The current IT market is growing at exponential rates, with a projected revenue of US$1.51 trillion in 2025. What once took decades to transform now happens within a single strategic planning cycle. For business leaders, this means opportunity and disruption are no longer consecutive; they happen simultaneously.

Such rapid growth calls for quick decisions, yet many teams still rely on siloed data streams, isolated customer feedback, and manual research. The result is a hit-and-trial approach to product development and messaging one that struggles to keep pace with dynamic customer expectations and shifting competitive landscapes.

At Contify, we believe true agility starts by unifying the voice of your customers with broader market and competitive intelligence (M&CI). By integrating rich qualitative insights with strategic market context, Product Marketing Managers (PMMs) can move beyond guesswork building offerings and crafting messaging that genuinely resonate and drive revenue growth.

In this blog, we’ll explore the pitfalls of siloed intelligence, how to combine VoC and M&CI for actionable insights, how integrated intelligence sharpens product messaging, and how it fuels truly agile roadmaps.

Understanding the Silos: Voice of Customer vs. Market & Competitive Intelligence

To unlock the full power of integration, it’s critical to first understand the distinct strengths and limits of Voice of the Customer (VoC) and M&CI when they operate independently.

How Voice of Customer Helps Boost User Experience

VoC captures customers’ needs, preferences, and feedback around your company’s products or services. It provides firsthand insights into user satisfaction, pain points, and expectations through various methods:

Surveys: Structured feedback collected via email, SMS, or in-app prompts at key journey moments.

