Overview

Founded in the early 70s and employing 10,000+ professionals worldwide, this large US-based commercial bank has a strategic focus on technology startups. It provides a host of financial services that include lending, investments, mortgage, commercial, and private banking services to the venture capital and private equity firms that invest in them.

The bank’s strategy team shares actionable insights on the market landscape with the key stakeholders across functions to improve the quality of strategic decision-making. These insights enable C-suite executives and business heads to draw the roadmap for new business initiatives such as investments, partnerships, M&A opportunities, and business expansion.

Key Challenges

Before approaching Contify, there existed no formalized setup to aggregate, structure, and deliver strategic insights from the bank’s market and competitive landscape to the different functions. The bank sourced intelligence in an ad-hoc manner from secondary research, professional networks, private meetings scattered across teams.

With no set processes in place to drive a centralized intelligence program, delivering actionable insights was tedious and unreliable. With the bulk of the team’s available resources spent on isolating the signals from the noise, reports often missed out on the granular analysis.

The bank was on the lookout for a technology-driven market intelligence solutions provider that could:

- Build weekly intelligent reports with updates from the bank’s market and competitive landscape to help their management team make informed decisions.

- Identify trends and insights through the internal sources and share the analysis in a report to be shared with the management team.

- Facilitate a multitude of ad-hoc requests from the management such as tracking the impact of COVID-19 on competitor movements, increased/decreased funding, layoffs, furloughed, evaluating new geographies, focused offerings, and products to traverse the COVID-19 environment, impact of the Paycheck Protection Program, etc.

Contify’s Solution

After adequate due diligence, Contify — a leading competitive intelligence solution provider was selected. Contify adopted a three-stage process to define what insights can be classified as ‘actionable’ by each of the functions within the bank. This was based on the Key Intelligence Questions relevant to each team. This helped the Contify team develop a thorough understanding of the user expectations and share results that resonated with different business heads to enable them to define their strategy for the road ahead.

Stage 1

Understanding the Key Intelligence Questions across teams

The Contify team worked with a dedicated Point of Contact from each of the functional teams, along with the strategy team to better understand the subjectivity of the intelligence requirements of the various teams:

- Strategy team wanted to monitor strategic moves by competitors such as geographical expansion, M&A activities, product/ service launches, partnership programs, startup funding, etc.

- Product team was looking for information related to competitors’ product launches, new features additions, new technology partnerships, and negative reviews by dissatisfied customers.

- Risk management team was looking for any compliance-related updates from government and regulatory bodies. They were particularly interested in announcements related to banking and financial metrics such as deposit interest rates, loan interest rates, service fees changes, and transaction fees changes, competitor financials, etc.

- Sales and accounts team was looking to explore opportunities to engage with their existing list of 100+ accounts. They wanted to scale this later to track all their 300+ high-value accounts. The insights included detailed account intelligence profiles with updates on their business strategies, expansion plans, management changes, etc.

Stage 2

Defining the Report Structure

The Contify team prepared a sample report for each team to validate the output and make sure it’s aligned with their expectations.

Throughout preliminary feedback sessions, we reviewed the data with the internal teams to understand the relevance and the comprehensiveness of the coverage. Some of the key updates suggested by their teams included:

- Generic business updates for all business functions

- Operational and regulatory updates — corporate restructuring, regulatory and legal, negative news, procurement and sales, operational challenges.

- Financial and banking related updates — commercial and private banks lending rates, related to deposit interest updates, loan interest rates, service fees changes, and transaction fees changes.

- Funding and investment updates — new funding announcements, M&As, portfolio investments, AUM changes, etc.

Stage 3

Solution Management and Delivery Mechanism

Contify kicked off the project by setting up a three-month pilot phase that included:

Market and Competitive Intelligence Platform

A dedicated market intelligence platform with a continuously updated Newsfeed of real-time updates from the bank’s operating segments, industries, and their 50+ competitors. The information was sourced from finance-specific sources, government and regulatory portals, news and company websites, press releases, social media, and other web sources.

Each team was assigned a dedicated research dashboard to access the real-time intelligence and insights on the platform itself. The team found using the web-based platform to review updates and insights more convenient than referring to static analysis reports and presentations, which could be outdated as soon as they are published.

Daily Instant Alerts

Time-sensitive updates from the bank’s market and competitive landscape, across key business segments such as Payment Solutions, Digital and Challenger Banking, Venture Capital, Fintech, Financial Services, Debt Funding, Corporate, etc., were shared as email notifications by making use of Contify’s Instant Alerts feature.

On the relevance of the Daily Instant Alerts, one recipient from the bank’s strategy team said, “The ‘Instant Alert’ watchlist is a great proxy for the firms that we care most about.”

