Introduction

The BFSI sector is one that undergoes rapid changes, leaving organizations under mounting pressure to keep up with evolving market dynamics. From fintech disruptions and shifting customer expectations to tightening regulatory scrutiny, the challenges are relentless.

To survive and thrive, banks, insurance firms, and financial institutions must innovate faster, launching competitive products that meet modern demands, while simultaneously safeguarding against operational, financial, and compliance risks.

Yet despite heavy investments in intelligence tools and research teams, many BFSI-led businesses get held back by a critical flaw: fragmented intelligence. Some of the most important BFSI functions, including product and risk teams often work in silos, relying on different data sources, systems, and frameworks to guide their decisions.

As a result, promising product ideas may overlook regulatory constraints, while risk assessments may miss the strategic implications of market trends or competitive moves.

This disconnect isn’t just inefficient, it’s dangerous. What’s missing is a centralized intelligence function that acts as the connective tissue between product innovation and risk mitigation. In this blog, we’ll explore why centralizing intelligence is no longer optional, how it enables smarter, faster decisions across product and risk teams, and how market and competitive intelligence platforms like Contify are helping BFSI leaders close the gap and create real competitive advantage.

How fragmented intelligence impacts BFSI-led businesses

Considering all the advancements in technology and analytics, intelligence in the BFSI sector remains surprisingly disjointed. Across banks, insurers, and financial service firms, different teams rely on different tools, different sources, and different methods to gather market, competitor, and regulatory insights.

While the volume of available information is growing rapidly, the ability to turn that information into unified, actionable intelligence often lags.

Fragmented sources, disconnected decisions

Intelligence gathering is still largely decentralized across many business functions. External updates, from new fintech launches to shifting compliance requirements are often delivered through email alerts, RSS feeds, vendor reports, or scattered dashboards. Because these inputs are not coordinated, different departments often have very different interpretations of the same market events.

This fragmentation leads to disconnected decisions. One team may view development as a competitive opportunity, while another sees it as a compliance risk, or worse, doesn’t see it at all.

Slow detection of critical signals

When insights aren’t flowing through a central system, early warning signs often go unnoticed or are recognized too late. For instance, regulatory bodies might hint at an upcoming policy change that impacts digital lending practices.

Or, a new entrant could be gaining traction in your key market segment. In both cases, your business runs the risk of missing its window to respond, not because the information wasn’t available, but because it wasn’t centralized, curated, or delivered to the right people in time.

Silos across functions

The consequences of this fragmentation become especially clear across core functions like product development, risk management, compliance, and strategy. Each may be working from their own intelligence inputs, shaped by different tools and priorities.

However, due to the lack of a shared understanding of external developments, strategic alignment suffers. Without a centralized intelligence layer to unify market awareness, teams risk pulling in opposite directions or duplicating work, leading to missed opportunities, preventable threats, and slower response times.

As a result, the way to inefficiency and organizational risk is paved, while teams continue operating on parallel tracks instead of gaining a common, real-time view of the market landscape.

This can be achieved with the help of a market and competitive intelligence (M&CI) platform like Contify. Let’s dig deeper.

The strategic importance of centralized intelligence

In a landscape defined by complexity, speed, and constant disruption, BFSI organizations can no longer afford to treat intelligence as a passive resource. It must become an active, integrated function; one that connects signals from the outside world to decisions on the inside. This is where centralized intelligence becomes essential: not just as a technology solution, but as a strategic capability.

From data collection to decision alignment

Centralized intelligence is more than just aggregating information. It allows you to create a system where relevant external insights are curated, contextualized, and delivered to the right people at the right time.

With such a system in place, organizations can move from reactive decision-making to proactive strategy execution. Teams are no longer caught off guard by developments they should have anticipated. Instead, they’re aligned on what’s changing, what it means, and how to respond.

