourcing of Information

Contify’s analysts identified sources that provide relevant coverage to the company on their key competitors and intelligence topics, mainly consisting of RSS feeds, News Websites, Company Websites, Internal Insights, Licensed Content, Stock Exchanges, Press Release Agencies, Business Information Websites, and Social Media such as Twitter and YouTube. The company’s paid sources were also integrated into Contify’s Sourcing Manager.

-

Taxonomy

A customized taxonomy was built for the telecom provider categorized into relevant topics, business activities, companies, regions, and channels, with third-party paid research reports from the company’s preferred analysts included in the taxonomy.

- Topics: Strategic Topics – Broadband and Devices | Innovation Topics – Innovations, Startups EdTech, and Fintech | Sustainability: B2C, B2B, Leadership Governance Initiatives, and Business Models/Innovation | Telco Topics – TV, Gaming, XR/VR/AR, Home OS, Consumer IoT & Smart Home, Infrastructure, Incubators Program, Technology, and Digital Payment

- Companies: Device Partners, Network Partners, Strategic Partners, Strategic Players, Telco Incubators, and Telco Operators

- Business Activities: Audit Risk, Awards and Recognitions, Bankruptcy, Business Closure, Business Expansion, Capital Investment, Capital Refinance/Restructure, Cost Cutting, Defaults (Finance), Demerger/Spinoff, Divestiture,Events, Financial Results, Funding Activities, Hirings, Layoffs, M&A Activities, Management Changes, Negative News, Operational Challenges, Partnerships and Alliances, Procurement and Sales, Regulatory and Legal, and Webinars

- Region: Americas, Asia, Europe, Middle East and Africa, and Global

- Analysts: ABY Research, Analysys Mason, Global Data, Omdia, STL Partners, and Strategy Analytics

- Channels: News Websites, Company Websites, Internal Insights, Licensed Content, Stock Exchanges, Press Release Agencies, and Social Media

- Content Types: News Articles, Marketing Resources, Press Releases, Social Updates, Thought Leadership, Events, Regulatory Filings, and Podcasts

-

Dashboards

Customized dashboards that allow a bird’s eye-view of all the companies and industry topics the company wanted to track, in order to identify trends and patterns. Multiple dashboards were created for each of the topics in their taxonomy, which consisted of multiple sub-dashboards with a variety of widgets in each of them to visually represent the following:

- News Feeds: The latest news updates regarding each topic, and a separate news feed for updates on each subtopic.

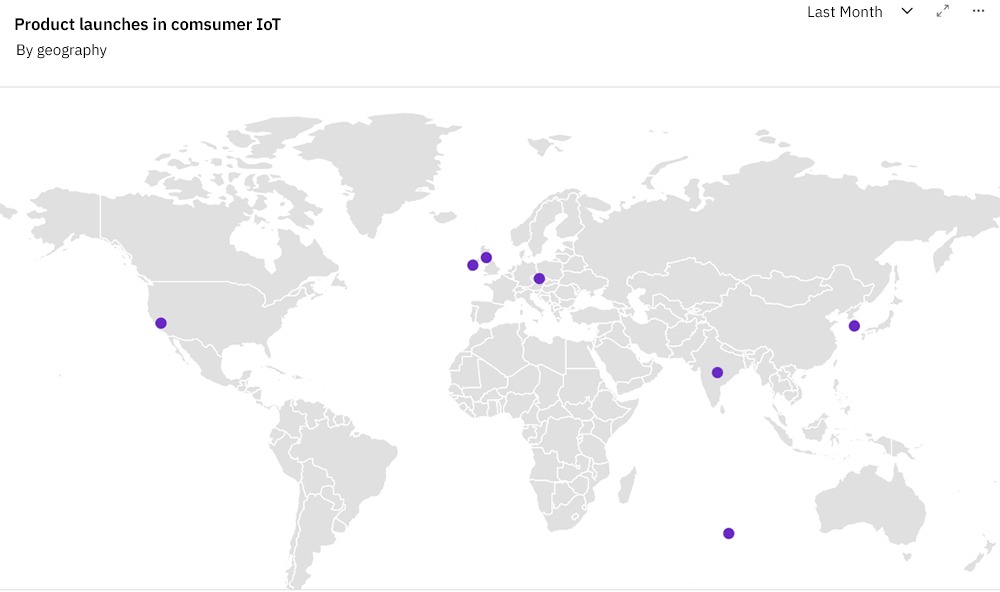

- Maps: Representing an event occuring in various regions of the world by geography, for example, product launches.

