Testimonial

It used to be just the two of us covering four markets, and most of our time went into chasing updates and curating information. We needed to spend less time gathering data and more time thinking about what it meant for our business. With Contify, the heavy lifting was automated, the noise was filtered out, and we were finally able to focus on providing actionable insights to our business leaders.

– Strategic Marketing Manager

About the Company

Industry

Manufacturing

Company Type

Global B2B Manufacturer

Employees

5,000+

Founded

1980s

A global leader in industrial ceramics and engineered materials, the company supplies mission-critical components to high-tech industries including semiconductors, aerospace, energy, and medical devices. Operating in niche, performance-driven B2B markets, the company relies on deep material science expertise and long-term innovation to maintain a competitive advantage.

Executive summary

The company’s two-person strategic marketing team was responsible for tracking competitors, customers, and market trends across four complex B2B industries. Their existing process was built around manual source monitoring, spreadsheets, and a basic news aggregation tool, which was time-consuming and prone to errors. They needed a way to scale intelligence gathering, improve relevance, and integrate delivery into the tools their business unit leaders already used.

By adopting Contify’s AI-powered market and competitive intelligence platform, the team automated the aggregation and filtering of intelligence from curated and newly discovered sources. Intelligence was delivered through customizable dashboards, newsletters, and Microsoft Teams integration, ensuring stakeholders received timely and actionable updates without experiencing information overload. The result was significant time savings, broader coverage, and actionable intelligence integrated seamlessly into business workflows.

The challenge

The company’s competitive intelligence function was managed by a small two-person team responsible for tracking developments across four distinct industries. Their process relied heavily on generic tools like Feedly and Excel, which required daily manual input to identify, tag, and distribute intelligence. This meant hours spent curating information across dozens of competitor websites, news sources, investor updates, and industry portals, leaving little time for actual analysis or strategic interpretation.

Each industry had its own nuanced competitive landscape and region-specific signals. The team had carefully built a source list over time, but struggled with:

- Noise and Relevance: Generic tools generated large volumes of irrelevant updates, making it challenging to distinguish meaningful signals in niche markets.

- Scalability Limits: Expanding coverage to more competitors, markets, or data sources was not possible without additional resources.

- Stakeholder Demands: Business leaders wanted in-depth intelligence on product pipelines, patents, investments, and partnerships.

- Responsiveness: Ad-hoc requests from business leaders led to context-switching and reactive work

- Workflow Disconnect: Intelligence was shared via static reports and emails, resulting in delays and limited visibility. Without integration into platforms like Microsoft Teams, stakeholders lacked timely insights within their daily workflows.

As a result, the team found itself overwhelmed with data yet at risk of missing critical developments in fast-moving markets.

The solution: AI-powered competitive intelligence platform

The company implemented Contify’s Market & Competitive Intelligence platform to replace its fragmented, manual process with a scalable and automated system. The platform was configured around the organization’s four focus industries: semiconductors & electronics, aerospace & defense, energy & chemicals, and medica devicesl, ensuring intelligence aligned directly with strategic priorities.

Key components of the solution included:

- Automated Intelligence Collection and Noise Reduction

Information was aggregated from over a million vetted sources, including industry journals, regulatory portals, competitor websites, and financial updates. AI-powered filtering and deduplication eliminated irrelevant content, addressing the team’s struggle with noise. - Competitor and Market Deep Dives