Why central information repositories matter more in BFSI

The cost of delayed or misinformed decisions is much higher in BFSI, due to the industry’s fragile nature. Consider the downstream impact of missing a regulatory update, underestimating a challenger’s product launch, or failing to spot shifting customer sentiment.

These aren’t theoretical risks, and hold the capacity to cause direct revenue loss, compliance penalties, brand erosion, or operational setbacks. Centralized intelligence helps mitigate these risks by:

- Ensuring consistency: Everyone across the organization works from a common set of validated insights.

- Accelerating response: Critical developments are surfaced and distributed in real time, reducing lag between detection and action.

- Improving collaboration: Teams across functions and geographies can work together with shared situational awareness.

- Strengthening strategic focus: With less time spent gathering information, teams can spend more time acting on it.

Key use cases for centralized market and competitive intelligence

The value of centralized intelligence becomes most apparent in the day-to-day decisions that shape your BFSI success, especially in areas where the consequences of acting too late (or in isolation) are high.

Here are some of the most common and critical use cases wherein a central repository for external and internal intelligence directly impacts outcomes.

1. Navigating regulatory shifts

In a highly controlled industry like BFSI, regulatory changes can make or break entire product lines or operational models. Whether it’s a new capital adequacy rule from a central bank, updates to data privacy laws, or cross-border compliance changes, keeping track of evolving requirements is a full-time job.

M&CI ensures that these developments are captured early, interpreted correctly, and shared across affected teams, through centralized repositories or collaborative options. This reduces the risk of non-compliance and enables you to adapt faster than competitors.

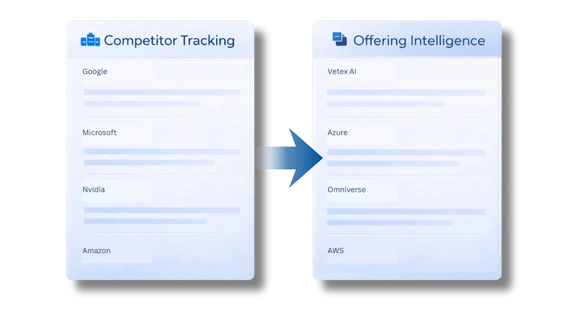

2. Monitoring competitor moves

The line between traditional banking practices and emerging challengers continues to blur. Fintechs, neobanks, and even non-financial platforms are introducing agile, customer-first innovations that threaten established players.

A centralized view of competitor activity helps organizations benchmark their offerings, assess threats, and identify strategic white spaces. When all teams have access to these insights, decisions become more coordinated and strategic.

3. Detecting early warning signals

External risks often emerge gradually, making it crucial to keep an eye on the market through media coverage, analyst reports, policy discussions, or market sentiment. Without a mechanism to monitor and surface these weak signals in real time, organizations may find themselves blindsided.

M&CI platforms can track multiple sources across languages and geographies to flag early indicators, such as a spike in customer dissatisfaction with a competitor, new sanctions being discussed, or a credit downgrade on a peer institution. These warnings can be automatically routed to relevant teams, prompting timely action.

4. Supporting product development with context

Launching a new product without a full understanding of the competitive and regulatory landscape is a gamble. With the right intelligence in one place, product teams can build with confidence, grounded in real-time insights on market demand.

Even after launch, ongoing intelligence helps teams fine-tune their offering, monitor adoption trends, and respond to customer or regulatory feedback proactively. Centralized intelligence transforms how those needs are addressed, as part of a wider system across enterprises.

Core features of a market and competitive intelligence platform for BFSI function

To truly support decision-making across product, risk, strategy, and compliance teams, BFSI organizations need more than just information. A comprehensive market and competitive intelligence platform helps you unify, contextualize, and operationalize external signals.

Below are the core features such a platform must deliver. Let’s check them out.

1. Automated, AI-powered market monitoring

An effective M&CI platform continuously tracks a wide array of external sources, from news websites, press releases, regulatory portals to social media, industry blogs, and more. This enables businesses to detect relevant developments in near-real time.