-

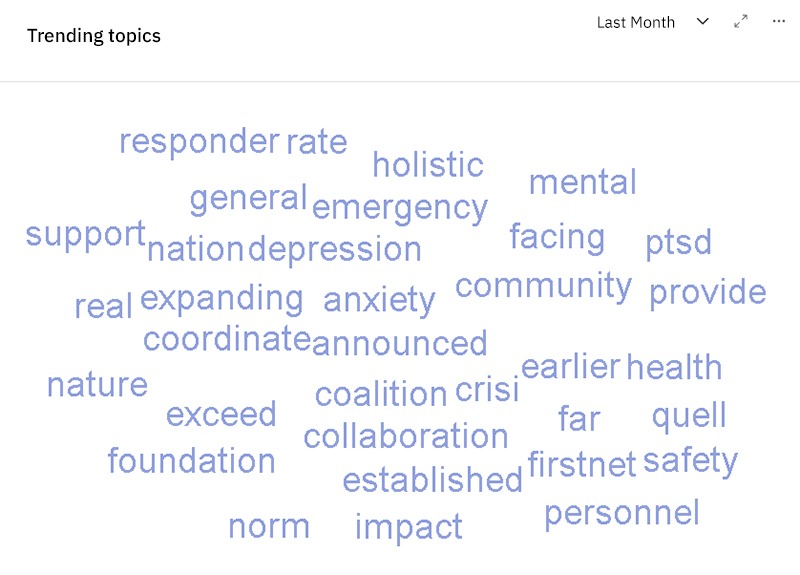

- Word Cloud: To represent the trending topics competitors have been publishing content on, and the keywords they’re using in their marketing resources.

-

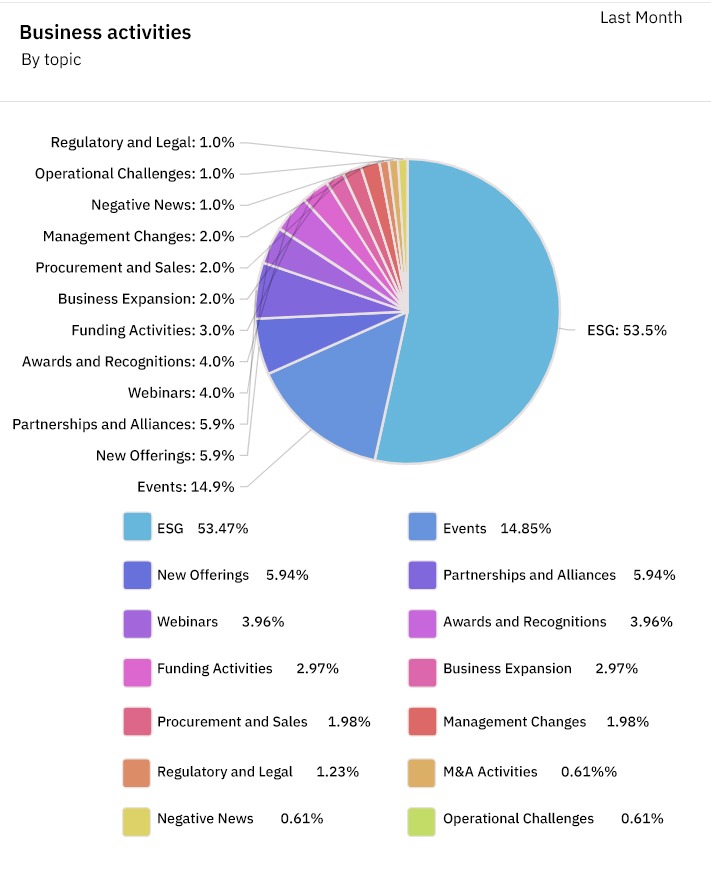

- Graphs depicting product launches and partnerships in various business activities for trend analysis, which offer insights on what competitors are focusing on, to help inform the company’s own business strategy.

- Overviews of competitors, partners, suppliers, etc.

- Graphs illustrating supplier shares by region and country.

- Graphs representing the revenue of partners and competitors, as well as their device share, R&D activity, mergers, and acquisitions, etc.

- Graphs representing the activities of competitors in each business segment for competitive analysis.

Impact

A Comprehensive and Centralized Repository for Easy Access to CI

With Contify’s platform, competitive intelligence was now available to the company’s various stakeholders in different intelligence functions in a centralized intelligence library. This helped the company resolve the challenges it faced earlier where a lot of time and effort was being wasted trying to look for relevant information sitting in different silos. In addition, Contify’s platform allowed the stakeholders to:

- Search and filter results depending on their intelligence needs

- Set user privileges, and monitor users’ consumption of CI, in order to see which topics are being read more frequently, and accordingly provide user-specific intelligence in the platform itself.

Elimination of Duplication of Efforts Across Multiple Global Departments

Without a centralized CI platform available to the company’s multiple global departments, a lot of time and effort was being wasted in duplication of efforts, i.e. multiple strategic departments collecting or analyzing information which was later found to already exist in the company’s database. The dashboards provided easy-to-consume analyses, comprehensible one-page summaries and overviews of information, and visually represented data in the form of graphs. This helped the company’s strategy teams save a lot of effort being spent in duplicate tasks, and spend more on decision making.

Time Saved Spent in Manually Collecting Market and Competitive Intelligence

The company’s strategy teams reported saving 60 hours of their time a month that was earlier spent in the manual collection and organization of intelligence. After the implementation of Contify’s solution, this saved time was spent on more important tasks like analysis and actual decision-making.

By the Numbers

-

60hrs

of time saved every month

-

2.5X

Faster decision-making

-

100%

Improved efficiency

Client Testimonial

“Changing customer demands, and evolving ICT innovations have made the telecom industry far more complex than it was a decade back. Contify’s solution helped us fill in the gaps in our market and competitive intelligence process, and accelerated our global digital transformation initiative considerably. The addition of a centralized repository in our M&CI arsenal, and the integration of paid research reports therein, was a game-changer for us. No one had been able to give us such an insightful perspective before.”

– Ecosystem Intelligence Project Manager, Telecom Company