Testimonial

For the first time, we have a clean, B2B-focused view of what our competitors are doing across product, marketing, and positioning. The summaries are concise, the dashboards are clear, and the website change tracking has been a game-changer for us. Contify has helped our teams make faster, more informed decisions without the noise or manual effort we were dealing with before.

– Senior Leader, B2B Fuel & Mobility Division

About the Company

Industry

Fuel Retail

Employees

10k+

Founded

1960s

Executive Summary

The organization, a large chain of convenience stores and fuel stations, needed a centralized way to understand competitor movements in the B2B fuel card and mobility market. During the initial discovery call, the team shared that they had no existing CI process, relied on manual, scattered information gathering, and struggled to separate B2B-relevant updates from the heavy B2C noise generated by general news sources. Leadership required clear, structured intelligence on competitor product launches, website messaging changes, marketing campaigns, executive movements, and emerging fleet card trends.

Contify implemented a fully configured Market & Competitive Intelligence platform tailored to the organization’s preferred competitor list and B2B-focused topic areas. The platform consolidated insights, filtered out non-business noise, tracked website changes and positioning shifts, captured marketing and social activity, and delivered concise AI-generated summaries for senior stakeholders. This created a structured, automated CI workflow that improved visibility, reduced manual research, and enabled faster, more confident decision-making across teams.

Business Challenge

The company’s B2B division, which manages fuel card and fleet mobility offerings, needed a structured way to understand competitor activity across the US market. During the discovery call, the team explained that there was no formal competitive intelligence process in place and no system supporting the ongoing monitoring of competing fleet card providers. All information gathering was manual, ad-hoc, and scattered across multiple sources, making it difficult to build a consistent view of what competitors were doing and why it mattered.

Leadership mandated greater visibility into competitors’ B2B actions but did not have time for long readouts or unfiltered news feeds. They wanted succinct, business-ready summaries focused only on B2B and fleet card relevance. However, most publicly available news sources mixed B2B updates with high volumes of B2C retail, promotions, and general store-level information, creating noise and reducing signal quality.

The company also required intelligence that went beyond news mentions. They wanted structured monitoring of:

- Product launches, new offerings, pricing updates, and feature changes

- Website content shifts, messaging updates, and revised landing pages

- Marketing campaigns, creative themes, and social activity

- Executive appointments and strategic decisions

- Industry-wide developments influencing mobility and payment services

- All aligned to their preferred competitor list and internal needs

Without a central platform, analysts struggled to answer basic competitive questions such as: Who launched a new offer? Which competitor adjusted their messaging last week? What campaigns are being promoted? How is the market shifting?

The result was a fragmented CI workflow that could not scale, provided inconsistent updates to leadership, and lacked the structure needed for long-term planning.

Solution Implementation

Contify deployed a fully configured Market & Competitive Intelligence platform tailored to the company’s B2B priorities and evaluation criteria of accuracy, meaningful insights, and leadership-ready reporting. The implementation focused on eliminating noise, centralizing fragmented information, and delivering high-quality intelligence leadership could absorb in minutes.

1. Curated B2B Competitor Intelligence Feed

Contify set up a curated intelligence feed based on the company’s priority competitors. This ensured all incoming updates aligned directly with their competitive landscape, covering:

- B2B fuel card product updates

- Loyalty programs targeting business customers

- Website messaging shifts

- Marketing campaigns and content strategies

- Strategic partnerships and executive moves

All non-business noise, consumer promotions, store openings and general retail news was removed automatically.

These enabled stakeholders to scan key takeaways in seconds without reading full articles.

2. Product Launch & Offering Tracking

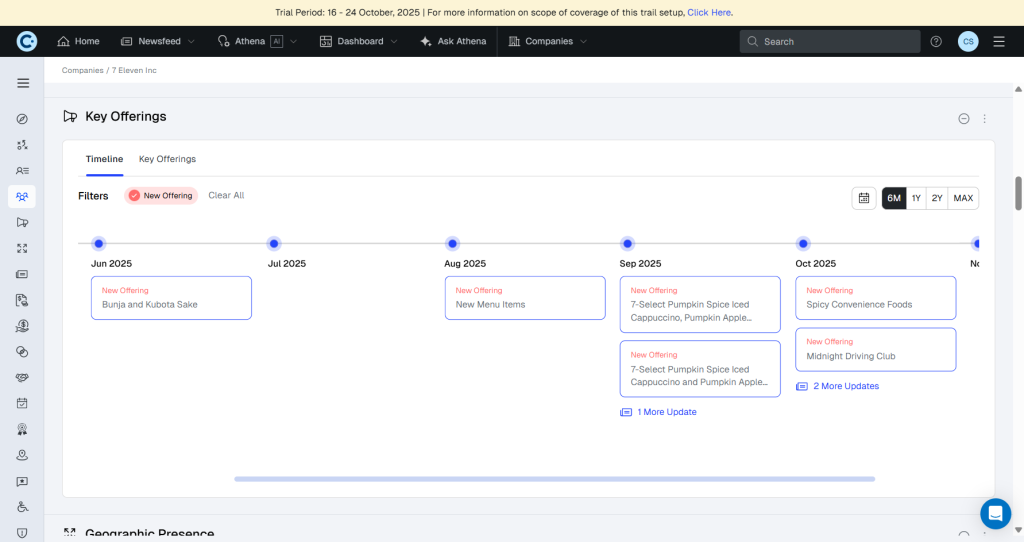

A timeline dashboard showcased month-by-month updates on competitor offerings, providing clear visibility into evolving product strategies.

