The business world today is highly complex, consisting of interconnected alliances and partnerships. Businesses function within networks of relationships with other companies that define how they compete, innovate, or reach customers and gain strategic business advantage.

These business partnerships help firms expand into new markets, share resources, reduce risks, or complement each other’s strengths. A single partnership announcement might seem like business as usual. However, when you aggregate these over time and analyze them, a clear view of a competitor’s strategy begins to emerge.

It provides a clear view into how they are thinking about future growth. How they are expanding, how they’re strengthening their capabilities, and what bets they’re placing on the future. And with the right tools, these insights (previously buried in news articles, press releases, or scattered across social posts) can be easily aggregated and analyzed for actionable outcomes.

Let’s break down what partnership analysis reveals and how you can use it.

What Kinds Of Insights Come From Analyzing Competitors’ Partnerships?

Partnerships shouldn’t be viewed as isolated events but as data points that can help understand the evolving competitive environment. If you track just one partnership, you see a name and maybe a press release. But if you aggregate all partnerships, patterns begin to emerge. You get answers to questions like:

- Are they filling a technology gap?

- Are they entering a new market?

- Are they hedging risk by widening their ecosystem?

- Are their partnerships clustered in one region or sector?

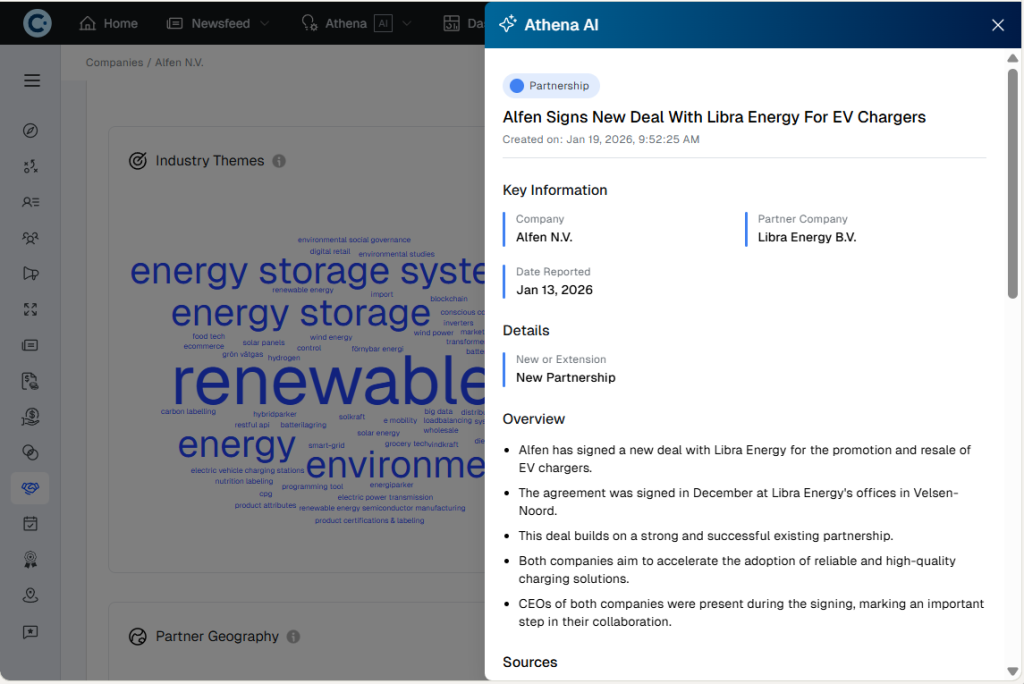

Let’s look at Alfen N.V., a provider of energy solutions, to understand how business partnership analysis can be applied in practice.

Here’s what you could uncover about your competitors:

1. Their main strategic priorities

Are they focusing on a select few market segments? If most partnerships are around a specific segment, that’s a clear signal of the competitor’s strategic priority.