Intelligence Reports

A market and competitive intelligence newsletter report tailored for different business functions was shared every Monday morning, with highlights from the week prior. The updates were categorized by the level of impact defined by each team. The Contify analyst added a summary with insights that outlined the implication of any update so that the team members can quickly draw inferences without reading the entire article.

The Contify team also accommodated ad-hoc monitoring requirements such as the bank’s strategy team requested for actionable insights covering the impact of the COVID-19 pandemic and the sales, and account management teams requested for an ad-hoc weekly report to track negative updates from 350+ accounts in real-time.

Trend-based Quarterly Reports for Management

The Contify team prepared a quarterly trends report including additional insights sourced through the existing platform and triangulated it with exhaustive secondary research. This quarterly analysis was shared directly with the executive management team through the platform. Key insights of the report included:

- M&A trends and analysis across the digital lending space with deals’ rationale, and segment trends.

- Impact of COVID-19 on operational and re-structuring on the banking (digital) sector, triangulating it with the other key market reports and thought leadership in the sector

- Key product/offering, geographical expansion trends by the challenger banks and payment solution providers

Product Insights

- Banking-related updates related to the Paycheck Protection Program; including how the banks are structuring the loans etc.

- Product roadmap and strategy-related updates adopted by the fintech companies and other competitors in the sector.

Deep Dives and Tracking on Key Market Trends

The strategy team requested a report which covers the COVID-19 impact on the financial services industry, fintech funding, regulations around the Paycheck Protection Programme, etc.

“The market scan has been very helpful for tracking all major bank and non-bank lenders’ implementation of the Payroll Protection Program.” – Chief Strategy Officer, Bank

Impact

Within the first three months of signing up, different teams deployed Contify’s competitive and market intelligence platform to leverage actionable insights through the regular market and competitor monitoring to drive impact.

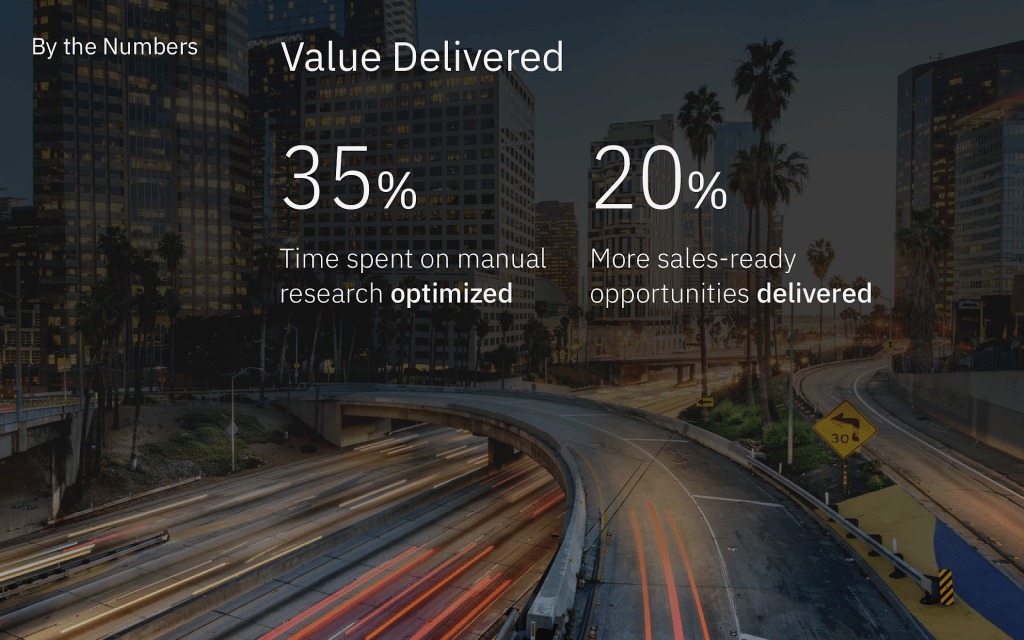

Strategy teams are now able to share the forward-looking plans pursuant to their competitive moves with speed and quality to the leadership and other business heads. The internal discussion with their stakeholders is more conclusive, and they also save their manual research efforts by 35%.

Our client’s sales and accounts team is now able to focus more on the closures of the accounts and targeting 20% more leads. Their interactions with the accounts are more engaging and resonating well with their potential users.

Quarterly insights reports delivered by Contify helped teams make informed decisions with enough supporting data and facts. The insights on the impact of Covid-19 helped the management to outmaneuver uncertainties and create strategies to thrive in the new normal.

By the Numbers

-

35%

Time spent on manual research optimized

-

20%

More leads available to sales representative