In the business world, we often say, “We’re going up against Microsoft,” or “Oracle is moving into our territory.” But if you sit down with a sales lead who just lost a high-stakes government contract, they won’t tell you they lost to “Amazon.” They’ll tell you they lost to AWS GovCloud because of a specific compliance certification that the rest of Amazon doesn’t even use.

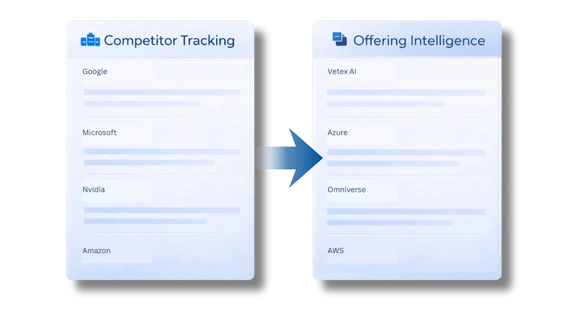

The reality of modern competition is that companies rarely compete with companies. They compete with specific offerings, business units, or even divisions buried deep within an enterprise. When your sales team hits the field, they aren’t battling a company but a specific product or service that might not even be under a separate brand.

If your Market & Competitive Intelligence (M&CI) program is still focused on parent company-level intelligence, you aren’t seeing the real picture. This blog will discuss why it is important to track product or service-level intelligence and how to do so effectively.

The Problem with the “Company Filter”

Large enterprises, let’s call them Multifaceted Competitors, operate across dozens of distinct markets. Treating them as a single entity in your CI program creates a massive amount of “Company Noise.”

Take a company like Microsoft, for example. For a CI team supporting a specialized Federal sales unit, Microsoft’s global profitability, its latest Xbox acquisition, or its retail store strategy is irrelevant noise. It clutters the feed and distracts analysts. The true competitor is the specific component Microsoft offers to federal agencies, often messaged subtly alongside other commercial offerings.

In these micro-battles, the competitor’s brand is a monolith, but their offering behaves like a niche specialist. If your M&CI program isn’t designed to filter out the 90% of corporate noise that doesn’t matter, you risk missing the 10% that actually wins or loses the deal.

Real-World Markets: Where Product and Services Define the Rival, not Companies

To understand why “You compete with Offerings,” we have to look at how these multidimensional Competitors position themselves in different sectors.

- Public Sector & Defense: Companies like Workday have a clear distinction with Workday Federal. It’s easy to tag, track, and analyze. However, others, like Microsoft, often mix their commercial messaging with their sovereign deployments. They might have a version of Fusion Cloud hosted in a domestic sovereign region that isn’t branded separately. To a generalist observer, it’s just “Cloud.” To a specialized CI team, it’s a completely different product with its own security protocols, pricing structures, and regulatory hurdles.

- Cloud & AI Infrastructure: In the race for AI dominance, the battle isn’t “Google vs. AWS.” It’s Google Vertex AI competing for the same developer mindshare as AWS SageMaker. These business units have their own distinct ecosystems. An enterprise might have a global partnership with Google Workspace, but when it comes to LLM orchestration, it is looking for specific offerings. Your CI will discover actionable insights by tracking the offering’s API updates, not from their CEO’s PR statements.

- Fintech & Embedded Finance: Stripe or Adyen not only “process payments.” They compete on specific modules, such as “Tax Automation” or “Point of Sale (PoS) Hardware.” A competitor might be irrelevant to you in the online space, but a dominant threat in the physical retail “Offering” space, filled with brick-and-mortar rivals.

M&CI Program Must Monitor Offerings

To win in today’s environment, your M&CI program must be as granular as the offerings you’re competing with. This isn’t just about having more data but having the right framework to interpret that data in a way that’s actually of use to your stakeholders.