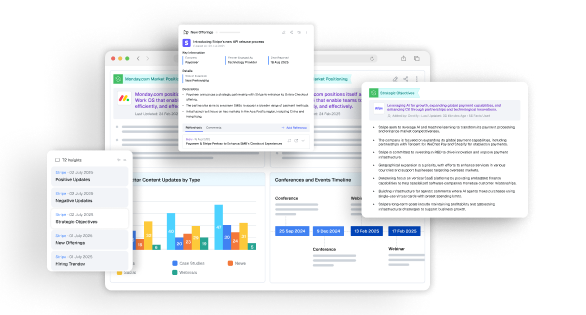

For example, an analysis of Alfen partnerships shows that most partner companies operate in the renewables and energy storage sectors. That tells you their ecosystem is concentrated in a space where network effects matter, and scale and integration are key to success.

2. What partner types do they prefer

The category of the partner, be it technology providers, solution partners, suppliers, distributors, or others, matters a lot. They indicate your competitor’s position in the value chain.

In the Alfen example, the platform shows that most partnerships are with solution partners. This means their strategy is to combine solution partners rather than implement solutions themselves.

3. Where they’re expanding geographically

Partnership geography reveals if the company is pushing into new markets or strengthening existing ones. Clicking on the map visualization shows the concentration of partners in places like Sweden. That translates to a company’s focus on regional growth, regulatory opportunities, or a new supply chain strategy.

How Do M&CI Platforms Accelerate Analysts’ Performance?

M&CI analysts’ work is heavily time-consuming and prone to errors. They have to gather all partnership announcements, organize them consistently, update them whenever something new is published, and maintain that structure and database for months or even years. They might end up spending all their time collecting headlines rather than finding patterns or changes in strategy. Competitor signals hidden inside news articles or press announcements go unnoticed because manual processes can’t keep up with the volume and complexity of the modern business environment.

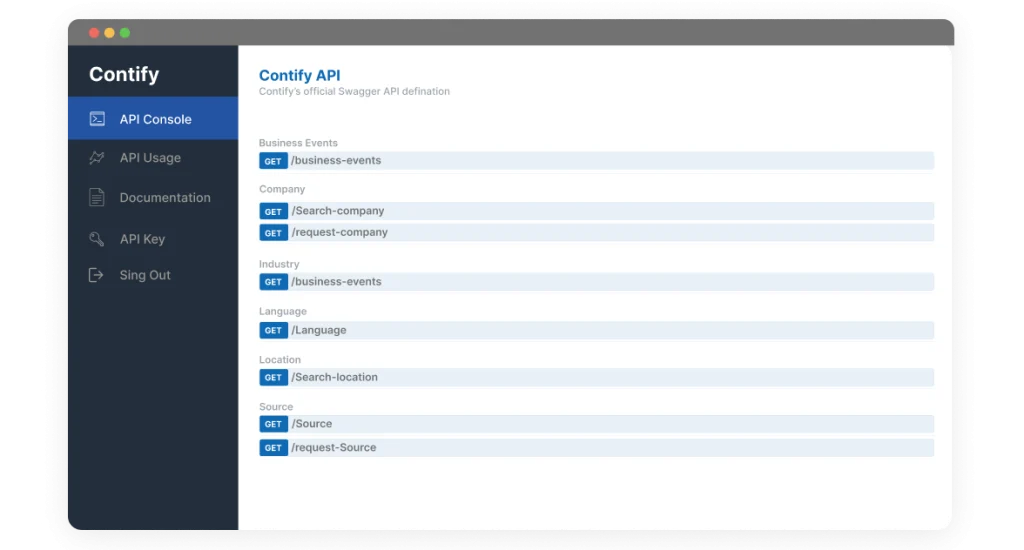

An interactive Marketing and Competitive Intelligence (M&CI) platform changes that. They can easily click on:

- Industry segment to see exactly which partners operate there.

- Geographic map to see partners by region.

- Partnership types to see partners by their role in the ecosystem.

On a platform like Contify, users go the extra mile beyond just seeing partner names. They can access the underlying details as facts extracted from news articles and press releases. Those facts show the terms of the partnership, expected deliveries, timeframes, financing details, and co-development roles.

For instance, a fact card shows that Alfen partnered with SPIE Nederland B.V. and Vattenfall to provide BESS technology for a 200MWh project in the Netherlands, with Vattenfall contracted for 50MW capacity under an eight-year period. That’s a key strategic insight, and not just a piece of news.

