The pharmaceutical industry moves quickly, marked by rapid scientific breakthroughs, increasing global competition, and an intense regulatory landscape. In this high-stakes environment, the cost of a misstep can be immense.

For instance, developing a new drug takes over 10 years, sometimes even 15 by the time all clinical trials are done. This process further costs at least hundreds of millions of dollars, even going well into billions.

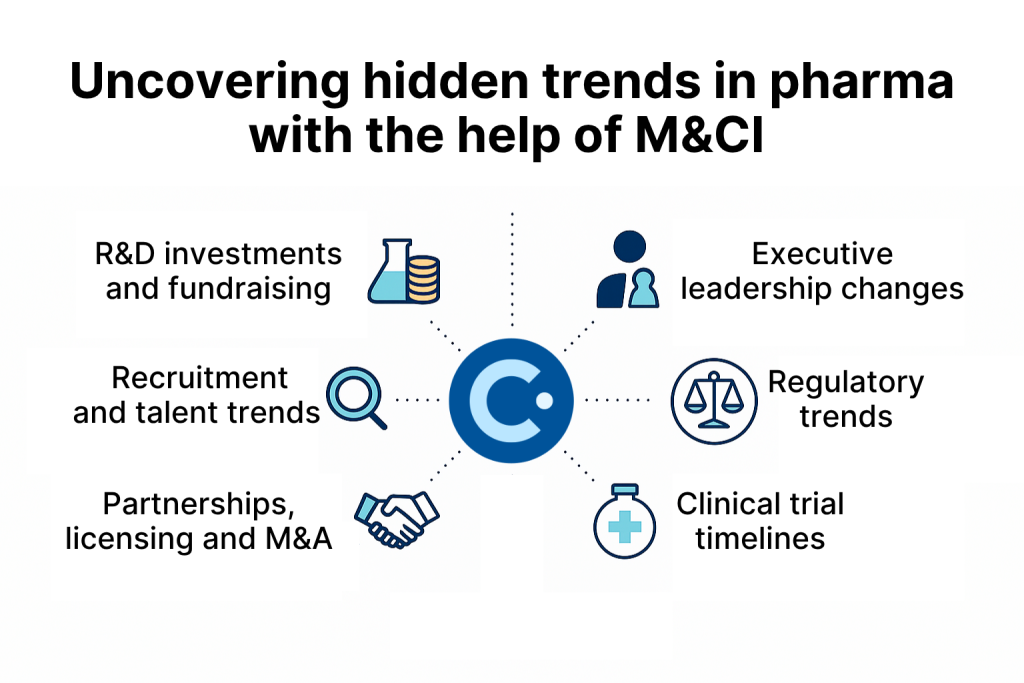

To navigate this complexity, pharmaceutical companies are increasingly turning to Market & Competitive Intelligence (M&CI). While the concept of M&CI is not new to the pharmaceutical industry, the stakes have risen dramatically. From accelerated innovation cycles to regulatory complexity and patient-centric care models, pharma companies are now leveraging advanced M&CI methodologies to stay ahead.

This blog delves into how pharmaceutical companies are revitalizing their M&CI practices to build more robust pipelines, mitigate development risks, and maintain a competitive edge in one of the most challenging industries worldwide.

Problems associated with the drug discovery and development process

Bringing a new drug to market remains one of the most complex and costly endeavors in business. Despite the promises of biotechnology, AI, and big data, the foundational challenges persist:

- Time: The process, from discovery through trials to approval, still takes 10–15 years on average.

- Cost: A 2022 study by Deloitte estimated the cost of bringing a drug to market at $2.3 billion, factoring in R&D, clinical trials, and regulatory hurdles.

- Failure rates: Nearly 90% of clinical drug development fails.

Such issues continue to pose problems, even for large pharmaceutical companies. Let’s look at some of the recent real-world cases of costly setbacks:

- GSK discontinued its phase 2 rheumatoid arthritis drug after unsatisfactory trial results in early 2024.

- Biogen Alzheimer’s drug Aduhelm was pulled from the market after failing to meet cost-benefit expectations.

- Voyager Therapeutics, a gene therapy pioneer, paused multiple trials due to immune-related safety issues.

Such outcomes, often from clinical holds or regulatory setbacks, lead to financial losses, reputational risk, and lost market opportunities. With shrinking patent windows and global competition, companies cannot afford these blind spots.

How M&CI is evolving and powering smarter use of AI in pharma

Given the high cost and failure rates in drug development, pharma companies aren’t just looking for more data, they need the right intelligence at the right time. That’s why modern M&CI is evolving beyond traditional competitor tracking to enable more predictive, proactive decision-making across the development lifecycle.

