Growing a business is very difficult. It is difficult because many market forces must be precisely aligned to unlock growth. PwC’s 28th Annual Global CEO Survey reflects how real this pressure feels at the top: 42% of CEOs say their company may not be viable in ten years if it continues on its current path.

One way to think about “unlocking growth” is to understand how a key opens a lock. The key’s unique cuts lift each pin into perfect alignment; only then does the cylinder turn and unlock.

Growth works the same way. You are the key, and the market landscape around you, customers, competitors, regulations, and economic conditions are the pins that can either align or jam your progress. What makes unlocking growth especially hard is that these pins in the market landscape are dynamic and always moving.

Fortunately, there are frameworks to make sense of the changing market landscape. Instead of reacting with abstract things like “We should move faster” or “We need more features,” companies can develop a disciplined approach to identify and evaluate changes, invest in opportunities that align the pins blocking their growth, and finally turn their cylinder.

One popular framework to do this is the Ansoff Matrix.

This article walks you through how to use the Ansoff Matrix to build growth strategies based on real market and competitive signals. To explain this concept, I’ll use a sample company in the online appointment management space. It could just be any other product in any category. That’s not the point. The point is to demonstrate how to create a structured, repeatable approach to unlock growth for your organization.

Quick Overview of the Ansoff Matrix

The Ansoff Matrix is a framework for analyzing your market and developing a structured approach to growth. This is done by mapping 1) new versus existing products against, 2) new versus existing markets.

What makes this effective is not the matrix itself, but what you feed into it. That’s where market and competitive intelligence become essential components feeding all four quadrants of the Ansoff Matrix framework. The strategic signals become the raw material that transforms the Ansoff Matrix from a framework into something you can actually use to make decisions.

Let’s deep-dive into the matrix, quadrant by quadrant:

Quadrant 1: Market Penetration

Existing Product/ Existing Market: Sell more of what you already have to more companies in your existing markets.

This is the lowest-risk growth strategy because you’re doubling down on the market segment you already know. Most companies underestimate the opportunity that remains in their markets. In this strategy, you plan for growth through aggressive marketing, competitive pricing, or acquisitions. The goal is to win more deals and capture a larger share of your current market.

What signals matter for the Market Penetration strategy?

To increase market penetration, companies usually make the mistake of offering aggressive discounts or increasing marketing spend without doing a competitive analysis. One way to grow faster than competitors is to position your offerings around the gaps in competitors’ offerings. The key competitive intelligence signals that support market penetration include:

- Customer reviews: expose where competitors’ offerings fall short and where your product offers a better value proposition.

- New campaigns and positioning: identify which verticals and use cases competitors are focusing on.

- Pricing changes: show which segments competitors are chasing (or quietly exiting).

- Partnerships and alliances: reveal new channels, markets, or ecosystems competitors are leveraging to grow.

- Customer wins: point to where demand is rising and which market segments are actively buying.

Market intelligence

Another way to plan for market penetration-based growth is to look for buying signals from the broader market, beyond competitors. For example:

1. New initiatives (indicate buying intent and availability of budgets):

- Digital transformation projects: indicate the need for new tools and workflows, signaling opportunities for new vendors.

- Sustainability and CSR: demonstrate that the company prioritizes brand reputation and should be open to solutions aligned with responsible growth.

- Automation programs: indicate that the industry is streamlining operations, reducing manual work, and receptive to offerings that optimize end-to-end processes.

2. Positive signals (money + growth posture):

- New investments: new capital allocation means new strategic initiatives, the leadership’s focus areas.

- Fundraising rounds: highlight companies looking to accelerate revenue.

- New facilities: suggest capacity expansion that should create downstream demand for tools, platforms, and services.

- Geographic expansion: identify new companies expanding to your markets that are likely to buy new tools, solutions, or platforms.

3. Negative signals can be just as valuable:

- Leadership changes: signal strategic shifts that often open the door to new vendors.

- Layoffs and restructuring: indicate restructuring phases when efficiency-driven tools may be needed.

- Cost-cutting: suggests that ROI is prioritized and that companies seek more cost-effective solutions.

If you map companies with these signals against your offerings, you can target accounts where they are likely to accept your offerings and help drive market-penetration-based growth.