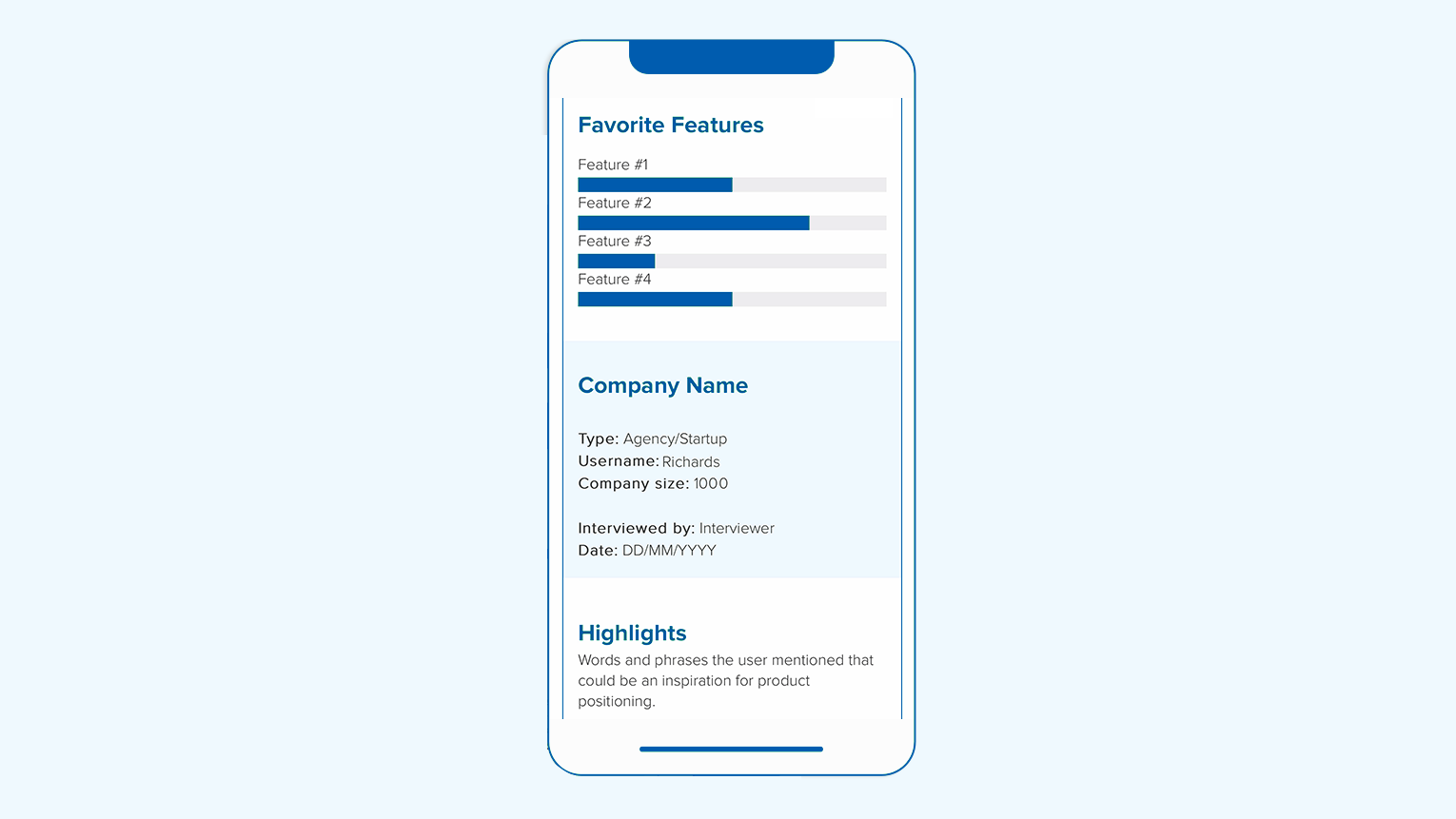

Customer Interviews & Focus Groups: Deep qualitative conversations to uncover motivations and unmet needs.

