Introduction

Choosing the right market and competitive intelligence platform for your organization can be challenging. You may have explored AlphaSense and liked its premium content library and AI search. However, you are not alone if you remain unconvinced by its limited use beyond finance and investment research use-cases and its limited intelligence-sharing capabilities.

In this guide, we will briefly cover what AlphaSense is and who it fits best. We will then walk through its best alternatives and competitors. If you need market and competitive intelligence tools like AlphaSense, but built for wider teams and use cases, this list will help.

What is AlphaSense?

AlphaSense is an AI-powered market intelligence and search platform designed for financial and business professionals who need comprehensive, reliable insights on public and private companies, and industry trends from premium content sources. These sources include broker research, expert transcripts, company filings, internal research, financial data, and market news – all made searchable with AI and natural language processing.

AlphaSense was founded by Jack Kokko and Raj Neervannan in 2008. The platform has gained recognition from leading financial research and corporate organizations in supporting market research workflows and decision-making.

Key features of AlphaSense

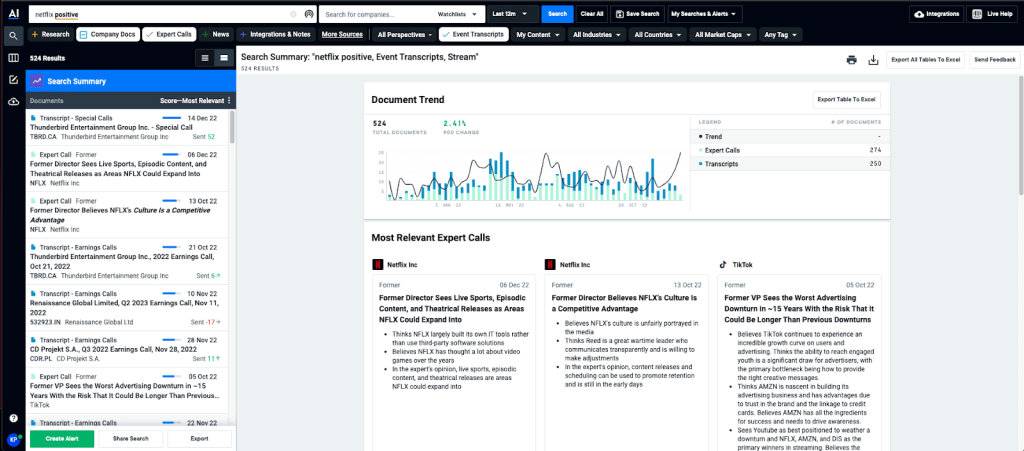

- Premium Content Universe: AlphaSense aggregates content from high-value sources, including SEC and global filings, earnings transcripts, broker research, expert call transcripts, market news, regulatory updates, and structured financials for many public and private companies. The platform brings together content that typically requires multiple exclusive subscriptions into one AI-enabled searchable interface.

- Expert Transcript Library: Through its Tegus acquisition, AlphaSense provides expert call transcripts featuring insights from former executives, industry operators, and subject-matter experts. These primary research viewpoints enhance insights beyond those offered by secondary sources.

- Generative AI Suite: The platform features purpose-built GenAI features that deliver AI insights, along with source citations for transparency and fact-checking.

- Deep Research runs iterative 10-30 minute research across AlphaSense content and produces detailed company primers and reports.

- Generative Grid applies prompts across multiple documents at once and produces organized tables, which can be useful during earnings season.

- Smart Summaries auto-generate tear sheets that capture key takeaways from transcripts.

- Smart Synonyms Search: The platform’s search engine understands context and broadens queries beyond exact keyword matches. For example, a search for “electric vehicles” can surface results that mention “EVs,” “driverless,” “autonomous cars,” and related terms without any manual intervention.

- Sentiment Tracking: The platform’s AI identifies sentiment in earnings transcripts and expert calls, tracking how companies discuss specific topics in positive, negative, or neutral terms. This helps analysts detect changes in management tone and identify inflection points.

- Smart Alerts & Monitoring: AlphaSense sends real-time alerts on watchlisted companies and topics. Alerts arrive through email or mobile push notifications and include highlighted keywords and links to source documents. However, it can’t be distributed to stakeholders who are not paid subscribers.

- Enterprise Content Integration: AlphaSense allows users to upload and index internal content, such as sales calls, win-loss interviews, documents, and research memos. Integrations with SharePoint, OneNote, Box, FileSync, and Evernote let teams apply AI search and GenAI analysis to internal knowledge.

Who is AlphaSense best suited for?

AlphaSense is ideal for finance and strategy professionals at large enterprises and financial institutions. It works well for teams who need access to premium content, including broker research, expert insights, and financial data, to conduct M&A due diligence, investment research, market research, and strategic planning.

Key AlphaSense limitations

While AlphaSense excels at providing deep financial market intelligence, it has several limitations in supporting a comprehensive, cross-functional market and competitive intelligence program. Organizations that need intelligence beyond finance and investment research use cases often see gaps in coverage, collaboration, and flexibility.

1. Finance-first focus that limits cross-functional use

AlphaSense’s sourcing and workflows are finance-focused and less suitable for teams that need continuous and structured market and competitive intelligence for strategy, product, marketing, or sales enablement use cases. Signals to support them often come from company websites (blogs, case studies, and other resources), social media, job boards, customer conversations captured by Gong or Chorus, and website changes that are constrained in AlphaSense.

2. Lack of coverage for key market and competitive intelligence channels

AlphaSense does not track forums, review sites, job postings, or social media platforms such as LinkedIn, X, Facebook, and YouTube, which are rich sources of information on companies. It also lacks the capability to track webpage changes. You can view what AlphaSense covers here.

These channels can surface early signals, including new customers, new partners, management changes, positioning shifts, pricing updates, hiring trends, and customer needs. For M&CI programs that need to capture these signals across the entire digital footprint, this creates blind spots.

3. Limited flexibility for adding custom sources (RSS-only additions supported)

AlphaSense restricts adding custom sources to only those that offer RSS feeds. This limitation may hinder coverage of many important sources that do not publish RSS feeds. For teams building tailored monitoring for industry-specific websites or niche publications, this limitation limits their ability to control what gets tracked.

4. Limited organization-wide intelligence distribution capabilities

AlphaSense allows sharing links and sending email alerts. However, when these links are accessed outside AlphaSense, access to the full underlying document may be limited by content type. In some cases, only partial details, such as the title, may be visible, and full access may require requesting a trial. Because of these restrictions, teams often rely on exports and downloads to share complete context with stakeholders, which creates friction and increases the risk of information silos.

5. No translation capabilities for global non-English intelligence content

AlphaSense provides non-English content in 37 languages, but it does not offer translation capabilities. For global M&CI programs, this means teams still need separate translation workflows to make global signals usable. This can slow response times and limit the value of non-English coverage for teams that operate primarily in English.

6. Limited customization and fixed offering

AlphaSense provides a fixed offering that cannot be customized to specific organizational needs or use cases. The platform lacks AI for auto-classification based on custom taxonomies. These constraints can force teams to adapt their process to the tool, rather than fitting the tool to their operating model and the company’s context.

7. Limited visualization capabilities for non-Financial data

The platform lacks robust charting and advanced visual analysis of non-Financial data, which are important for teams that need to see trends and patterns over time happening in their market landscape.

8. Limited integrations for intelligence distribution

AlphaSense’s integrations focus mainly on ingesting internal content (such as SharePoint, OneNote, Box, and Evernote), but it offers fewer options for distributing intelligence into tools teams use in their daily workflows, such as MS Teams, Slack, or enterprise cloud platforms like Snowflake. This makes it harder to distribute intelligence beyond the subscriber group.

9. Usability challenges at scale

Multiple AlphaSense users on review sites cite complexities in the interface and difficulties in filtering large result sets. Even when content coverage is strong, teams may spend extra time refining searches and separating high-value updates from noise. This learning curve can slow adoption among new users.