3. Website Change Monitoring

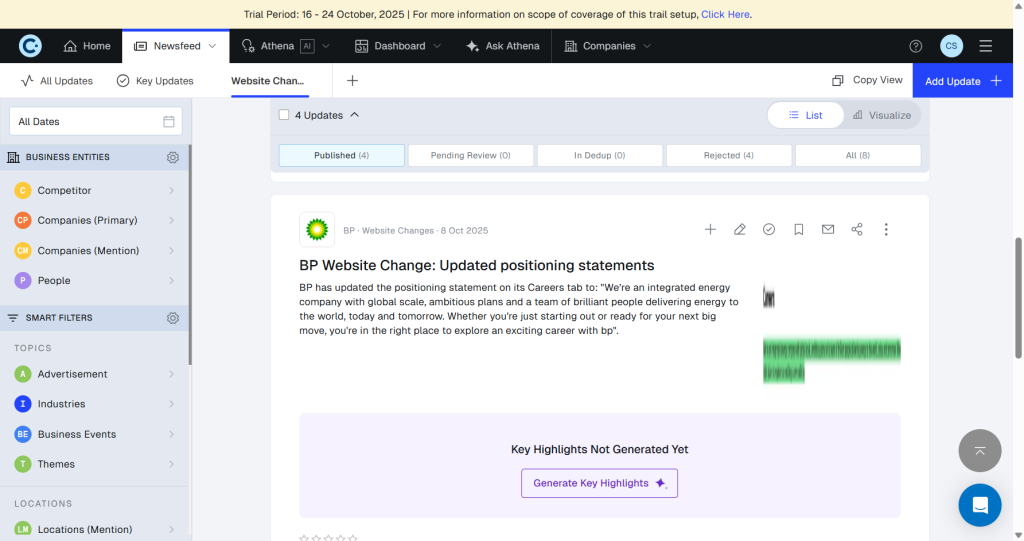

Automated crawling revealed changes across competitor landing pages, messaging, and positioning. Before–after views helped teams spot strategic shifts instantly.

4. Positioning & Messaging Dashboards

Contify visualized competitor claims, themes, and narrative shifts using word cloud and frequency mapping.

5. Marketing Campaign & Content Insights

Dashboards captured both organic and paid activity:

- Social posts

- Blog content

- Campaign themes

- Creative direction

This addressed the client’s request to understand “what their offers and ads look like and who they seem to be targeting.”

6. Competitor Offering Comparison

A structured comparison table allowed teams to review feature differences, discounts, and fleet management tools across multiple providers.

7. Weekly AI-Powered Executive Newsletters

Contify automated weekly newsletters, summarizing the most important competitor actions, enabling leadership to review the entire market in minutes.

8. Cross-Functional Intelligence Delivery

The platform supported:

- Strategy teams evaluating competitive moves

- Marketing teams analyzing positioning and creative

- Product teams reviewing feature updates

- Sales teams refining competitive messaging

- Leadership making confident, timely decisions

Results & Impact

The Contify implementation transformed how the company tracked and interpreted competitor activity across the fuel retail and mobility ecosystem. What once took hours of manual research became a streamlined, automated intelligence workflow.

Key Outcomes

Faster Insight Generation

- AI summaries cut analysis time dramatically.

- Weekly digests enabled rapid leadership consumption.

- Website tracking exposed competitor shifts instantly.

Cross-Functional Adoption

- Strategy, marketing, product, and sales all relied on the platform.

- Dashboards enabled structured conversations and planning.

Higher Quality Decisions

- Insights were B2B-specific, noise-free, and leadership-ready.

- Competitive moves could be interpreted with clearer context.

Reduced Manual Effort

- Automated sourcing and filtering replaced scattered research.

- Multi-year structured data improved trend analysis.

Before & After Contify

| Category | Before Contify | After Contify |

| Competitor Monitoring | Manual, inconsistent, fragmented | Automated, structured, comprehensive |

| Signal vs Noise | High B2C noise | Clean B2B intelligence |

| Website Change Tracking | No visibility | Automatic detection with comparisons |

| Product Visibility | No structured tracking | Timeline of launches & updates |

| Marketing Insights | Siloed and scattered | Unified view of campaigns & content |

| Leadership Reporting | Manual summaries | Automated AI newsletters |

| Decision Support | Reactive & incomplete | Proactive & data-backed |

| Analyst Effort | High manual workload | Automated, repeatable workflow |

Key Takeaways

- The company transformed its fragmented competitive tracking into a centralized, reliable intelligence workflow.

- Contify delivered noise-free, B2B-specific insights that helped leadership stay informed without long readouts.

- Product, marketing, strategy, and sales teams all benefitted from structured dashboards and AI-driven summaries.

- Multi-year intelligence enabled deeper trend analysis and long-term planning.

- The organization replaced manual research with an automated, repeatable CI program.

Learn how Contify can help your CI efforts, visit contify.com or book a demo.

FAQ’s

2. Can Contify track both company-level actions and broader market trends?

Yes. Contify monitors competitor announcements, website changes, leadership moves, and marketing activity, alongside industry-wide signals such as regulatory developments, mobility trends, and changes in payment services. This supports comprehensive market intelligence programs without manual effort.

3. How does Contify ensure insights remain relevant for B2B decision-makers?

AI-led filters remove consumer promotions, store-level news, and unrelated content. Insights focus on strategic developments, product updates, and business customer offerings, supporting stronger B2B competitive analysis and decision-making across teams.

4. What role does AI play in improving insight quality for retail and convenience store businesses?

AI accelerates the process of identifying messaging shifts, new offerings, competitive claims, and content themes. For retail organizations, AI-driven summaries and pattern detection reveal how competitors position their brand and adapt to changing conditions, supporting stronger AI competitive intelligence for retail strategies.