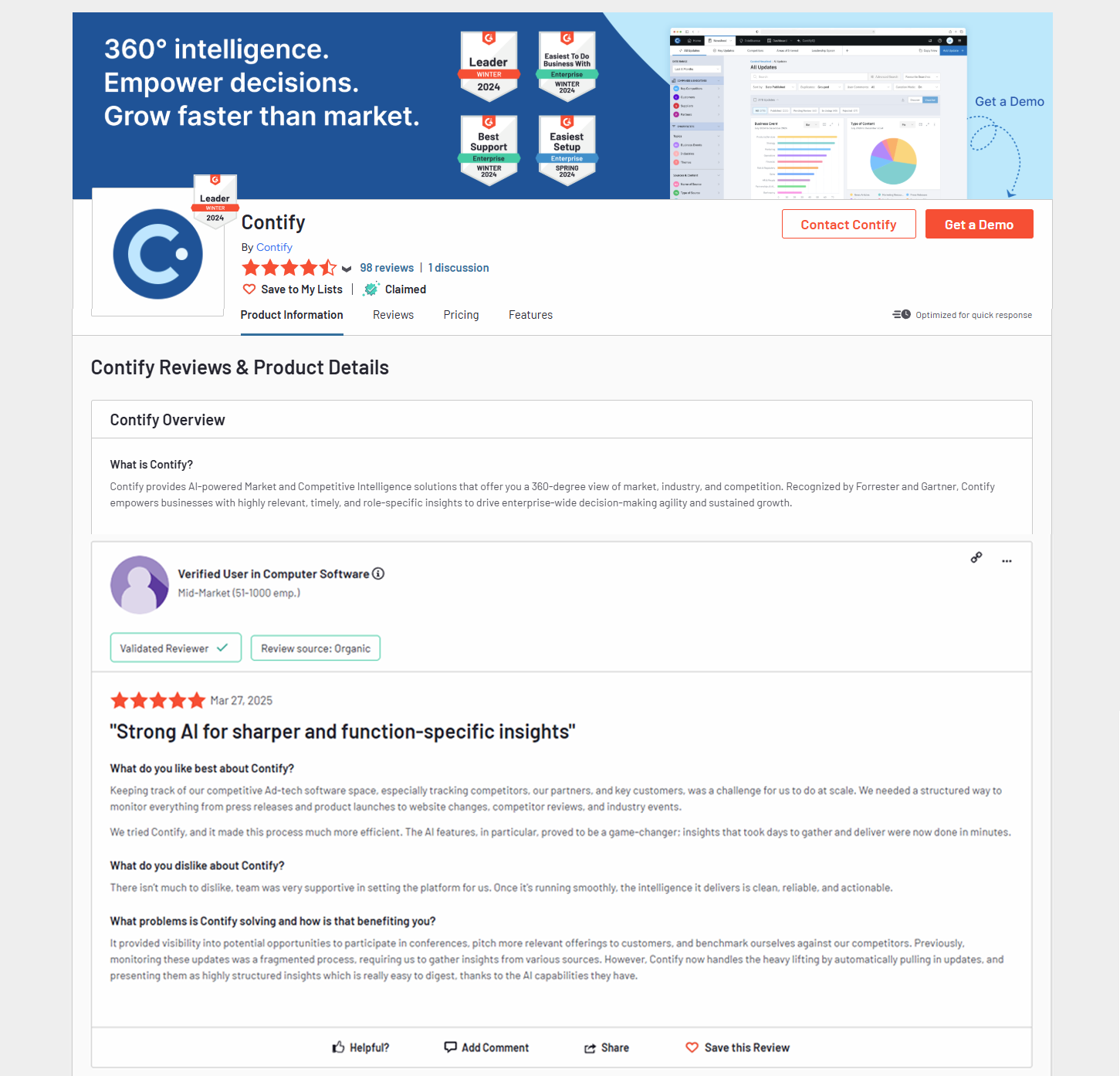

Online Reviews & Social Media Monitoring: Real-time, often candid feedback from platforms like G2, Capterra, Reddit, and LinkedIn.

Support Tickets & Live Chat Logs: Revealing recurring issues and immediate customer concerns.

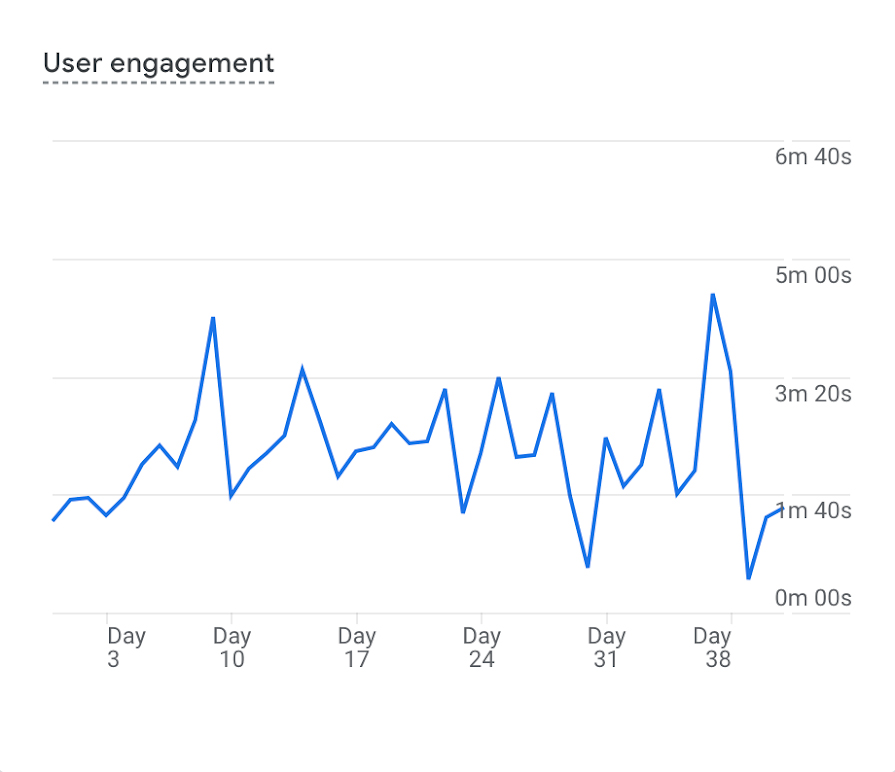

Website & In-App Behavior Analytics: Tools like Google Analytics, Hotjar, and Pendo show where users succeed or struggle within the product.

VoC highlights usability issues, validates product-market fit, and surfaces emerging user needs.

However, relying solely on VoC can be risky as it narrows focus to current customers and may miss broader market shifts, competitive threats, or emerging opportunities users aren’t yet articulating.