Top AlphaSense alternatives and competitors at a glance

Here’s a quick at-a-glance table comprising the top 7 market and competitive intelligence tools that are a great alternative to AlphaSense:

| Tools | Key Features | Pros | Cons | Best For |

| Contify | – Noise-free, GenAI-validated intel from 1 Mn+ sources- Custom taxonomy & organization-wide newsletters- Automated insights such as SWOT, Ansoff Matrix, Growth Strategies, etc.- Auto-updating dashboards & company profiles- Unlimited platform users & subscribers | – Best-in-class noise reduction & data quality- Broadest source coverage (social, web, news, reviews)- Flexible, scalable pricing (unlimited users)- Integrated distribution to Slack, Teams, & CRM | – Initial learning curve- Not designed for high-volume PR/brand monitoring | Comprehensive, cross-functional M&CI programs involving noise-free monitoring of competitors, customers, key accounts, partners, and industry trends with broad coverage and company-wide distribution in formats such as feeds, dashboards, newsletters, and alerts. |

| Bloomberg Terminal | – Real-time market data across all asset classes- Integrated trading & execution workflows- Proprietary Bloomberg Intelligence research | – Unparalleled financial data depth & speed- Industry-standard for trading & quantitative analysis | – Very high cost per user- Steep learning curve (command-based interface)- Lacks non-financial strategic intel (social, reviews) | Financial professionals, traders, and investment analysts needing real-time market data and execution tools. |

| CB Insights | – Predictive scoring for private companies (Mosaic)- Tech market maps & emerging trend analysis- Deal & partnership network mapping | – Excellent predictive analytics for private markets- Visualizes complex ecosystem relationships- Strong for spotting early-stage startups | – High entry cost- Focused heavily on private tech companies- Limited daily operational monitoring tools | Corporate strategy, innovation, and venture teams focused on tech scouting and private market deals. |

| PitchBook | – Detailed private market financial data (VC, PE, M&A)- Investor & fund performance benchmarks- Comprehensive deal history & multiples | – Deepest private financial data & deal metrics- Excellent screening tools for deal sourcing- Strong Excel/PPT plugins for analysts | – Focused on deal data, not strategic M&CI- Limited tracking of qualitative signals (news, social)- No internal content integration | VCs, PE firms, and investment banks that need granular private-market financial and deal data. |

| Klue | – Automated competitive monitoring & insights- Dynamic battlecards integrated with CRM- Win-loss analysis program | – Purpose-built for sales enablement workflows- High adoption among sales teams- Strong battlecard templates & UI | – Limited to competitive intel and win-loss | Product marketing and sales enablement teams focused specifically on competitive battlecards and win-loss. |

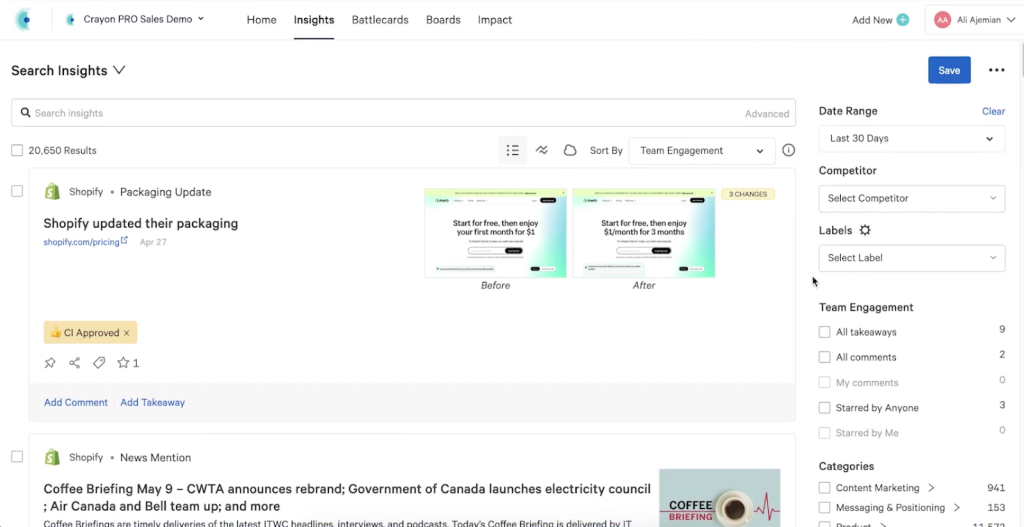

| Crayon | – Website change tracking with AI summaries- Competitive battlecards & sales alerts- Market & competitor scoring | – Strong tracking of competitor digital footprints- User-friendly for sales & marketing teams- Good integrations with sales stack | – Users often report high noise levels in feeds- Limited historical data without add-ons- Less flexible for complex non-competitor topics | Mid-to-large B2B revenue teams prioritizing competitor website tracking and sales enablement. |

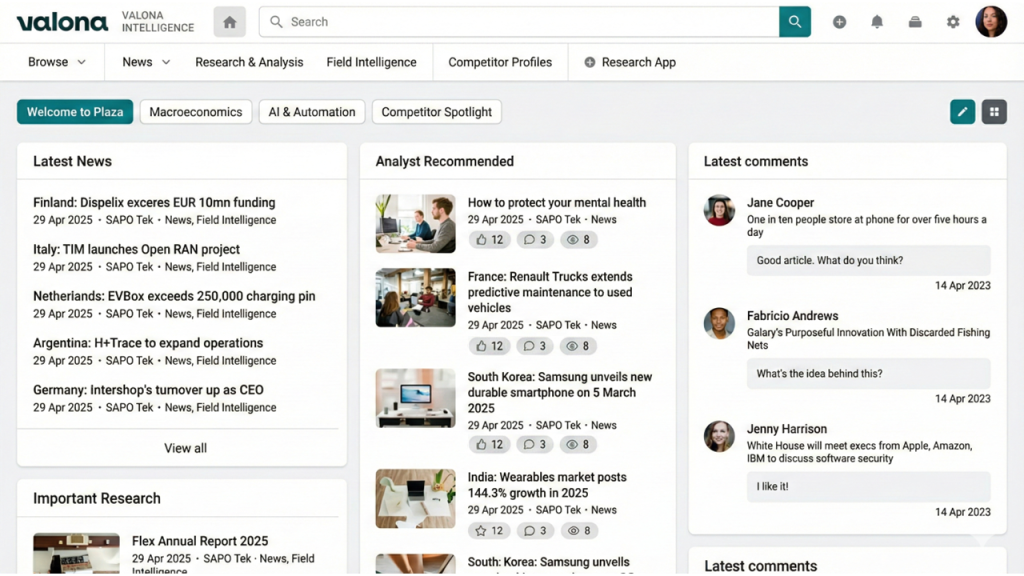

| Valona Intelligence | – Global monitoring in 115+ languages- AI research assistant + optional analyst services- Validated financial & trade flow data | – Strong global news coverage & translation- Hybrid model (AI + human analysts) available- Good for verified financial insights | – Less coverage of digital signals (social, reviews)- AI features often restricted to power users- Higher cost for full analyst support | Global enterprises needing hybrid intelligence (platform + analysts) and verified financial insights. |

Contify

Contify is a purpose-built AI-native market and competitive intelligence (M&CI) platform that provides trustworthy, verified, and decision-ready insights on your market, industry, competitors, key accounts, and other strategic entities. Contify enables organization-wide teams to make faster, more confident decisions and respond to competitors with greater agility.

Founded in 2009 by Mohit Bhakuni (an IIT Delhi and INSEAD alumnus), Contify has helped many Fortune 500 companies and fast-growing enterprises, including Deloitte, EY, IQVIA, Labcorp, Airbus, Lenovo, and Wipro, to identify growth opportunities, inform product strategy, enable sales, sharpen go-to-market (GTM) plans, and improve cross-team collaboration through a single, shared view of the market.