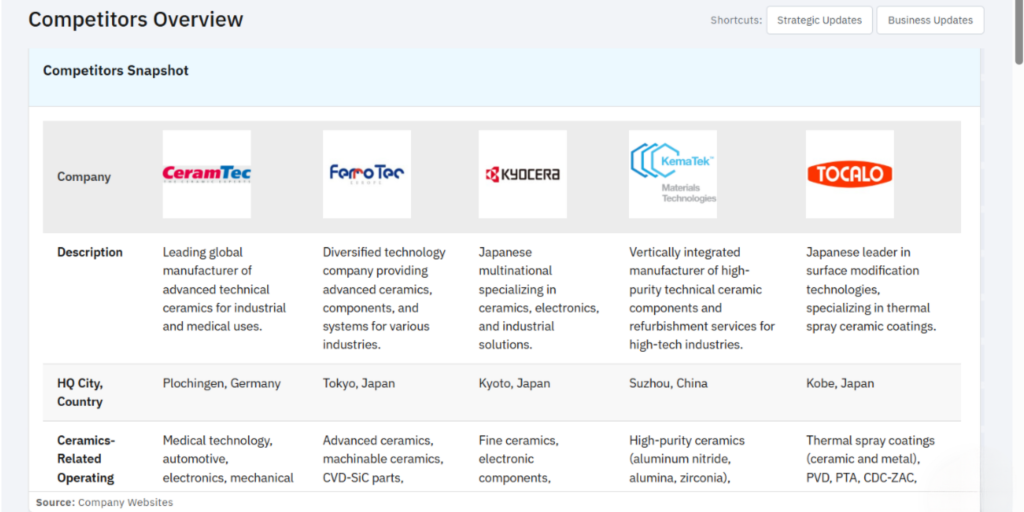

Dashboards tracked key competitors, including CeramTec, Kyocera, Ferrotec, Tocalo, and Kematek, as well as strategic players such as SpaceX, Applied Materials, and Rheinmetall. Patent filings and investment strategies provided structured visibility into R&D pipelines and capex priorities.

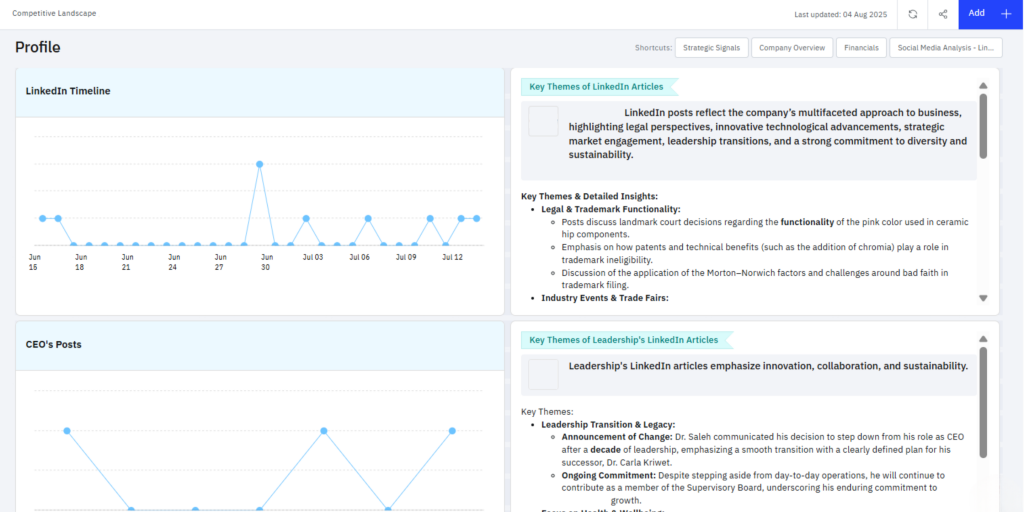

- Social and Leadership Signal Tracking

Contify surfaced insights from LinkedIn, including company campaigns and executive thought leadership. Tracking leadership transitions also provided early signals on potential shifts in strategic direction.

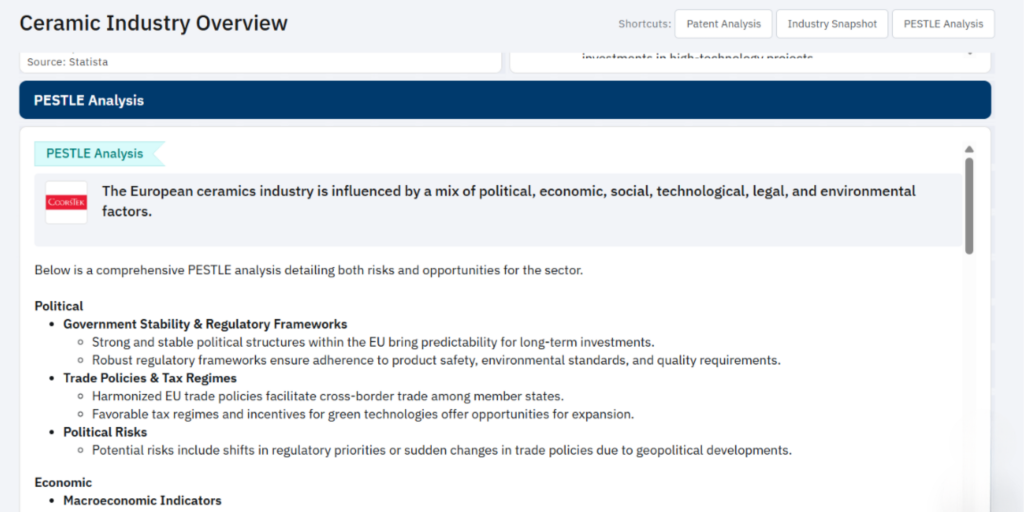

- Structured Market Context with PESTLE

The platform identified broader risks and opportunities through a PESTLE analysis, highlighting sustainability pressures in the European ceramics sector and geopolitical trends in defense and energy.