Market & Competitive Intelligence (M&CI): The Strategic Landscape View

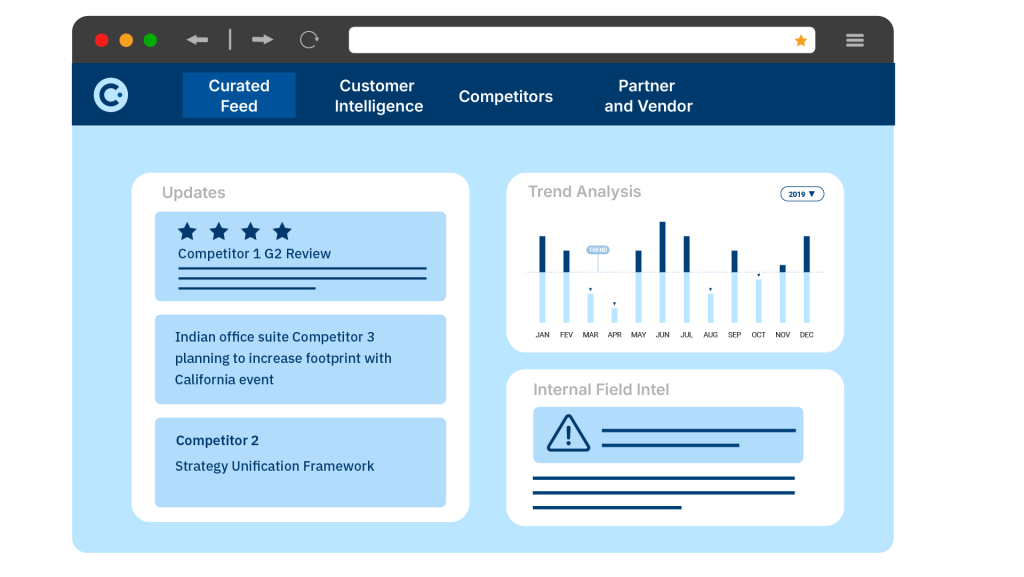

Market and Competitive Intelligence (M&CI) enables you to systematically collect and analyze information about competitors, industries, technologies, and customer segments. Some key M&CI practices include:

- Competitor Monitoring: Tracking websites, product launches, pricing updates, marketing campaigns, M&A activity, and customer reviews.

- Industry Trend Analysis: Studying analyst reports, research publications, regulatory changes, and economic indicators.

- Partner and Vendor Intelligence: Monitoring the activities, capabilities, and shifts among your suppliers, partners, and third-party vendors to anticipate risks, spot opportunities, and strengthen your ecosystem strategy.

- Customer Intelligence: Aggregating CRM data and sales insights to identify trends across customer groups.

- Internal Field Intel: Collecting insights from Sales, Support, and Customer Success about competitor mentions and win/loss reasons.

M&CI offers critical strategic context, mapping opportunities, threats, and competitive positioning. But without VoC, strategies can become detached from real customer experience, leading to products that miss the mark at a practical, day-to-day level.

Integrating the both is crucial for striking the perfect balance for business success.

Understanding how to Integrate Market Insights with Customer Feedback

The real secret for agile product marketing lies in breaking down silos, integrating VoC and M&CI into a unified stream of insights, validated by real-world user needs.

A common mistake businesses make is considering that integration simply refers to collecting both types of data. Instead, focusing more on actively combining and analyzing them is imperative to drive deeper, more actionable insights.

- VoC tells us what customers are experiencing or asking for.

- M&CI explains why it matters and what to do about it.

For example, a user might complain that a feature is confusing. Integrated analysis could reveal that a competitor has just launched a simpler version, and that market demand for that capability is growing.

Critically, this includes analyzing competitor customer reviews along with your own. Insights from how the market perceives competitors help spot gaps and opportunities faster.

Let’s check out a few other things to consider when consolidating your internal information with external market data.

1. Centralized Intelligence Platforms

A central data repository should be at the core of your information workflow, so employees across the organization can easily find and access the same information. It also eliminates data silos and ensures that every department can work from the same set of information.