Related reading: How Lenovo built 360° value chain resilience with Contify

Key features of Contify

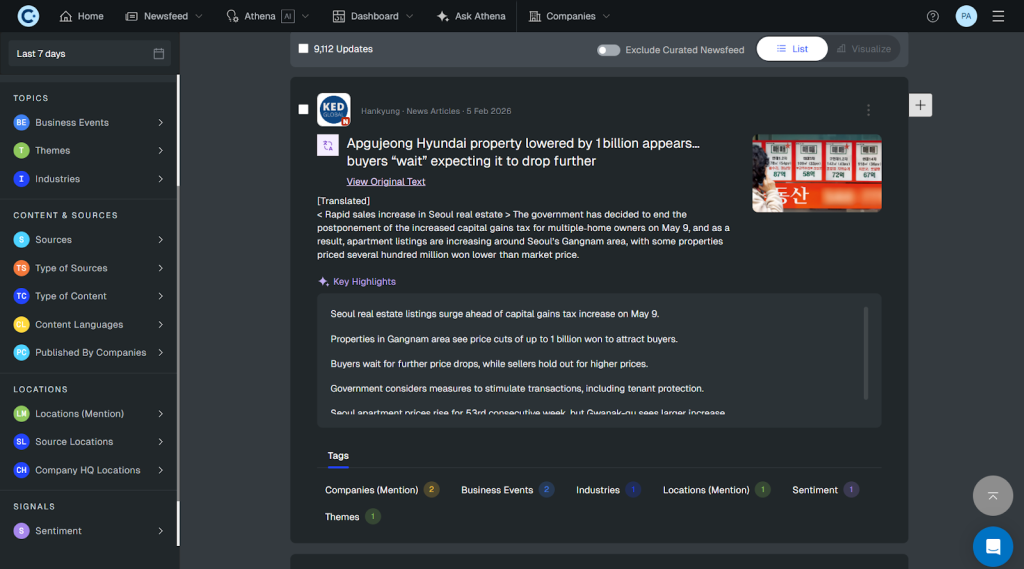

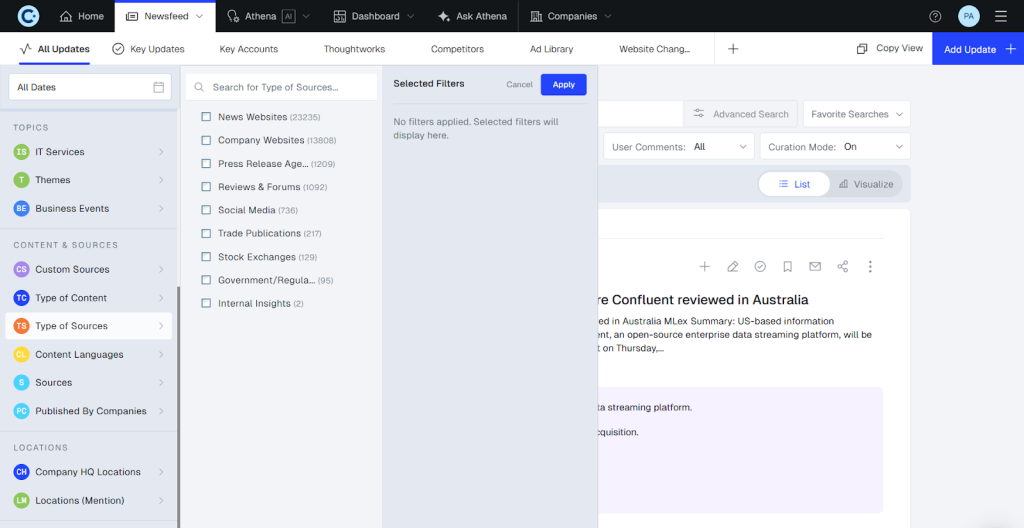

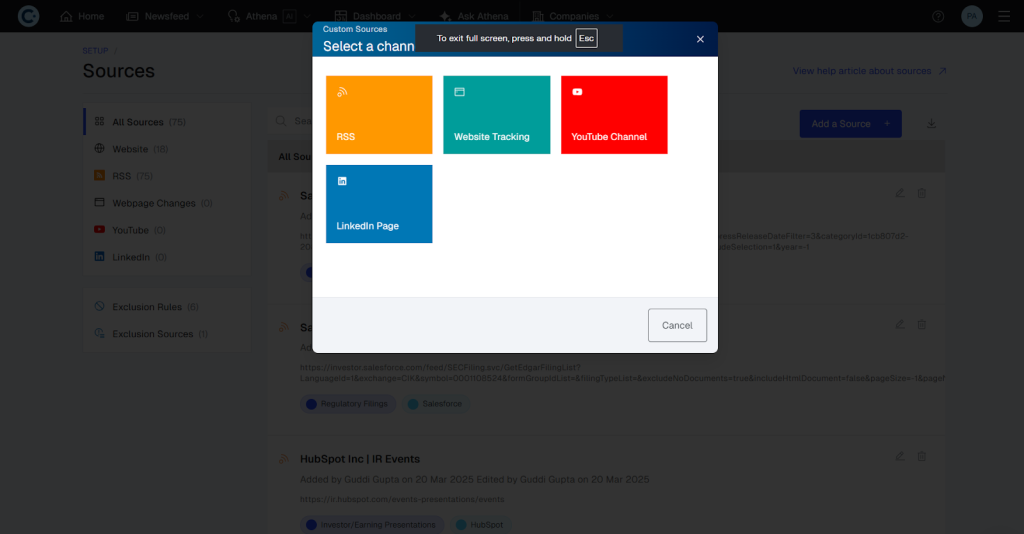

- Extensive Coverage: Contify sources information from over 1 Mn+ vetted global sources, including news, company websites, regulatory portals, job boards, review sites, social media, and more, covering 700k+ companies, 100+ industry segments, and extensive business topics. Users can also integrate internal content, such as SharePoint and customer conversations from Gong, to gain a more complete view.

- Cleanest Intelligence Feeds: By combining advanced AI algorithms and techniques such as deduplication, disambiguation, and GenAI-validated tagging, Contify filters out noise and delivers only the most relevant and reliable intelligence along with its extracted key highlights. Contify is widely recognized in the industry for providing the cleanest intelligence feeds. This improves signal quality for teams that need reliable monitoring at scale.

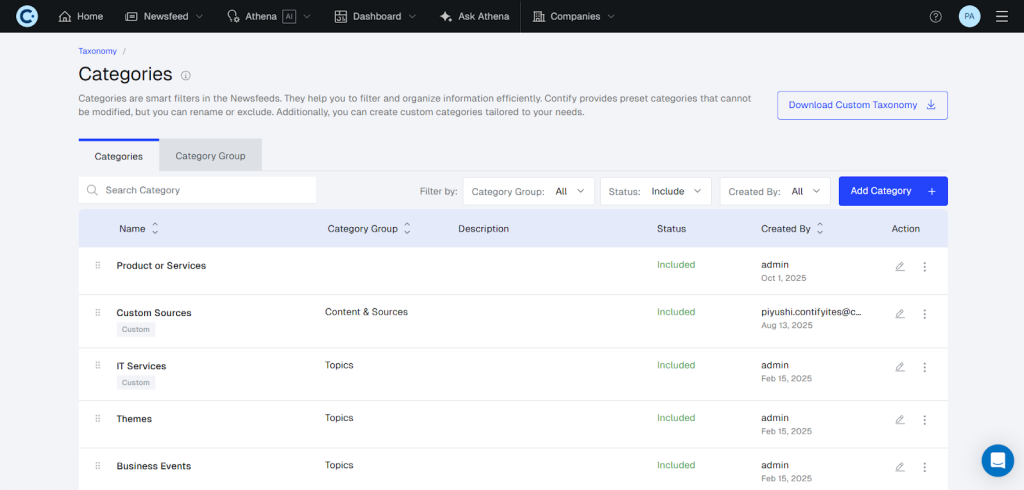

- Robust Business Taxonomy & Custom Tags: Contify provides several preconfigured M&CI categorizations covering companies, business events, themes, industries, executives, source types, locations, sentiment analysis, and more. The platform’s Taxonomy Manager also lets users create custom category groups, nested tags within them, and add AI-based tags tailored to their organization’s external market landscape and internal organization structure. This enables them to efficiently filter, discover, and analyze intelligence relevant to their specific needs.

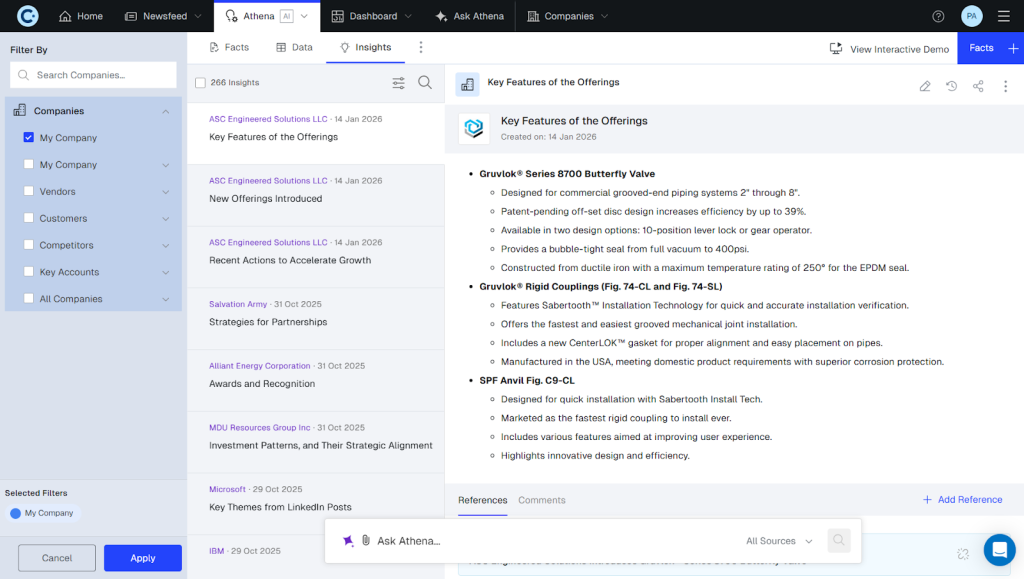

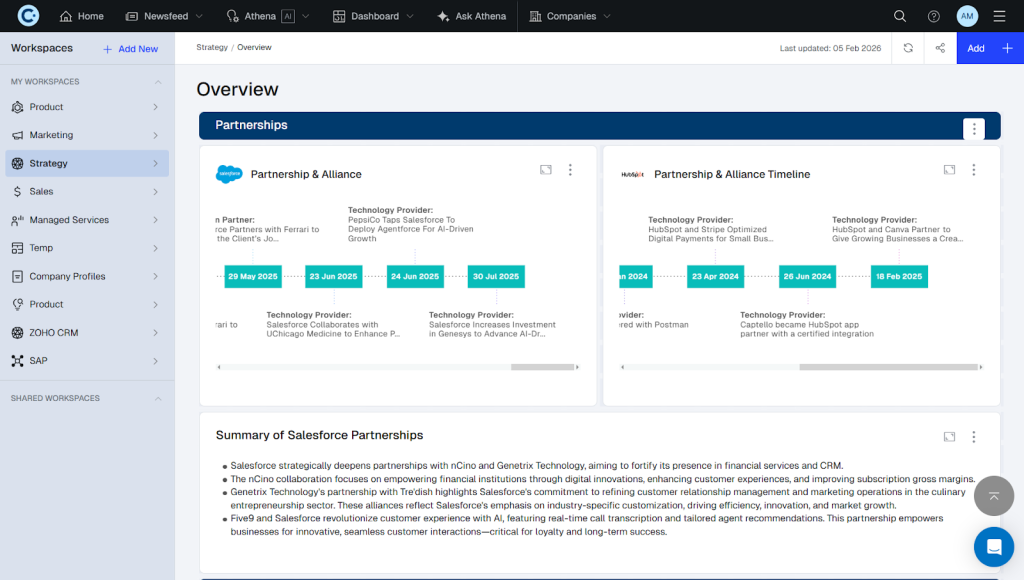

- Automated Insights & Analysis: Contify’s AI extracts key data points and highlights from intelligence datasets, connecting them to deliver continuously updated, decision-ready insights. This turns raw data into precise, actionable analysis that would otherwise take hours to compile manually. With a vast library of predefined insight templates, users can access auto-updating analyses, including SWOT, the Ansoff matrix, a company’s strategic objectives, product and growth strategies, battlecards, and more.