1. Moving from “Sourcing” to “Deciphering”

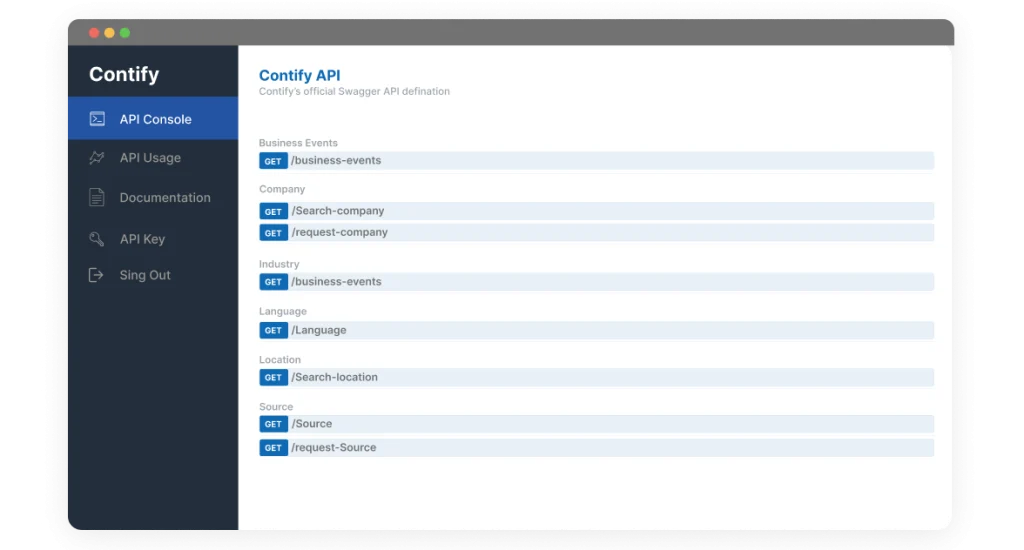

Most CI programs fail because they are “Source-Heavy.” They ingest everything from a competitor’s newsroom. But sophisticated M&CI Platforms are designed to monitor specific products or services where you actually compete.

For example, instead of tracking “Microsoft Corporation,” a high-performing CI team sets up a taxonomy that isolates “Sovereign Signals.” They filter specifically for Microsoft Federal in the US-East, or Azure and CJIS Compliance. This requires an intelligent system that understands the relationship between a parent company and its sub-offerings, ensuring that the only updates entering your CI platform and reaching the battlecard are those that directly impact the sales team’s current deal.

2. The Challenge of “Dark” Divisions

The most challenging intelligence tasks are competing with offerings that don’t have their own websites. As we saw in the example of Microsoft Fusion Cloud, some companies don’t properly segment their business units. They might use the same branding but offer entirely different service-level agreements (SLAs) or hosting environments for different sectors.

Your M&CI program must be capable of tracking data that doesn’t exist in the “commercial” market. This means monitoring:

- Federal Portals & Regulatory Filings: Where specific contract requirements are listed.

- Technical Documentation & GitHub Repos: Where subtle changes in an offering’s capability are first signaled, etc.

3. Building Product or Service-Centric Battlecards

The most successful CI teams curate battlecards focused on a specific part of the company. When the salesperson is in a room with a government CTO, they don’t need to know about Oracle’s global ERP growth. They need to know the specific limitations of Oracle’s National Security Region deployments compared to your own. They need to know if the competitor’s “sovereign” claim is just marketing fluff or a truly isolated infrastructure.

The Role of Sophisticated M&CI Platforms

You cannot expect an analyst to manually sift through thousands of “Microsoft” mentions to find the one that mentions a specific federal regulatory update. Doing this at scale is impossible with manual tracking, until now with the arrival of Advanced M&CI platforms.

Advanced M&CI platforms systems allow you to:

- Automate Relevance: Use AI to distinguish between a “commercial” update and a “sovereign” or “product-specific” update.

- Define Advanced Taxonomies: Build a digital map of your competitors’ internal business units that is relevant to your sales team.

- Empower Dedicated Analysts: The most effective programs combine sophisticated technology with dedicated analysts who can “write the query” that decodes a competitor’s mixed messaging.

Competitive Intelligence: From Companies to Offerings

| Feature | Traditional Company-Centric CI | Modern Offering-Centric CI |

| Primary Focal Point | The Parent Company (e.g., “Microsoft”) | Specific Business Units or Offerings (e.g., “Azure GovCloud”) |

| Data Scope | 10-Ks, global earnings, and corporate PR | Product updates, regulatory portals, and regional SLAs |

| Noise Level | High: Flooded with irrelevant global corporate news | Low: Filtered for specific markets and use cases |

| Primary User | Executive Leadership & General Strategy | Specialized Sales Teams & Product Marketing |

| CI Team Role | Sourcing and aggregating newsfeeds | Deciphering “dark” divisions and mixed messaging |

| Tactical Output | General “How to Beat [Company]” Battlecards | Specific “How to Win Deals” Playbooks |

| Detection Goal | Tracking corporate M&A and global shifts | Identifying subtle changes in products and services |

Conclusion: Modern CI is all about Offerings

In the enterprise space, the “big picture” is often a distraction. If your competitive intelligence is focused on the parent brand, you are playing a game that your sales team isn’t actually in.

Winning requires a shift in mindset: Companies don’t compete with companies; offerings compete with offerings. The most successful CI teams today are those that have moved past the “Corporate Newsfeed” and built systems capable of precision at the level of the offering. They understand that their rival isn’t a giant conglomerate; it’s a specific, localized, and often subtly messaged product that is trying to solve the exact same problem they are.

If your M&CI program isn’t reflecting this granularity, you aren’t just missing data; you’re losing the deal.

Is your CI program stuck at the corporate level? To truly understand the “offering-vs-offering” landscape, you need more than just a news aggregator. You need a platform that decodes the complexity of multifaceted competitors.

Contify provides an advanced M&CI platform that combines AI with expert human analysis to help you isolate the signals that matter. We help you move past the corporate noise so your CI teams can build the precision battlecards your sales team actually needs.