Example: Market Penetration

Let’s develop intuition about this with our example company in the online appointment space, looking to grow in its existing market. The product category is crowded. Switching costs are high. And it looks like a saturated market. Let’s analyze the market signals, what they indicate, and what the company could do with them.

Market Signal: Across review sites and forums, customers repeatedly complain about poor support from competitors. The pattern isn’t a one-off; it’s systemic. Customers report slow responses, a lack of empathy, and unhelpful resolutions.

- What it indicates: Customers are dissatisfied with the lack of empathy and support from competitors.

- What to do with it: Build a support experience that’s better, faster, and more personal. Create a dedicated customer success team. Put robust complaint-resolution processes in place, and then market them aggressively in your marketing campaigns.

Market Signal: Competitors are criticized for high processing fees and unexpected add-ons that hurt small businesses, especially regarding cash flow and predictability.

- What it indicates: Customers are frustrated by hidden fees and unpredictable bills.

- What to do with it: Implement a transparent pricing model with no hidden fees. Clear processing rates. Easy-to-understand tiers. Make cost predictability part of your promise.

By incorporating such competitive signals into your growth plans, you’ll not develop vague plans, such as “We should improve our pricing.” Instead, your plan will be sharp and specific. For example, “Let’s go after Square’s customers with campaigns built around transparent pricing and dedicated account managers.”

Quadrant 2: Product Development

New Product / Existing Market: Sell something new to companies in your existing market.

In this strategy, you develop and sell something new to companies in your existing market. This involves creating new products or enhancing current offerings.

What signals matter for product development strategy?

A common mistake is to build new offerings solely on intuition, while ignoring external market signals. Undoubtedly, internal data from existing customers is a valuable source of insights. However, integrating these internal insights with external market realities yields the most effective product development strategies to drive growth. Following strategic signals could help develop relevant market insights.

- User reviews (complaints + requests): show customers’ unfulfilled requirements and expectations.

- New competitors: identify the gaps in existing offerings that new entrants are trying to address.

- Win–loss insights: show which competitors are winning, why they are winning, and where you must improve.

- Competitor release notes and roadmap: show where baseline expectations are heading.

- Product recalls or discontinuations: expose weaknesses that are ready for better solutions.

- Investments in product: indicate where competitors are strengthening their offerings.

Example: Product Development

Getting back to our example of the online appointment company. On the surface, all competitors’ offers are undifferentiated: most players offer booking, scheduling, and basic payment processing. But an intelligent market monitoring of strategic signals reveals a different story.

Market Signal: Emergence of flexible payment options, such as Buy Now, Pay Later (BNPL), through partnerships.

- What it indicates: Customers are no longer satisfied with basic payments; they want flexible, buying-friendly options that support larger purchases.

- What to do with it: Instead of treating payments as a commodity, the company could integrate BNPL directly into the product. Make it simple for your customers to split payments and offer it without additional administrative overhead.

Market Signal: Launch of features such as Partial Use Product, which enhance inventory management and reporting capabilities.

- What it indicates: Operators need granular visibility into inventory, usage, and profitability. They want to move from rough estimates to precise, real-time insight.

- What to do with it: The company should consider building inventory management and usage-tracking capabilities: partial use, automated alerts, and reporting. The product won’t show just what’s in stock; it would help customers understand what’s moving, what’s leaking, and where margin could improve.

When you include such competitive signals in your growth planning, product development will not be about adding features that competitors offer. It will become about building a complete 360-degree view of customers’ needs and anticipating what they will expect in the short and long term.

Quadrant 3: Market Development

Existing Product / New Market: Sell what you already have to entirely new markets.

This strategy is riskier than the first two quadrants. This involves introducing existing products into entirely new markets or customer segments to expand the reach of your offerings.

What signals matter for market development strategy?

Many companies make the mistake of assuming: “New market = more revenue.” In reality, new markets expose every weakness you already have. Strategic signals to support the market development-based growth strategy could come from monitoring competitors and your target markets. The following are a few sample strategic signals from competitors to help develop “Market Development” strategies.

- New Regional Office: indicates competitors’ commitment, not experimentation.

- Targeted regional campaigns: reveal where they believe the demand is.

- Partnerships/distributors: show how competitors are planning to go to market in the new market.

- Localized hiring: job postings for sales, support, or marketing roles in a new region reveal that they have decided to scale in the new market.

- Customer wins in new markets: proof that new customers have started buying in the new market.