- Ask Athena: Contify’s conversational AI assistant lets users ask intelligent queries in natural language and get trusted responses grounded in verified, business-grade sources and proprietary internal data.

- Live Company Profiles: Contify provides AI-powered Live Company Profiles that give a real-time, strategically unified view of any company out-of-the-box, seamlessly consolidating strategic insights, customer profiles, products, customers, financials, leadership details, trends, and more into one place. These profiles help business teams eliminate hours of fragmented research and gain instant, actionable context to identify opportunities, assess risks, and inform every strategic move.

- Intuitive Dashboards and Battlecards: Contify offers role-specific dashboards and battlecards with auto-updating widgets to visualize historical and real-time intelligence from diverse sources. With an extensive library of pre-built templates, users can track trends, compare competitors, and present insights and reports tailored to different stakeholders’ needs.

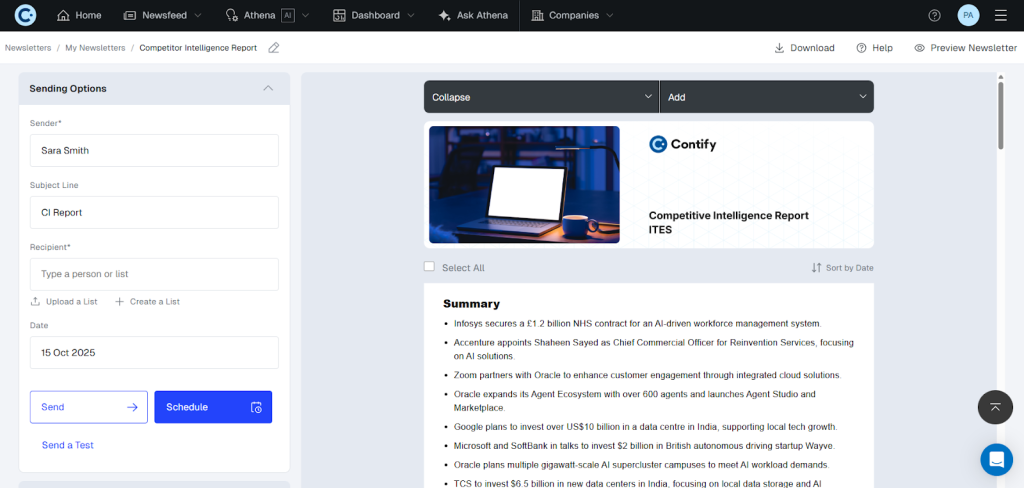

- Intelligence Newsletters and Alerts: Contify enables users to quickly create branded intelligence newsletters with built-in AI summaries and templates. They can then distribute these newsletters organization-wide to unlimited subscribers, including stakeholders without platform access. Additionally, Contify offers real-time alerts to keep teams informed as key market events unfold.

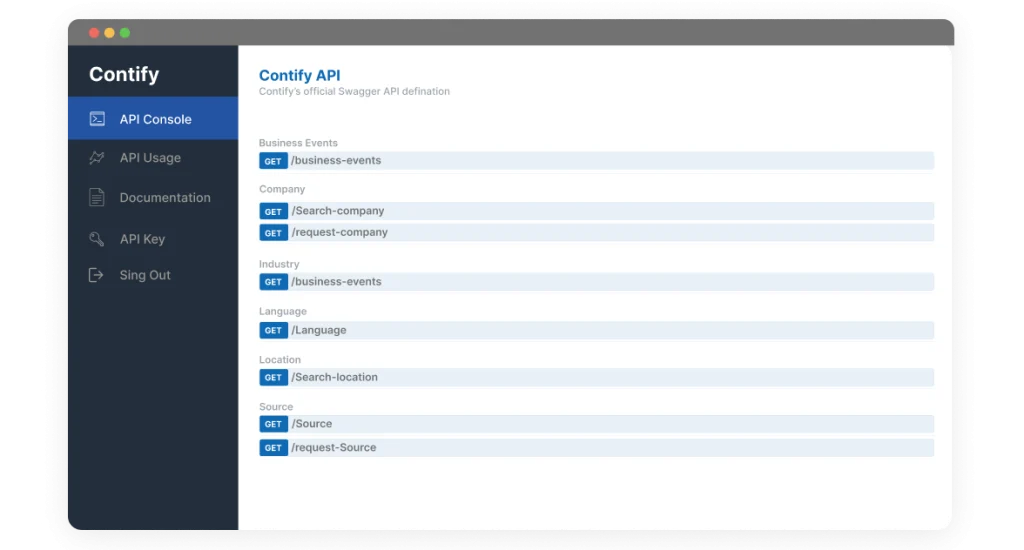

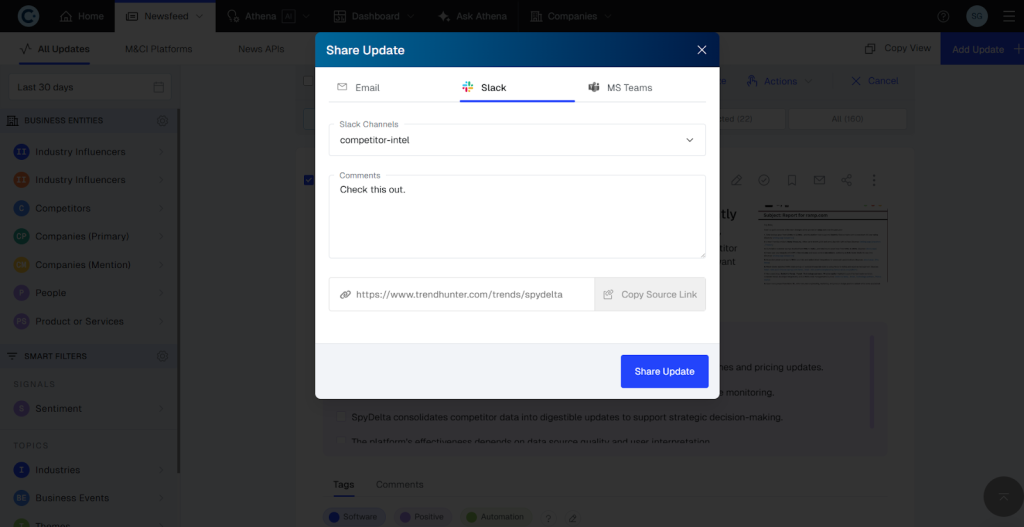

- Workflow Integrations and APIs: Contify supports integrations with systems such as Slack, MS Teams, Salesforce, and Snowflake to deliver intelligence into daily workflows. It also supports embedded widgets and APIs/webhooks to extend intelligence to other tools.

AlphaSense vs. Contify: Where does Contify win?

- Customizable platform that adapts to client’s scope: Contify adapts to organization’s specific use cases and workflows rather than imposing a fixed offering. It allows users to customize taxonomy tagging, dashboards, newsletters, insights, and alerts to match their organization’s operating model and cross-functional requirements.

- Org-wide intelligence sharing: Contify’s newsletters and alerts can be shared to unlimited subscribers, including those without platform access. Additionally, Contify allows the addition of unlimited platform users to enable enterprise-wide intel consumption.

- Context-aware AI trained on organization’s understanding: Contify AI understands the client’s company and its offerings. This allows it to generate automated insights tailored to their business context and priorities.

- More complete global coverage: Contify provides translated intelligence in 117+ languages from over 200k+ non-English sources, useful for global market and competitive intelligence programs.

- Personalized dashboards and deeper charts and graphs: Contify provides over 50+ dashboard templates with auto-updating qualitative insights and 20+ advanced chart types, including stacked bar/column charts, bubble/suburst charts, interactive timelines, geographic maps, trend analysis, and more. This enables the creation of role or use-case specific dashboards that update in real time and can be embedded in Power BI, Tableau, or SharePoint.

- Broader digital footprint coverage: Contify covers sources such as social media (X, YouTube, Facebook, and more), job boards, review sites, forums, and website changes, helping teams track intelligence signals that don’t appear in filings or research reports.

- No limits on custom sourcing: Contify supports adding sites with or without RSS feeds and bringing in subscription databases such as LexisNexis and GlobalData, helping teams avoid coverage gaps.

- Better workflow distribution: Contify integrates with tools like Slack, MS Teams, Salesforce, and Snowflake, and supports embedded widgets and APIs/webhooks. This enables intelligence to reach teams where they work daily.

Contify pros

- Robust coverage with the availability of structured intelligence datasets on 700k+ public and private companies, growing business topics, industries, business events, themes, and more, all continuously monitored.

- Easy self-serve option to add custom sources.

- Global multilingual intelligence with translated content in over 117+ languages.

- Customized tagging of intelligence content to fit the organization’s structure and requirements.