- Seamless Distribution and Workflow Integration

Insights were distributed via newsletters, dashboards, and email alerts. Business unit leaders and commercial teams received timely, role-specific updates directly in their workflows. - Scalability and Analyst Control

The CI team retained full control of their intelligence platform. They excluded or added custom sources, adjust taxonomies, and manage dissemination. This autonomy enabled expanded coverage without additional headcount.

The impact

Contify’s implementation delivered both measurable efficiencies and strategic impact:

- Time Savings: Manual data gathering and formatting time was reduced by 60–70%, freeing analysts for deeper analysis and strategic work.

- Noise Reduction: Automated filtering ensured only relevant updates reached stakeholders, reducing time wasted on irrelevant information.

- Expanded Coverage: The team expanded monitoring to more competitors and markets without increasing headcount.

- Cross-Functional Adoption: Leaders across business units, commercial teams, and product management accessed intelligence through newsletters, dashboards, and Teams integration.

- Structured Insights: Patent trends, investment activity, and competitor communications were presented in clear, structured formats with direct implications.

- Strategic Agility: By combining competitor intelligence with macro-level context through PESTLE, the company became more proactive in identifying risks and opportunities.

Contify transformed the company’s intelligence program from a manual reporting task into a scalable, insight-driven function that directly supported enterprise growth.

Before and after: at a glance

| Before Contify | After Contify |

| Manual curation using Feedly and Excel | Automated tracking, tagging, and sharing |

| About 12 core competitors | Dozens of competitors across four industries |

| High noise with generic news | Contextual insights by sector, topic, and business unit |

| Ad hoc reports and slide decks | Dashboards, newsletters, and Teams alerts |

| Reactive and time-intensive | Proactive, curated intelligence with minimal effort |

| Mostly spent on data gathering | Mostly spent on generating insights |

Conclusion

For a global manufacturer operating in highly specialized markets, scaling intelligence with limited resources had been a daunting challenge. The stakes were high. Competitor movements, whether a new product launch in ceramics for aerospace or an R&D partnership in semiconductors, had direct implications on the company’s growth strategy, customer acquisition, and long-term R&D priorities. Manual tracking left the CI team buried in data and struggling to provide actionable insights.

With Contify’s Market & Competitive Intelligence platform, the company fundamentally changed how it approached competitive intelligence, from reactive and manual data gathering to proactive insight generation and distribution. The two-person team could now operate at the scale of a much larger unit, supporting multiple business leaders with minimal friction. The result was a lean CI function capable of delivering enterprise-wide coverage, anticipating competitor moves, and informing strategic decisions without additional headcount.

FAQ’s

What makes AI-driven market intelligence valuable for niche manufacturing markets?

In highly specialized B2B sectors like advanced materials manufacturing, generic industry coverage often produces irrelevant noise. AI-driven market intelligence applies custom taxonomies and advanced filters to ensure updates align with specific technologies, applications, and competitor sets. For example, instead of receiving broad “manufacturing” updates, a CI team can track ceramic innovations, aerospace adoption, or semiconductor supply chain changes, providing intelligence that is both context-rich and actionable for strategy.

How do small CI teams scale intelligence coverage without adding headcount?

Scaling without expanding headcount is one of the toughest challenges for small competitive intelligence teams. Platforms like Contify automate the monitoring of competitors, strategic entities, and markets across geographies, while also deduplicating and prioritizing updates. This allows a two-person team to cover multiple industries effectively, focusing their time on analysis and implications rather than data gathering. The result is a force-multiplying effect: broader intelligence coverage with the same or fewer resources.

How does advanced noise filtering improve B2B market intelligence?

In niche B2B industries, generic news feeds often overwhelm teams with irrelevant updates. Advanced noise filtering removes unrelated stories and duplicates, while prioritizing updates from trusted sources like company websites, regulatory filings, or industry journals. This allows CI teams to focus on the intelligence that directly impacts competitors, markets, and customers; making insights more accurate and actionable.