Contify goes beyond the ordinary by leveraging advanced AI, including Retrieval-augmented Generation (RAG) models, context engineering, and pre-configured guardrails, to deliver trustworthy, high-quality insights from aggregated data.

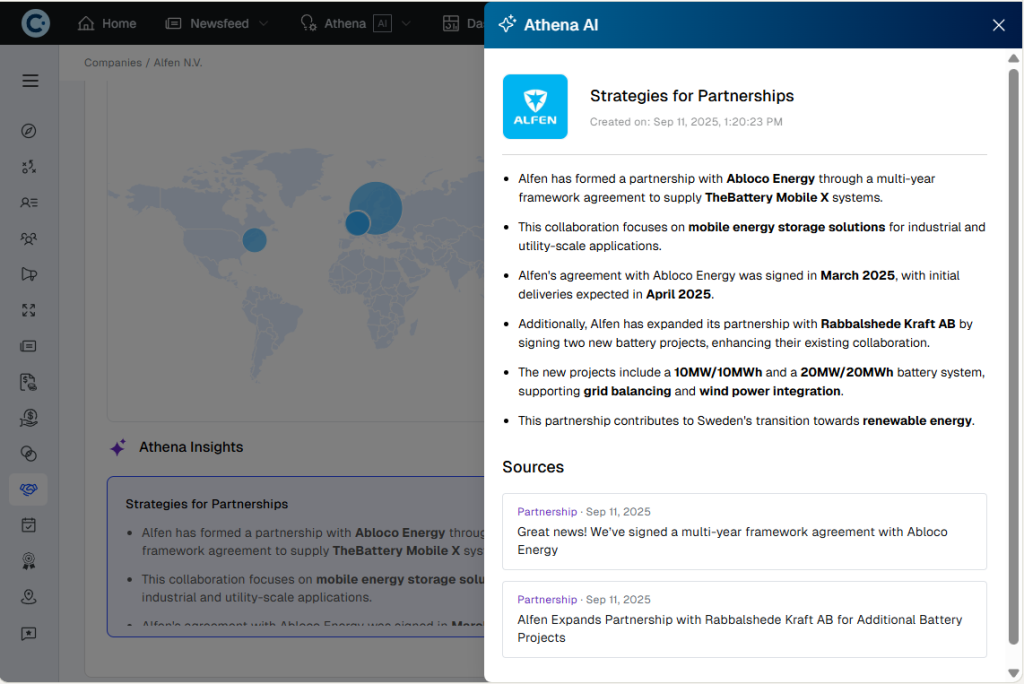

Instead of just telling you what happened, Contify’s Athena AI can explain how these data pointers correlate and what they mean for your organization. For example, by analyzing the Alfen-Rabbalshede expansion, Contify’s AI can automatically generate insights such as:

“This partnership contributes significantly to Sweden’s transition towards renewable energy and reinforces the competitor’s dominance in the wind power integration niche.”

These insights allow your team to stop “connecting the dots” manually and start making decisions based on the patterns the AI has already identified.

How Do Competitive Insights From Partnership Analysis Influence Real-World Decisions?

Partnership analysis should be systematic and scalable, instead of being driven by spreadsheets and manually intensive tasks.

Once you understand a competitor’s partnership strategy, you can adjust your go-to-market (GTM) plans based on where rivals are strengthening distribution, delivery, or integration capabilities. You can identify white spaces where there are no active partners and get a first mover advantage, either by building in-house or by forming joint ventures of your own. Patterns in partnerships also make it easier to anticipate where a competitor is likely to expand next, way before an official market entry is announced.

Insights like these help companies spot risks and opportunities early, even while they are still coming up. That’s the real purpose of competitive intelligence: Modifying strategy before the competitors catch up. This helps you get a sustained competitive advantage in the long term.

Final Thoughts

Analyzing business partnerships is not just about mapping individual announcements; it requires a systematic process. Tools like Contify are specifically designed to transform scattered news articles, press releases, and social updates into a single, centralized dashboard for your entire organization. By automating the collection and analysis of partnership data, you ensure that your strategy is built on a foundation of comprehensive, real-time intelligence.

If you’d like to see how Contify can help you implement a structured market and competitive intelligence program, click here to request a demo.