- Pre-defined prompt templates to generate insights and analysis outputs using agentic AI workflows.

- Unlimited platform users can be added without incurring additional costs, enabling enterprise-wide adoption of intelligence.

- Integrations with Slack, MS Teams, and email for seamless intelligence distribution.

- User-friendly interface and easy-to-use features

Contify cons

- Requires a learning curve initially due to customization options.

- Not suitable for PR use cases such as brand monitoring. The core M&CI engine is designed to provide unique strategic information by removing duplicates and similar information, not designed for tracking the extent of media coverage, which is essential for PR and Brand Monitoring.

Who is Contify best suited for?

Contify is ideal for mid- to large-sized enterprises and high-growth companies in fast-moving industries, such as IT/ITeS, SaaS, BFSI, management consulting, manufacturing, pharmaceutical, and healthcare. It empowers M&CI professionals and strategy, marketing, sales, and product leaders with automated, noise-free, and in-depth insights into competitors, customers, partners, and the broader market landscape from external web sources and internal data. The insights can be accessed in various formats, including feeds, newsletters, alerts, company profiles, reports, battlecards, and dashboards delivered into their daily workflows – Slack, MS Teams, Email, or Snowflake.

Bloomberg Terminal

Bloomberg Terminal is a financial data and analytics platform that many consider as industry standard for real-time financial market intelligence, quantitative research, and supporting integrated trading workflows. Many financial professionals use Bloomberg and AlphaSense together to combine real-time financial market information with premium content libraries.

Founded in 1981 by Michael Bloomberg, Bloomberg Terminal serves more than 350k subscribers worldwide and is synonymous with financial market data and analysis.

Key features

- Real-Time Market Data Across All Asset Classes: Bloomberg Terminal provides comprehensive, real-time data on over 35 Mn+ financial instruments such as equities, bonds, currencies, commodities, and derivatives across 330+ exchanges. The platform’s data feeds deliver normalized, consolidated market data that powers trading decisions, risk management, and portfolio analytics across front and back offices.

- Bloomberg Intelligence Research: The platform provides access to research analysis from Bloomberg’s in-house research team of over 350+ professionals, covering major sectors and industries. It includes deep dives into company fundamentals and specialized areas such as credit, equity strategy, Fixed Income Clearing Corporation (FICC), and Environmental, Social, and Governance (ESG), along with analysis of the impact of government policy.

- Integrated Trading and Execution: Bloomberg Terminal integrates multi-asset execution and order management solutions directly within the platform, enabling users to seamlessly move from research to execution. This integration includes sophisticated pre- and post-trade analytics, automated trading tools, and connectivity to global settlement and regulatory reporting.

- Advanced Analytics and Charting: The platform provides sophisticated analytical tools for financial modeling, backtesting, scenario analysis, and risk assessment. Users can sync data into Excel, SQL, and Python for custom analysis, and leverage tools like Bloomberg BQuant (BQNT) for quantitative research and strategy backtesting.

- Instant Bloomberg Messaging: The platform also provides access to a proprietary messaging network that connects users with a global community of 350k+ financial professionals, allowing communication for deals, financial market intelligence, and counterparty connections.

- Bloomberg News and Market-Moving Information: Bloomberg News provides real-time breaking news and analysis that directly affects financial markets, seamlessly integrated with data and analytics. However, Bloomberg’s search functionality is more limited as compared to modern search interfaces.

Bloomberg pros

- Unparalleled depth and breadth of real-time financial market data across all asset classes.

- Industry-standard platform with strong network effects through Instant Bloomberg messaging.

- Integrated trading execution eliminates workflow friction between research and execution.

- Bloomberg Intelligence provides institutional-grade proprietary research from experienced analysts.

- Sophisticated analytical tools for quantitative analysis, backtesting, and financial modeling.

- Comprehensive pricing data and valuations across liquid and illiquid securities.

Bloomberg cons

- Steep learning curve with a complex, command-based interface that may require a few months to achieve proficiency.

- Limited AI-powered search capabilities.

- Not designed for qualitative market and competitive intelligence use cases beyond financial research (lacks social media monitoring, review sites, job boards, website change tracking).

- Limited integration capabilities with modern collaboration tools and restrictive data export policies.

Who is Bloomberg Terminal best suited for?

Bloomberg Terminal is best for finance professionals at investment banks, asset management firms, hedge funds, and large corporate finance departments who needreal-time quantitative market data, trading execution, and deep financial analytics. It is particularly valuable when you need comprehensive market coverage, real-time pricing across asset classes, and integrated trading execution capabilities.

CB Insights

CB Insights is a predictive company intelligence platform that specializes in private company analysis and emerging technology tracking. CB Insights excels at forward-looking predictive analytics for private tech markets using proprietary scoring algorithms that help organizations identify breakout startups, emerging technologies, and market shifts before they become obvious.

Founded in 2008 by Anand Sanwal, CB Insights (formerly known as ChubbyBrain) is used by corporate strategy, finance, and innovation teams at top investment banks and other leading companies like IBM, Microsoft, 3M, and Wells Fargo.

Key features of CB Insights

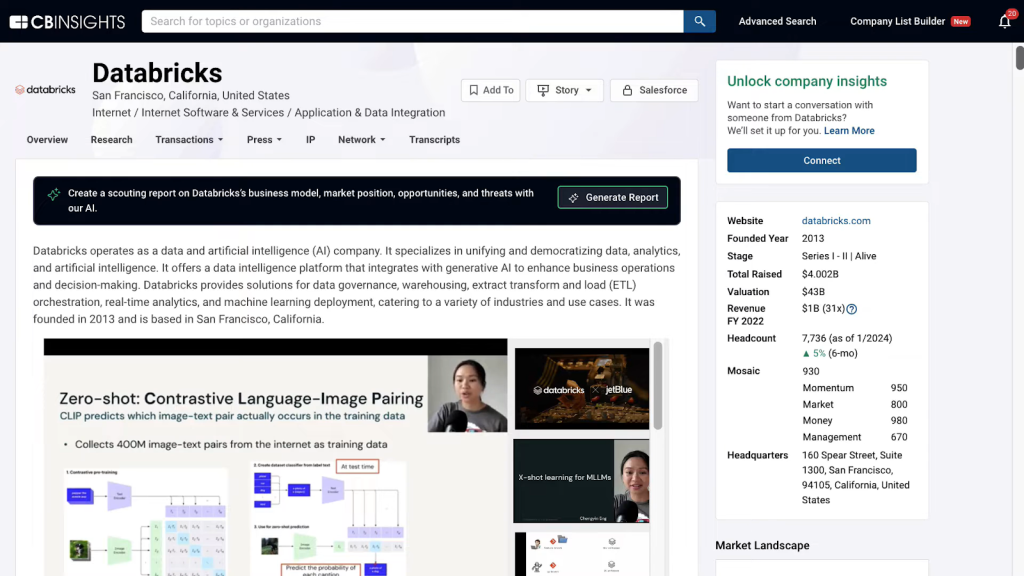

- Company Profiles with Predictive Scoring: CB Insights offers detailed profiles of private tech companies and startups, including funding, relationships, competitors, tech stacks, and hiring. Each profile features proprietary scores such as Mosaic, Commercial Maturity, and Exit Probability, which predict success, IPO potential, and acquisition potential. It focuses on historical and predictive data points rather than on real-time strategic intelligence from diverse external sources, as provided in Contify.

- Mosaic Score (Predictive Analytics): The platform’s flagship feature is Mosaic Score, which is an NSF-backed algorithm predicting private company success by analyzing four pillars: Growth Momentum (social media, news, web traffic), Financial Strength (funding, burn rate, investors), Industry Health (industry trends, competition), and Management (team quality, experience).

- AI Agents and Predictive Analysis: CB Insights provides AI agents that produce research deliverables. These agents include Scouting Reports (SWOT analyses of companies), Acquisition Hunter (identifies strategic targets), Competitive Sentinel (monitors rival investments), Earnings Analyst (earnings call intel), and Business Relationship Analyst (maps customer, vendor, and partner networks).

- Technology Market Intelligence: The platform tracks 1,500+ technology markets with quantitative rankings, market maps, patent analysis, and expert research reports. CB Insights maintains a comprehensive library of industry reports on emerging technologies, though most focus is on the tech sector.

- Venture Capital and M&A Tracking: Users can monitor VC investments, private equity deals, M&A activity, IPOs, and SPACs across the tech ecosystem. The platform tracks funding rounds, valuations, investor networks, and partnership activity to reveal where capital is flowing and which companies are gaining momentum.

- Business Relationship Data: CB Insights maps customer-vendor relationships, strategic partnerships, and technology integrations to help identify hidden opportunities and understand company ecosystems. This relationship data enables teams to uncover deals that would be invisible without network intelligence.

CB Insights pros

- Extensive coverage of private company intelligence with 11M+ profiles focused on tech and startups.

- Proprietary Mosaic Score provides predictive analytics to help identify future winners for the right VC decisions.

- AI agents generate instant research deliverables (SWOT, scouting reports, acquisition targets) that reduce research time.

- Business relationship data reveals hidden partnerships and M&A opportunities through network analysis.

- Visual intelligence tools (strategy maps, market maps, relationship graphs) make complex market patterns easier to digest.

