Introduction

In 2025, US medtech companies are navigating one of the most complex landscapes in the industry’s history. FDA approval cycles are unpredictable, Integrated Delivery Networks (IDNs) are consolidating purchasing power, and payer models are shifting rapidly toward value-based care. Strategy leaders must balance global innovation from AI-powered diagnostics to surgical robotics with the immediate pressure of proving value in hospital contracts.

For the Head of Strategy at a leading US-based medtech company, these pressures had a common bottleneck: fragmented intelligence. Market signals whether a competitor’s new device filing, a hospital system expansion, or an M&A move was scattered across sources. By the time teams connected the dots, opportunities were often lost.

The Challenge

The executive outlined three persistent challenges:

- Reactive intelligence: News aggregation came too late, often after competitors had already acted.

- Blind spots in competitor moves: Traditional channels overlooked early indicators, such as FDA 510(k) filings, patent activity, or IDN partnership strategies.

- Cross-functional misalignment: Strategy, sales, and product teams operated from different sources of truth, which slowed down decision-making.

In the U.S. context, where 57 medtech M&A deals worth $9.2 billion were announced in just Q1 2025 and hospitals are aggressively renegotiating vendor contracts, the cost of slow or incomplete intelligence was steep.

The Approach

The company deployed Contify’s Market & Competitive Intelligence platform to create a comprehensive M&CI program. With these functionalities, it enabled them to scale their M&CI operations and:

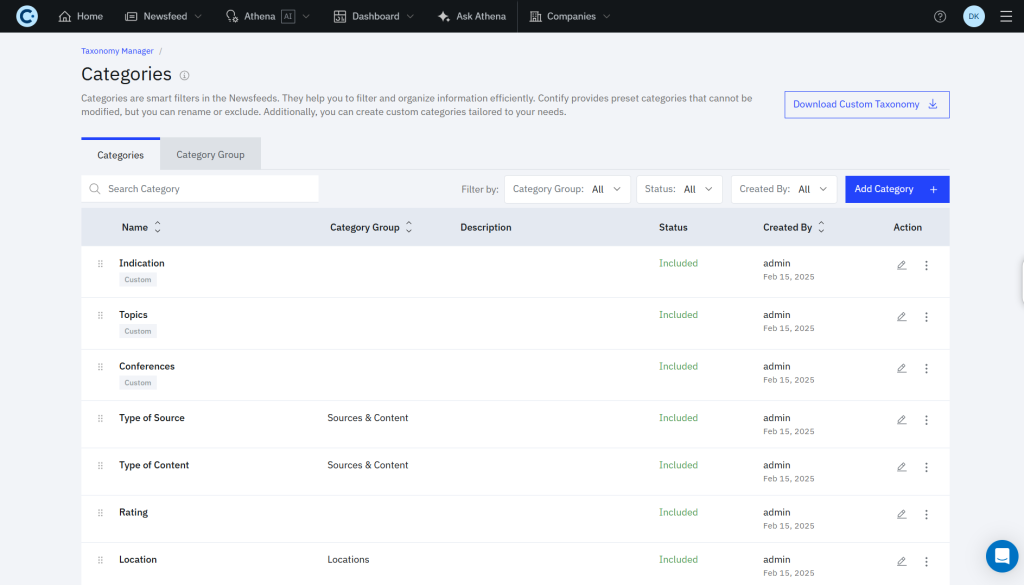

- Customized Taxonomy: Focused on priority product lines, surgical devices, diagnostics, and catheter systems, mapped against competitor portfolios and hospital procurement data.

- Regulatory & IP Monitoring: Automated tracking of FDA device approvals (510(k), PMA, De Novo) alongside patent filings and trademarks to catch competitor innovation at the source.

- Customer Intelligence: Real-time signals from IDNs and hospitals, including RFPs, awards, expansions, and leadership changes, flowing into dashboards, helping sales for better targeting and planning.

- Competitor intelligence: Single stream of competitors’ regulatory, clinical, and commercial moves, including 510(k) or PMA or De Novo activity, recalls, trials and publications, launches and new indications, GPO or IDN contract wins, and pricing shifts.

- Collaboration Layer: Curated intelligence delivered via newsletters, dashboards, and Slack/Teams integrations, ensuring leadership and frontline teams had the same visibility in real-time.

Results

Within the first quarter of adoption, the impact was tangible:

- Faster Time to Insight: Early identification of 20+ competitor device filings, on average, 3 to 4 months before they surfaced in mainstream industry media.

- Revenue Risk Mitigation: Strategy teams flagged two major IDN contract shifts in advance, allowing sales leadership to reframe value propositions and preserve margin.

- Cross-functional Adoption: Weekly newsletters reached over 150 internal stakeholders, streamlining alignment between strategy, sales, and product.

- Efficiency Gains: Automated scanning reduced manual monitoring efforts by 65%, freeing analysts for strategic analysis rather than information gathering.

Takeaways

The case underscores why structured intelligence is now mission-critical in the U.S. medtech market:

- The U.S. remains the largest medtech market globally, but faces policy headwinds from FDA staffing shortages slowing approvals to looming device tariffs that could squeeze margins.

- Hospitals, under financial strain, are consolidating into IDNs that centralize purchasing, making C-suite engagement and economic evidence essential for device adoption.

- Payers are raising the bar with value-based procurement models, demanding real-world outcomes data alongside FDA clearance.

For Heads of Strategy, this environment means the difference between winning or losing market share often hinges on who interprets signals faster and proves value sooner.

Conclusion

For this U.S. medtech leader, building a structured M&CI program wasn’t a tactical upgrade; it was a strategic necessity. By capturing competitor filings early, aligning cross-functional teams, and contextualizing U.S. hospital and payer dynamics, the company shifted from reactive monitoring to proactive strategy execution.

The broader takeaway for medtech executives is clear: In 2025 and heading into 2026, competitive advantage belongs to those who operationalize intelligence, transforming fragmented signals into decisive action before the market moves.