- Events & Conferences: sponsoring, speaking, or exhibiting at regional conferences reveals the new markets where they are buying visibility.

Example: Market Development

If our appointment management product, which works well for US-based small businesses, considers growth using the market development strategy, here’s how market signals will come into play.

Market Signal: Competitors begin rolling out features tailored to beauty businesses: tighter operations workflows, better staff scheduling, inventory tracking, and sector-specific reporting.

- What it indicates: There is a clear need for tools that simplify business management in this new vertical.

- What to do with it: The company could consider extending its product into not just any vertical, but specifically the beauty vertical, guided by competitive signals, where it can develop specialised workflows, templates, and pricing models that leverage its unique capabilities and meaningfully differentiate its offering from competitors.

Market Signal: Competitors are pouring resources into Europe: local offices, translated support docs, GDPR-compliant features, and even tuned marketing.

- What it indicates: Customers in Europe expect localization: language, payment rails, and data sovereignty. There is a need for tailored marketing approaches to effectively engage European customer segments.

- What to do with it: The company could consider expanding to Europe if it can easily build region-specific landing pages, provide partnership enablement capabilities, and set up on-the-ground support.

When you use such market signals, market development-based growth will be more than just choosing a new location on a map (e.g., “Let’s go international”), or picking a new industry vertical (“let’s target healthcare”), or deciding on a new customer type (“let’s sell to enterprises”). It will be about choosing a direction backed by rigorous market and competitive analysis.

Related reading: Multilingual Intelligence: Unlocking Truly Global Market & Competitive Insights

Quadrant 4: Diversification

New Product / New Market: Sell something new to new customers or new markets.

Diversification is the riskiest strategy; that’s why it is also called “di-worse-ification.” It involves developing new products for an entirely new market segment. Diversification is the quadrant where companies make their biggest mistakes because they tend to rely on vision rather than evidence.

“Diversification makes very little sense for those who know what they’re doing.” – Warren Buffett

Diversification is commonly used to spread risk and tap into new revenue streams beyond the core business. For example, Pepsi decided to diversify from a soda company into a global food and beverages company to adapt to changing consumer preferences and mitigate risk across markets.

What signals matter for diversification strategy?

Diversification for growth makes sense only if it is established that the other three quadrants cannot lead to growth. The following competitive signals help you assess whether to pursue a diversification strategy.

- Acquisitions in adjacent or unrelated categories: show competitors expanding beyond their core market.

- Investments into new industry verticals: signal moves into entirely new segments.

- Leadership roles for new businesses: indicate commitment to new lines of business.

- Acqui-hires in new technical domains: suggests they are building capabilities outside their current product stack.

- Product launches in new markets: indicate an attempt to diversify their business.

- Spin-offs or lab initiatives: signal exploratory pushes into future markets.

In addition to competitors, companies should actively monitor regulators when planning diversification-based growth. The opening of regulations could unlock new markets that were previously restricted.

Example: Diversification

Now, let’s apply this to our sample company in the appointment management space.

Market Signal: A competitor partners with a financial services firm to offer flexible payment options

- What it indicates: A trend toward offering financial services alongside existing offerings.

- What to do with it: The company could explore partnerships with financial services providers to bundle financial services offerings and target new customer segments.

Diversification Signal: A competitor drops point solutions and starts offering an end-to-end salon platform, covering inventory, payroll, client CRM, and more.

- What it indicates: Point solutions that address a single pain area are losing ground to integrated offerings. Businesses want a single solution to run their entire operation.

- What to do with it: The company could layer in management features, such as staff scheduling, revenue forecasting, and compliance tools. It could consider going beyond a scheduling system and becoming the operations backbone for a specific vertical.

Diversification is not about risky adventures; it’s about taking informed risks with a clear view of where the market is heading. Like other growth strategies, a successful diversification strategy is based on rigorous market and competitive intelligence.

How To Implement the Ansoff Matrix in Practice

Companies that implement the Ansoff Matrix successfully usually do these two things consistently:

- They monitor competitive signals

- They map signals into the four quadrants

After tracking competitive signals and mapping them to the Ansoff Matrix quadrants, they roll up insights from the four quadrants into a unified growth strategy.