- Strong integration capabilities via APIs and data feeds for embedding intelligence into existing workflows.

CB Insights cons

- High cost, with pricing starting at $60,000 per year, making it prohibitive for smaller organizations.

- Focuses primarily on private tech companies with limited coverage of public companies and industries outside IT and technology.

- Lacks advanced AI search capabilities and sentiment analysis across datasets.

- Cannot upload internal company content (sales calls, win-loss interviews, SharePoint documents).

- Limited customization of dashboards and reporting features compared to purpose-built M&CI platforms.

- Leans heavily toward venture capital and M&A use cases, with limited applicability to broader market and competitive intelligence programs.

Who is CB Insights best suited for?

CB Insights is ideal for corporate development and innovation teams seeking predictive intelligence on private tech companies and emerging markets. It’s valuable for technology scouting, startup partnership evaluation, venture investing, M&A target identification, and competitive monitoring. Organizations looking to identify breakout companies early and track tech trends will benefit most from CB Insights’ analytics, which focuses on private companies.

Pitchbook

PitchBook is an investment research and company intelligence platform that specializes in data on private and public capital markets. PitchBook excels at providing structured financial data for deal sourcing, fundraising, and due diligence, with a strong coverage of the private markets.

Founded in 2007 by John Gabbert and acquired by Morningstar in 2016, PitchBook is now part of Morningstar’s research and data portfolio. It serves venture capital firms, private equity firms, and investment banks around the world.

Key features of Pitchbook

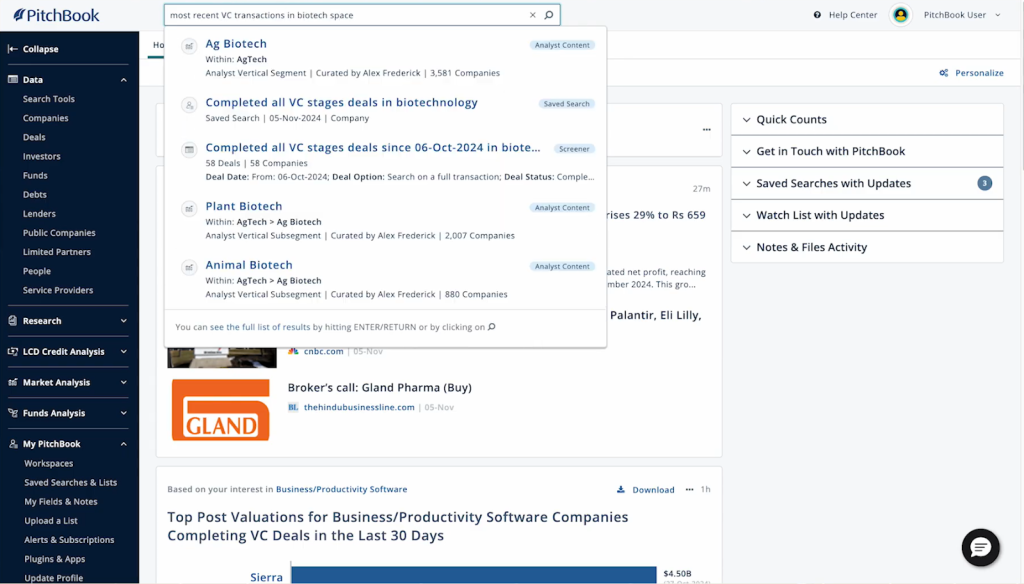

- Company Profiles and Deal Coverage: PitchBook offers detailed profiles of global companies, both private and public, with a focus on Mergers and Acquisition (M&A), venture capital, private equity, and debt financing. Each profile includes funding history, valuations, cap tables, financials, business relationships, technology stacks, and leadership teams. These profiles emphasize historical financial performance and deal-level transactional metrics rather than real-time strategic intelligence.

- Investor, Fund, and LP Intelligence: The platform provides data on over 450k+ investors and 110k+ funds, including strategies, performance, LP commitments, fundraising, deals, and syndicates. This helps users identify investors, analyze investment trends, benchmark fund performance, and target suitable limited partners.

- Financials and Non-Financial Metrics: PitchBook provides historical company financials, debt details, valuation multiples, estimates, and projections. It also offers non-financial metrics, such as patent data, employee counts, web traffic, hiring trends, app reviews, and social media stats, to supplement financial analysis.

- Earnings Call Transcripts and Equity Research: The platform offers earnings call transcripts for public companies and broker research from providers such as Morningstar, HSBC, Guggenheim, and Piper Sandler, though broker research may incur extra fees.

- Advanced Search and Screening Tools: PitchBook’s screening tools allow users to create custom datasets across companies, deals, investors, and funds, with multiple filters. Users can upload prospect lists, use advanced search, and perform comparisons to find investment opportunities and evaluate competitors.

Pitchbook pros

- Extensive coverage with 3Mn+ company profiles and investment data across VC, PE, M&A, and credit.

- Comprehensive financial data, including pre/post-money valuations, cap tables, debt structures, and historical performance metrics.

- Extensive investor and fund intelligence covering 450k+ investors and 110k+ funds with LP commitments and fundraising activity

- Advanced search filters and screening capabilities that allow sophisticated deal sourcing and the creation of custom datasets.

- Strong Excel and PowerPoint plugins streamline data integration into financial models and investor presentations.

- Emerging Spaces feature helps investors identify trending markets and spot alternative investment opportunities early.

- Real-time alerts and custom dashboards available for tracking funding rounds, M&A activity, and market developments.

Pitchbook cons

- Not built for holistic, comprehensive qualitative market intelligence beyond financial and deal data.

- Company profiles focus on financial metrics and deal history rather than on real-time strategic intelligence from diverse sources such as social media, job boards, review sites, and changes to competitors’ websites.

- Cannot index internal content necessary for M&CI use cases.

Who is Pitchbook best suited for?

PitchBook is best for VCs, PEs, IBs, M&A advisors, and corporate development teams that need detailed private-market data for deal sourcing, fundraising, due diligence, and portfolio management. It’s especially useful for investment research, valuation benchmarking, tracking funding, finding targets, and analyzing capital flows. Organizations aiming to identify breakout companies early, evaluate private-market opportunities, and use detailed financial metrics for investment decisions will find PitchBook’s deal intelligence most valuable.

Klue

Klue is a competitive intelligence and win-loss platform that helps organizations turn competitor signals and buyer feedback into battlecards and insights that sellers can use to stay ahead in competitive deals.

Founded in 2015 by Jason Smith and Sarathy Naicker, Klue serves enterprises worldwide, including notable companies such as Shopify, SurveyMonkey, and Zendesk. It helps product marketing managers and CI professionals by transforming competitor data into battlecards and win-loss insights that integrate directly into existing sales workflows.

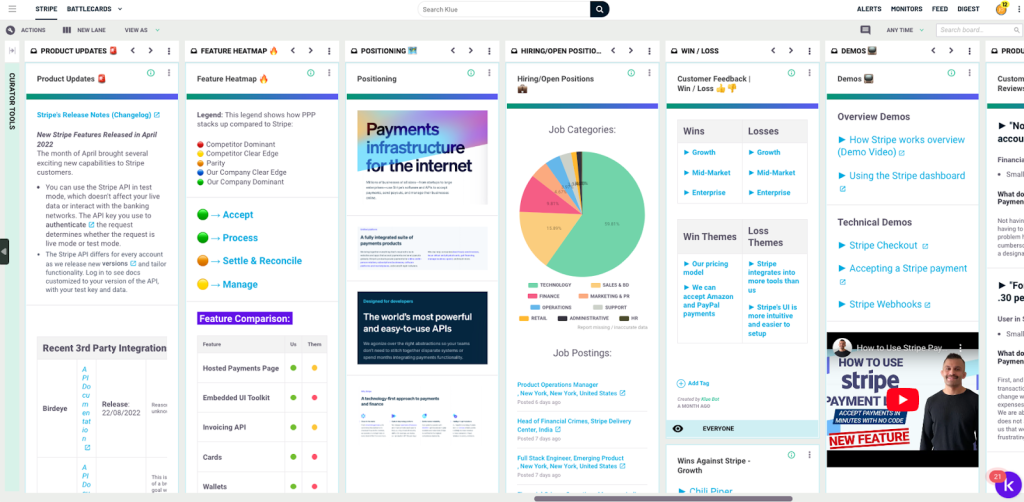

Key features of Klue

- Competitive Monitoring: Klue gathers competitive intelligence automatically from millions of public sources across the web. These include competitor website changes, news articles, press releases, product launches, social media mentions, and customer reviews from platforms like G2 and Capterra. The platform also allows users to integrate internal sales conversations from Gong, Chorus, Clari, and Zoom.

- Competitive Battlecards: Klue offers comprehensive tools to build and maintain dynamic battlecards, with sections such as “Why we win,” “Why we lose,” “Landmines to lay,” “Quick dismisses,” and more. Battlecards can be accessed through integrations with Salesforce, Slack, Microsoft Teams, and mobile apps.

- Win-Loss Analysis: Klue captures objective buyer feedback through expert-led interviews, automated surveys, and AI-generated insights to understand why deals are won or lost. The platform offers both full-service research teams and self-serve options, combining human expertise with automation to deliver depth and scale.