However, broad monitoring is not the key, instead it’s intelligent filtering. The platform must distinguish signal from noise and highlight only the updates that are relevant to the institution’s strategy, product lines, risk profile, and regulatory obligations.

Such as, the Contify platform provides intelligence from over a million vetted sources. Yet, the noise never reaches you as only the most relevant updates make it to your newsfeed.

Suggested read: Cut Through the Noise: Leverage Curated Intelligence in a Data-Overloaded World

2. Multilingual and geographically diverse coverage

Global BFSI firms need visibility across multiple markets and languages. An M&CI platform should support multilingual content aggregation, enabling centralized access to intelligence in local contexts.

This includes sourcing intelligence from local publications, regional regulators, and non-English language reports, ensuring that teams in every geography have access to the insights that matter most in their context.

Multilingual coverage also helps global teams maintain awareness of geopolitical shifts, cross-border regulatory movements, and competitor strategies in emerging markets.

Contify tracks trustworthy non-English sources in over 50 languages, ensuring your teams in APAC, EMEA, and the Americas all get timely, localized insights without managing separate tools.

3. Customizable and personalized dashboards

Not every team needs the same lens on the external world. A strong platform offers customizable dashboards that allow each function. So, your product marketing, risk intelligence, or compliance teams can focus on what matters to them.

With Contify’s user-configurable dashboards, stakeholders can track only what’s relevant. For instance, product teams can track the innovations by specific competitors without being overwhelmed by noise.

4. Smart tagging and relevant taxonomies

Raw data becomes decision-ready only when it’s structured. A robust M&CI platform should use machine learning and editorial oversight to tag and categorize intelligence into themes like customer experience, operational risk, digital transformation, and ESG impact.

Contify enables user-defined taxonomies, allowing BFSI firms to classify updates in ways that align with their strategic priorities and internal terminology. It also provides a balance of AI and human filtering to ensure only the most relevant information reaches your teams, free of duplications.

Suggested read: Unlocking the Power of Taxonomy in Market & Competitive Intelligence

5. Real-Time Alerts with Workflow Integration

Centralized intelligence only works when insights flow into the right hands at the right time. M&CI platforms must support real-time alerting across preferred channels, whether it’s Microsoft Teams, Slack, Outlook, or enterprise intranets.

Contify goes a step further by allowing alerts to be embedded into daily workflows with flexible distribution and integration with tools like SharePoint or internal dashboards. This ensures that teams don’t just receive intelligence, they use it.

Suggest read: Introducing Contify SharePoint Integration: Unified AI Insights from Your Internal and External Intelligence

Ready to start your journey to centralized intelligence?

Taking the first step toward centralized intelligence doesn’t require overhauling your entire workflow. You can start with recognizing the gaps and committing to better alignment across functions. Evaluate where intelligence currently lives in your organization and identify the silos holding back collaboration.

Then, explore platforms like Contify that offer the tools to unify, curate, and distribute actionable insights in real time. With the right approach, you can move from fragmented data to a shared strategic vision, one where product, risk, and compliance teams operate with clarity and confidence.

Take the Contify 14-day free trial and experience how centralized intelligence can amplify your BFSI operations.

Frequently asked questions

How do data silos affect BFSI businesses?

Data silos slow down decision-making and increase the chances of missing critical insights. When different teams operate on disconnected tools and information, it leads to inefficiencies, compliance risks, and missed opportunities to respond to market changes.

What role do M&CI platforms play in BFSI?

Market and Competitive Intelligence platforms collect and deliver relevant intelligence from multiple sources, such as news, competitors, customers, and regulators into one place. For BFSI teams, this means faster insights, better regulatory tracking, and smarter, more strategic decisions across functions.

How does centralizing intelligence benefit BFSI organizations?

With centralized intelligence, BFSI firms can act faster, reduce risks, and improve collaboration across teams. It ensures everyone, from compliance to strategy is aligned, helping the organization stay agile, informed, and ahead of the competition.