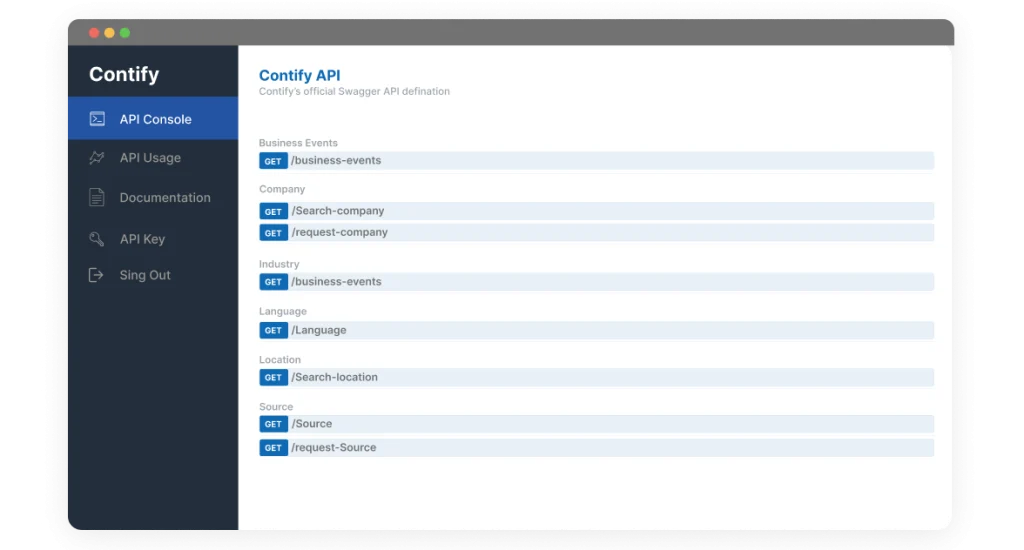

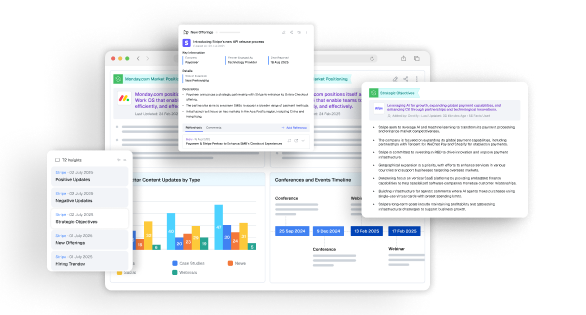

Comprehensive platforms like Contify enable organizations to aggregate diverse internal and external sources, including news articles, competitor websites, customer reviews, analyst reports, and internal VoC, like insights for surveys or sales calls.

Importantly, these platforms let you tag, categorize, and set intelligent alerts based on specific topics, competitors, or market movements. Having a single source of truth speeds up access to insights while also promoting better collaboration and faster, more informed decision-making across teams.

2. AI and ML-led Insights

As the volume of customer feedback and market data continues to grow exponentially, manual analysis has become both impractical and inefficient. That’s where artificial intelligence comes in. Technologies like Natural Language Processing (NLP) can read through thousands of customer comments, competitor reviews, and articles, pulling out common themes and spotting shifts in sentiment that would be easy to miss manually.

Instead of teams having to sort through endless reports, NLP highlights what’s changing and why it matters. ML takes this even further by finding hidden patterns across different sources of feedback.

And now, with the help of Generative AI, teams can go a step beyond: they can actually ask direct questions, like “What product features are customers asking for this quarter?” and get clear, synthesized answers drawn from all their data. Together, these AI tools make it possible to turn massive amounts of raw information into real, actionable insights at a scale that was never possible before.

3. Integrated VoC Platforms

Bringing customer feedback and market intelligence together in one place is important, but it’s not enough on its own. Businesses need to make sure these systems are seamlessly connected to each other. That means setting up integrations between VoC tools, CRM platforms, customer support systems, and your M&CI platform.

For example, feedback collected from surveys, product reviews, support chats, and behavioral analytics tools should all flow automatically into your intelligence hub, without needing manual uploads or copy-pasting.

At the same time, it’s critical to push insights out into the tools your teams already use, like Slack, Microsoft Teams, or project management systems. This way, important feedback and market shifts show up where people are already working, making it easier to spot trends early and take action quickly.

When your systems are connected like this, customer needs and market opportunities become part of the daily conversation, instead of staying buried in a separate dashboard that only a few people check.

4. Cross-Functional Processes

Even with the best technology and connected systems, insights won’t drive change unless teams come together to discuss them and act on them. That’s why building a regular cadence of cross-functional insight reviews is so important.

These sessions should bring together teams like Product, Marketing, Sales, and Customer Success to look at the latest findings from both customer feedback and market intelligence. But the goal isn’t just to share information, but to make thought out decisions.

Are customers asking for something new that competitors are starting to offer? Is there a growing frustration with a feature that needs redesigning? Are there signs that a competitor is gaining ground in a key market? By discussing these questions openly and agreeing on next steps, teams can stay aligned and move faster. Over time, regular insight reviews create a culture where decisions are grounded in real-world evidence.

Refining Product Messaging with Integrated Intelligence

Integrating VoC with M&CI empowers Product Marketing Managers (PMMs) to craft messaging that is customer-validated, competitor-aware, and market-tuned.

Rather than relying on assumptions, PMMs can:

- Anchor messaging in real customer language: VoC insights reveal how users actually describe their challenges, goals, and frustrations, helping marketers mirror that language authentically in campaigns.