- Automated Insights: Klue automatically generates multiple types of competitive insights from CRM data, sales calls, win-loss interviews, and trusted external sources. It packages insights into daily or weekly Klue Cards, delivered directly to sellers where they work, eliminating the need for manual research.

- Newsletters: Klue offers intuitive capabilities for creating and sharing newsletters. Users can compile relevant updates into a digest with AI summaries and include their own insights. Newsletters can be shared immediately or scheduled for later delivery, and performance can be tracked using metrics such as open and click-through rates.

- Workflow Integrations: Klue seamlessly integrates with existing business tools, including Salesforce, Slack, Microsoft Teams, and Gong, making competitive intelligence accessible within daily workflows.

Klue pros

- Intuitive platform with a strong focus on competitive enablement and battlecard creation.

- Comprehensive automated intelligence collection from millions of public sources across the web.

- Easy-to-use drag-and-drop interface for quickly creating visual newsletters and battlecards.

- AI-powered features that automatically generate insights such as “Win Stories,” “What Prospects Are Saying,” “Objection Handling,” “Talk Tracks,” etc.

- Strong customer support, with dedicated customer success managers who handle manual work and onboarding.

- Excellent battlecard templates and designs that effectively support sales conversations.

- The win-loss program provides unbiased buyer feedback from expert researchers and automated surveys.

Klue cons

- Focused primarily on competitive intelligence and sales enablement, with limited support for intelligence on other market forces like customers, partners, industry trends, or broader market intelligence.

- Limited evaluation during trial.

Who is Klue best suited for?

Klue is ideal for product marketing, competitive intelligence, and sales enablement teams at B2B and SaaS companies that want competitive insights and battlecards within their daily workflows (CRM, collaboration tools), rather than living in a separate research destination. It’s especially useful when you want one system to run competitive intel and win-loss together, and you’re optimizing for seller adoption with deal-based delivery.

Crayon

Crayon is a competitive intelligence platform that helps businesses monitor competitors and enable sales teams with real-time intelligence. The platform focuses primarily on competitor tracking and sales enablement, providing automated monitoring across various digital channels to help revenue teams stay ahead of their competition.

Founded in 2015 by Jonah Lopin, Crayon serves mid-market and enterprise businesses, including notable companies like Gong, Dropbox, and ZoomInfo. The platform helps product marketing and sales teams by transforming competitor data into actionable insights through battlecards, alerts, and AI-powered analysis tools that integrate directly into existing sales workflows.

Key features of Crayon

- Battlecards and Sales Enablement: Crayon provides tools to create dynamic battlecards that equip sales teams with competitor differentiators, objection-handling strategies, and talk tracks. These battlecards are automatically updated with real-time competitor intelligence and can be integrated directly into CRMs like Salesforce and HubSpot, enabling reps to access them during live deals.

- Automated Competitor Monitoring: The platform tracks competitors across digital footprint sources, including websites, social media, job boards, news sites, and review platforms. Crayon monitors over 100 data types and dynamically scores intelligence based on its impact in your market using machine learning.

- Crayon Answers (AI Assistant): A generative AI-powered assistant that provides conversational, real-time answers to competitive questions during sales conversations. Sales reps can ask questions like “How do we position against Competitor X?” and receive immediate responses grounded in Crayon’s intelligence database.

- Sparks AI Analysis: Analyzes competitive data with AI to create custom enablement content, run SWOT analyses, and transform raw intelligence into sales assets. Sparks automatically analyzes sales calls to identify common objections, summarize win-loss takeaways, and update battlecard content.

- Website Change Tracking: Crayon tracks web page changes with automatic annotations and summaries. This enables teams to spot pricing updates, positioning shifts, and messaging changes immediately.

- Content Creation Tools: Enables users to create branded newsletters, announcements, reports, and battlecards with AI-assisted summaries of competitor updates that can be shared organization-wide.

- Integration Capabilities: Seamlessly integrates with existing business tools, including Salesforce, HubSpot, Slack, and Microsoft Teams, making competitive intelligence accessible within daily workflows.

- Analytics and Reporting: Tracks battlecard usage, measures sales engagement, and correlates competitive intelligence with deal outcomes to quantify ROI. Custom reports highlight patterns in competitor wins and losses to inform the go-to-market strategy.

Crayon pros

- Intuitive platform with a strong focus on sales enablement and battlecard creation.

- AI-powered competitor website tracking with automated change detection and summaries.

- Comprehensive battlecard templates designed for different sales roles and scenarios.

- Strong integrations with CRM and collaboration tools to support competitor-specific sales use cases.

- User-friendly interface designed specifically for go-to-market teams.

- Excellent sales enablement features, including dynamic battlecards that update automatically.

Crayon cons

- Focused primarily on competitive intelligence and does not provide intelligence on other market forces like customers, partners, or broader industry trends.

- Users often complain about receiving duplicate content and excessive noise in their feeds.

- Limited historical data availability, which is typically provided at an additional cost.

- Less suited for enterprises requiring customizations, flexibility, and custom taxonomy configurations.

Who is Crayon best suited for?

Crayon is ideal for B2B sales and marketing teams in mid- to large-sized organizations operating in competitive markets who need straightforward competitor monitoring, battlecards, and sales enablement capabilities. It is particularly well-suited for organizations that prioritize sales team adoption and need competitive intelligence integrated directly into their existing sales tool (E.g., Salesforce and Slack). Product marketing managers and sales enablement leaders focusing on competitor intelligence will find Crayon’s features most valuable.

Valona Intelligence

Valona Intelligence is another purpose-built market and competitive intelligence platform that combines AI-powered monitoring with analyst services to deliver insights into market developments and competitor moves.

Founded in 1999 by Marjukka Nyberg and Kim Nyberg and formerly known as M-Brain, Valona serves several notable organizations worldwide, including IKEA, Goodyear, HSBC, and Philips, providing critical intelligence from 200,000+ global sources and industry-specific datasets to help them lead in rapidly changing markets.

Key features

- Global Source Monitoring: Valona monitors 200k+ information sources globally in 115+ languages, including news, filings, trade journals, regulatory databases, and paywalled publications. Source coverage is heavy on news and media outlets rather than on a comprehensive digital footprint. Users can also integrate field intel and internal knowledge sources, such as SharePoint.

- VAL AI Research Assistant: Valona’s AI research assistant provides conversational intelligence by answering questions in natural language and generating structured responses using established frameworks such as SWOT and Porter’s Five Forces. It integrates both external market insights and organizations’ internal content, such as field intelligence, analyst reports, customer insights, and sales materials

- Real-time Competitor Profiles: Valona provides Competitor Profiles with real-time insights, earnings data, and validated financials, along with automatically generated analysis and visualizations that make performance gaps, risks, and opportunities instantly visible.

- Dashboards and Visualizations: Valona offers intuitive dashboards with visualizations beyond charts and graphs, including trend radars and competitive benchmarking, that are easy to create and fetch data from Valona’s intelligence database.

- Automated Alerts and Newsletters: The platform offers personalized automated alerts for smaller groups and newsletters for larger audiences. It includes features for newsletter creation and subscriber management, providing an effective way to engage with audiences. Automated alerts help keep users informed in a timely manner

- Analyst and Consulting Services: Valona combines AI capabilities with optional analyst and consulting services, available at an additional cost, for organizations that need expert support beyond the platform.

- Workflow Integrations: Valona provides two-way integrations with Microsoft Teams, Salesforce, Slack, and other platforms where teams work daily, ensuring intelligence reaches people through shared dashboards, profiles, newsletters, alerts, and exportable visuals for executive reporting.

Valona Intelligence pros

- Strong news aggregation capabilities with 200k+ sources in 115+ languages, including paywalled publications.

- Validated financial and trade flow data sourced from A-INSIGHTS.

- Pre-built dashboards and profiles that accelerate time-to-value.

- Combines AI capabilities with optional analyst and consulting services for organizations that need expert support.

- Strong customer support, as praised by users for quality service and ongoing assistance.

Valona Intelligence cons

- Limited coverage beyond news and media outlets of critical intelligence sources, such as company websites, social media, review sites, job boards, and YouTube.

- Restriction of AI features to power users, limiting org-wide platform adoption.

- Doesn’t provide auto-updating pre-defined insights that combine multiple updates for ready-made outputs.

- Limited customization options for taxonomy and source integration.

Who is Valona Intelligence best suited for?

Valona Intelligence is best suited for mid- to large-sized organizations that need competitive and market intelligence primarily from news and media sources, with analyst support available at an additional cost, along with specialized foresight features. The platform is especially well-suited for companies willing to invest in tiered licensing, with dedicated power users (analysts) who manage intelligence for broader stakeholder groups.

How to choose the right AlphaSense alternative

If you’re evaluating alternatives to AlphaSense for your market and competitive intelligence program, it’s best to consider the following few criteria:

- Data coverage: Start by defining the sources that surface the intelligence signals relevant to your program. While AlphaSense covers exclusive sources that are a great fit for finance and investment research, it misses many critical information sources, including job boards, review sites, social channels, website changes, and customer call transcripts from Gong or Chorus, all of which are important for a comprehensive M&CI program. Evaluate whether the platform tracks these critical information sources.