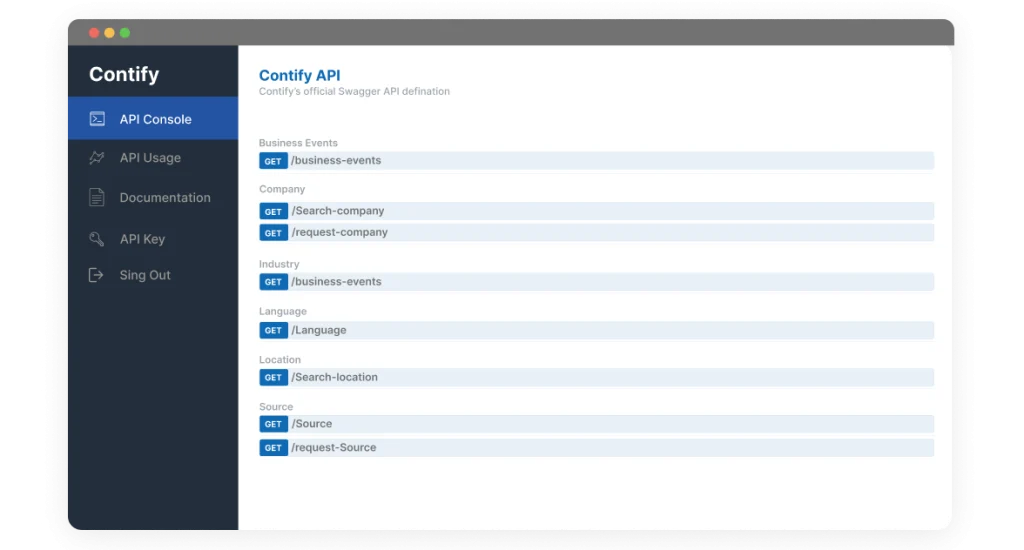

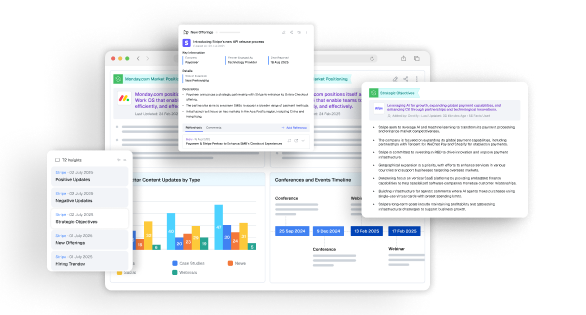

With Contify, that entire process becomes automated. How?

Contify provides a real-time, unified view of your competitive landscape by consolidating strategic insights, customer profiles, products, financials, leadership details, and market trends into a single platform. It does this through:

- Intelligence Sourcing: Contify continuously captures intelligence from over 1 M verified sources across 750k companies.

- Newsfeeds: An AI-validated processing engine to deliver structured and reliable newsfeeds.

- Business Facts: Athena (Contify’s Agentic AI Insights Engine) extracts key data points and highlights for critical business events.

- Automated Insights: Business facts are connected in context using preconfigured templates to auto-update insights.

- Live Dashboards: Insights and visualizations based on structured content come together in live dashboards.

Related reading: Agentic AI insights engine powering truly autonomous intelligence

Final Thought

If you thought that a structured market and competitive intelligence (M&CI) program would not add real business value, I hope this article has given you enough reasons to reconsider. And if you’re using M&CI only for tactical work, such as battlecards to help sales win more deals, you’re leaving most of its value on the table.

While battlecards are essential and certainly help in sales, the real reasons a deal is won or lost are established long before a buyer even starts the buying journey. They are laid when you make the core decisions about what problem to solve, for whom, and how to solve it. However, they are not set in stone. The market landscape continues to evolve, and if you want to grow faster than your competitors, your strategy has to adapt faster than theirs.

“It is not the strongest that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.” – Charles Darwin

M&CI is one of the essential tools that help you evolve and adapt to the changing markets and customer expectations.

To build a truly competitive company, you not only have to develop effective growth strategies but also execute them efficiently. The Ansoff Matrix provides a framework that forces discipline in selecting the right growth strategies. When you combine this discipline with market and competitive intelligence, the decisions are grounded in real market insights rather than intuitions. With this robust methodology, your strategy won’t be just a presentation deck, but an operating system that drives sustainable growth.If you’d like to see how Contify can help you implement an Ansoff Matrix-based growth strategy, click here to request a demo.