- Highlight true competitive advantages: M&CI provides a clear view of where competitors are strong or vulnerable. Analyzing competitor reviews, messaging, and customer sentiment identifies gaps that your messaging can directly address.

- Focus on validated benefits, not features: Customers don’t buy features; they buy outcomes. Integrated insights reveal which outcomes matter most to your audience, and how to frame your product as the clearest path to those outcomes.

How Integrated Insights Map to Messaging Components

| Messaging Component | VoC Input Example | M&CI Input Example | Refined Messaging Outcome |

| Value Proposition | Direct quotes on “biggest benefit”, High CSAT for specific outcome achieved | Competitor value prop analysis, Market trend data showing demand for specific outcome | Clear, concise statement highlighting the unique, validated benefit most important to the target market |

| Differentiation | Feedback highlighting unique feature appreciation, Pain points with competitor tools | Competitor feature gap analysis, Competitor website/messaging monitoring, Analysis of competitor customer reviews highlighting weaknesses | Messaging emphasizing unique strengths and addressing competitor weaknesses directly |

| Pain Point Addressal | Open-ended survey responses detailing frustrations, Support ticket theme analysis | Analysis of unmet market needs, Forum discussions on industry challenges, Competitor reviews revealing common frustrations | Messaging that directly acknowledges and solves specific, validated customer pain points using their language |

| Credibility/Social Proof | Positive reviews, Testimonials, High NPS scores, Case study participation | Competitor customer lists/logos, Industry awards & recognition monitoring | Prominent use of customer logos, testimonials, ratings, and case study results in marketing materials |

By continuously integrating fresh VoC and M&CI inputs into messaging frameworks, PMMs ensure that marketing efforts stay:

- Relevant to evolving customer needs

- Responsive to competitive pressures

- Resonant with functional and emotional drivers

Ultimately, integrated intelligence turns messaging from static declarations into dynamic conversations that customers recognize as real, relatable, and worthy of their attention.

Informing Agile Roadmaps with Integrated Intelligence

Contradictory to popular belief, agility isn’t limited to moving fast; it’s pertinent that you move in the right direction.

For Product Marketing Managers and Product Managers (PMs), specifically in IT industry, this means roadmaps must be fueled by evidence, not assumptions. Integrating VoC and M&CI transforms traditional roadmap planning into a dynamic, customer-validated, and market-aligned process.

Without integrated insights, roadmaps often fall victim to:

- The “HiPPO” Effect (Highest Paid Person’s Opinion): Decisions driven by senior stakeholders’ preferences rather than market reality

- Internal Bias: Teams prioritizing familiar requests or personal pet projects over true market needs

- Feature Parity Traps: Chasing competitors’ features reactively without considering differentiated value or customer demand

By contrast, integrated intelligence enables objective, strategic prioritization so PMMs and PMs can focus on features or initiatives that meet three critical criteria:

- Customer-Validated: Users are actively asking for or struggling without it

- Strategically Important: Aligns with market trends, future-proofing the product

- Competitively Differentiating: Creates or widens gaps versus competitors

Organizations should also keep in mind that roadmaps shouldn’t just be informed by integrated intelligence once, they should continuously evolve based on real-time feedback and market shifts.

Establishing a living intelligence process means:

- Regularly reviewing VoC and M&CI inputs in sprint planning or quarterly roadmap sessions.

- Setting up alerts for major competitor moves or market shifts that could impact priorities.

- Tightly integrating customer feedback loops into post-launch analysis to validate whether roadmap bets are paying off.

- Using centralized intelligence platforms (like Contify) to track and update evolving insights across product, marketing, and leadership teams.

Crafting the Road from Intelligence to Impact with Contify

Modern businesses often operate in markets that are volatile, competitive, and increasingly customer-driven.

However, collecting customer feedback or tracking competitors in isolation is no longer enough. The true differentiator lies in integrating Voice of Customer and Market & Competitive Intelligence into a single, actionable foundation for decision-making.

This is where Contify can help you excel.

Contify’s AI-powered M&CI Platform breaks down silos by aggregating, analyzing, and delivering intelligence from multiple streams. From customer feedback to competitor updates, market trends, and strategic signals, you can find it in a single source of truth.

By empowering Product Marketing Managers and Product Managers with real-time, centralized intelligence, Contify helps organizations surface emerging opportunities faster than the competition. As a result, empowering you to build resilient, agile strategies that adapt to market shifts.

Get in touch with us today to learn how integrated intelligence can become your competitive advantage.