- Data quality: Evaluate how the platform implements guardrails to deliver noise-free, validated information. The challenge in M&CI workflows is that there’s too much information and too little time to make sense of it. Hence, a platform that enforces governance, validation, and auditability across all layers of its offering is critical. This involves integration of vetted sources, a robust AI-driven noise removal engine, content validation, knowledge graphs, and rigorous eval frameworks for AI usage.

- AI capabilities: Having a conversational AI interface in the platform is now table stakes. A purpose-built M&CI platform should deliver dynamically updated insights grounded in verified information. Evaluate whether the platform can auto-update insights and deliverables such as battlecards, dashboards, and company profiles as new intelligence flows in. Also, check how the vendor ensures accuracy, traceability, and auditability of information, so teams can trust outputs without manual verification.

- Customizations: Check what types of customizations the platform supports to fit your M&CI workflows and stakeholder needs. Because AlphaSense has a more fixed offering, it can limit personalization at scale. In alternatives, look for custom source integration, a flexible taxonomy builder, curated newsfeeds, role-specific auto-updating insights with prompt edit options, and customizable dashboards.

- Intelligence distribution capabilities: Evaluate the platform’s ability to distribute intelligence to stakeholders in the formats they consume. AlphaSense has sharing limitations in newsletters and alerts. As an alternative, look for a built-in newsletter builder with templates, scheduling, distribution list management, engagement tracking, and support for unlimited subscribers at no additional cost.

- Integrations: Check whether platform integrations help you both ingest intelligence and activate it where teams work. AlphaSense offers strong internal content ingestion but has limitations when pushing intelligence into other tools. A reliable alternative should include connectors and APIs for SharePoint and Google Drive, Gong or Chorus, CRM, and distribution-oriented APIs and integrations with tools like Slack, MS Teams, Snowflake, etc.

- Pricing: Evaluate whether pricing supports organization-wide adoption, not just a small team. AlphaSense’s restricted content access inflates costs if you need a broad stakeholder reach. As an alternative, look for pricing that scales with your monitoring scope, while keeping consumption flexible through unlimited readers or subscribers.

Ready to see the difference? Start your 7-day free trial of Contify today and experience the industry’s cleanest intelligence feed.

FAQs

Which AlphaSense alternative is best if I need a comprehensive, noise-free market and competitive intelligence platform with strong distribution?

Contify is the best AlphaSense alternative if your priority is broad coverage, noise-free intelligence gathering, and easy distribution across the company. It tracks intelligence from 1 Mn+ sources, including company websites, news, social media, job boards, and review sites, as well as internal content, using deduplication, disambiguation, and GenAI-validated tagging to deliver the cleanest intelligence feeds in the industry.

For distribution, Contify lets you add unlimited platform users and send newsletters and alerts to unlimited subscribers, including those without platform access. It also integrates with tools like Slack, MS Teams, Salesforce, and Snowflake so updates reach teams where they already work.

The platform provides custom taxonomy tagging, role-specific dashboards, automated insights, and AI-powered Live Company Profiles that auto-update as new intelligence emerges. Contify also offers multilingual translation for global programs (117+ languages) and is designed to serve cross-functional use cases for strategy, product, marketing, and sales teams on a single platform.

Which AlphaSense alternative is best for sales enablement and battlecards?

Klue, Crayon, and Contify all offer battlecard capabilities, but with different strengths.

Klue and Crayon are purpose-built for competitive intelligence and sales enablement. Both integrate directly into popular CRMs like Salesforce and collaboration tools like Slack and MS Teams, delivering battlecards where sales reps work daily. Klue also offers a comprehensive win-loss program combining expert-led interviews and automated surveys to capture objective buyer feedback. If your primary goal is to equip sellers with competitor intelligence during deals with minimal friction, Klue or Crayon are specialized for this use case.

Contify provides auto-updating battlecards and insights within its M&CI platform. Its battlecards include competitive intelligence along with market trends, customer insights, and industry developments for a more comprehensive strategic context. Contify allows Product Marketing and Competitive Intelligence teams to extend their CI impact beyond the sales team. For sales teams, Contify delivers not just competitive context but also account and prospect intelligence integrated with competitive positioning, enabling reps to understand the full competitive and market landscape around deals they're pursuing. This makes Contify valuable for organizations that need either solely competitive enablement for sales or comprehensive market intelligence that serves sales alongside other business functions from a single platform.

Can I use CB Insights or PitchBook instead of AlphaSense for market intelligence?

CB Insights and PitchBook can cover some “market intelligence” needs, but they are primarily built for private-market and deal-focused intelligence (funding, investors, M&A, screening), not end-to-end competitive and market intelligence monitoring and distribution.

- Choose AlphaSense when your core need is premium, finance-oriented content and research workflows, including broker research, expert call transcripts, filings, earnings transcripts, and market news, all in a single AI-searchable experience.

- Choose CB Insights when your priority is predictive intelligence and structured insights into private companies and emerging technologies for innovation scouting, corporate development, and M&A target identification.

- Choose PitchBook when the priority is structured private-market data for deal sourcing, fundraising, and due diligence across VC/PE/M&A, including investor and fund intelligence and deal-level metrics.

- Choose Contify when you need continuous, cross-functional M&CI across a broader digital footprint (for example, company websites, social channels, job boards, review sites, website changes), plus stronger organization-wide distribution via newsletters/alerts and workflow integrations (for example, Slack/MS Teams/CRM).

In practice, many teams pair a deal intelligence tool (CB Insights or PitchBook) with a purpose-built M&CI platform (such as Contify) and add AlphaSense when premium financial research content is a must-have.

How does Bloomberg Terminal differ from AlphaSense?

Bloomberg Terminal is built for real-time financial market intelligence, quantitative analysis, and trading workflows, with live multi-asset market data and analytics. AlphaSense is built for AI-powered search and synthesis across premium research and company documents, including broker research, expert call transcripts (Tegus), filings, earnings transcripts, and market news. Many finance teams use both: Bloomberg for live market and pricing context with trading execution, and AlphaSense for faster discovery and analysis across large volumes of research content.

Can AlphaSense and Contify be used together, and what are the advantages of this?

Yes, AlphaSense and Contify can be used together because they serve complementary needs. AlphaSense is useful when you need premium finance-oriented content like broker research, expert call transcripts, filings, earnings transcripts, and market news, with AI search across that content and indexed internal knowledge.

Contify is purpose-built for ongoing market and competitive monitoring across a broader digital footprint, like company websites, social media, job boards, review sites, and website changes, then turning it into outputs like dashboards, battlecards, alerts, and newsletters for different teams.

A practical advantage of pairing them is improved coverage and activation. AlphaSense gives depth on premium content, while Contify fills gaps with external web signals and, most importantly, supports org-wide distribution. AlphaSense alerts and links can be constrained to paid subscribers, while Contify lets you share newsletters and alerts to unlimited subscribers.

How do AlphaSense and its alternatives handle noise reduction and data quality?

Different platforms take different approaches to reducing noise and improving data quality. AlphaSense uses Smart Synonyms and AI to improve search relevance and broaden queries beyond exact keyword matches, but users often report difficulty filtering large result sets that require significant manual refinement.

Contify is widely recognized in the industry for providing the cleanest intelligence feeds by combining advanced AI algorithms, including deduplication (removing duplicate content from syndicated sources), disambiguation (correctly identifying companies with similar names), and GenAI-validated tagging (the highest accuracy in categorizing content with company names, business events, locations, type of content, etc.). This multi-layered approach filters noise before intelligence reaches users.

When evaluating alternatives, ask vendors to demonstrate their noise-reduction methodology using a live feed filtered for your specific use case. Request metrics on how they handle duplicate content from syndicated sources, how they disambiguate company names, and what control you have over relevance tuning. Data quality is often the difference between a feed that gets used consistently and one that gets ignored due to noise.

How do I know which M&CI platform is right for my organization?

Start by defining your intelligence program's primary use case and stakeholder needs.

- If you're focused on investment research and M&A due diligence with premium financial content requirements, AlphaSense, Bloomberg, CB Insights, or PitchBook may fit.

- For a comprehensive M&CI program that supports strategy, product, marketing, and sales teams across the organization, consider Contify, which provides broader digital footprints and supports cross-functional intelligence distribution.

- If your priority is competitive intelligence for sales enablement, Klue and Crayon are specialized for this use case. Contify can also be evaluated here, especially if you want to give sales reps not just competitive intelligence but also account and prospect intelligence, integrated with competitive positioning, to help them understand the full market landscape around deals.

Map out which sources matter most to your intelligence program (social media, websites, news, filings, internal content), how intelligence needs to be distributed (newsletters, dashboards, CRM integration, collaboration tools), and whether you need organization-wide access or analyst-only licensing.

Also, calculate the total cost based on the number of people who need intelligence access, not just platform logins. Then take a trial of your top 3-5 choices and test them across competitors, topics, data quality, and workflows for at least a week.

Is there any M&CI platform that supports multiple use cases across different teams?

Yes, Contify is designed to support multiple use cases across different teams from a single platform. Its flexible taxonomy, customizable dashboards, role-specific templates, and integrations with Slack, MS Teams, Salesforce, and Snowflake enable it to serve strategy, marketing, sales, and product teams simultaneously with relevant, non-overlapping intelligence. Contify's unlimited platform users model and newsletter distribution to unlimited subscribers make cross-functional adoption feasible without per-user fees inflating costs.