And AI is a key enabler of this evolution.

AI is rapidly transforming drug discovery by identifying patterns in massive datasets, predicting molecule interactions, and helping design more efficient trials. But its true potential is only realized when it’s guided by robust, up-to-date market and competitive intelligence.

Here are some recent high-profile collaborations that reflect this synergy:

- Sanofi struck a deal with BioMap to leverage their AI platform for antibody discovery and protein engineering.

- Bayer collaborated with Google Cloud to develop an AI-powered approach for early-stage drug discovery, utilizing genomics and medical imaging data.

- AstraZeneca and BenevolentAI’s ongoing collaboration for targeting novel drug pathways in chronic kidney disease and idiopathic pulmonary fibrosis.

These projects are already yielding results. Reports indicate that AI can reduce discovery timelines by 30 to 40%, lower preclinical failure rates, and improve candidate selection.

However, without real-time M&CI inputs, such as competitive trial activity, emerging science, and regulatory trends, AI models risk operating in a vacuum. They might duplicate failed efforts or miss shifts in the external landscape.

That’s why forward-thinking pharma teams are integrating M&CI directly into their AI workflows, enabling smarter predictions, fewer blind spots, and faster course corrections.

How AI-powered M&CI enables pharma workflows

AI-powered M&CI platforms such as Contify can help pharmaceutical companies at each stage throughout the drug discovery and development process in the following ways:

Here’s how M&CI supports different phases of the drug lifecycle:

1. Early Development

- “Go or No-Go” Decisions: Intelligence on competitors’ pipeline attrition, past failures, or trial endpoints helps prioritize viable leads.

- Clinical Trial Design: Real-world data on trial strategies, endpoints, patient segments, and geographic focus to enable improved protocol design.

- Tracking Competitor Pipelines: Stay informed on emerging compounds, new indications, and trial start dates.

2. Pre-launch (Before FDA/EMA Approval)

- Message Positioning: Identify unmet needs, track evolving narratives, and tailor market messaging.

- Competitive Messaging Surveillance: Monitor press releases, ad campaigns, investor briefings, and social media for insights on how rivals position new drugs.

3. Post-launch (Market Defense)

- Defending Market Share: Spot early signals of biosimilars or new entrants. Respond proactively with precision marketing, legal measures, or pricing strategies.

- Patent Watch & Generic Threats: Monitor patent litigation, ANDA filings, and manufacturing trends.

Beyond these stages, M&CI also delivers intelligence on:

Taking a closer look at how pharma companies are leveraging Contify

Pharmaceutical firms face the recurring challenge of siloed intelligence operations. Teams across R&D, regulatory, medical affairs, marketing, and strategy often duplicate efforts or miss key insights. This can prove to be detrimental, if things go wrong.

Contify addresses this by centralizing, structuring, and distributing actionable intelligence across the organization. Here’s how global pharma leaders use Contify’s M&CI platform:

- Tracking competitors’ negative news: Negative news keeps you informed about your competitors’ failed trials, regulatory rejections, or market withdrawals, so you can avoid repeating costly mistakes and optimize internal development strategies

- Spotting early breakthrough therapies: Early identification of high-potential therapies through pipeline monitoring and scientific publications allows you to proactively adjust your own pipeline and therapeutic area focus.

- Monitoring global drug approvals in near-real-time: Real-time visibility into approvals across international agencies helps anticipate competitive entries, shifts in standard of care, and global market opportunities.

- Interpreting regulatory agency behavior: Tracking how regulatory bodies make decisions, based on approval timelines, trial requirements, and safety concerns for more informed risk assessments and submission strategies.

- Consolidating clinical trial intelligence: Aggregating trial data provides a unified view of competitor R&D activity, highlighting emerging trends, success rates, and white spaces.

- Discovering unmet market needs: Analyzing competitor moves, such as discontinued programs, target shifts, or gaps in patient subgroups reveals potential unmet needs and opportunities for differentiation.

- Validating strategic and commercial decisions: Benchmarking decisions against competitor strategies helps align with market dynamics and strategic advantage.

Contify provides users with access to all the actionable intelligence from 1mn+ sources across departments and geographies, in one place.

Sign up for a free 7-day trial today to learn how Contify can help your organization stay ahead in competitive markets.

FAQ’s

What stages of the drug lifecycle benefit from M&CI?

M&CI supports early development (trial design, pipeline evaluation), pre-launch planning (messaging, positioning), and post-launch defense (market share protection, patent monitoring).

How does M&CI help avoid R&D failures?

By analyzing failed trials, regulatory decisions, and competitive moves, M&CI helps pharma teams learn from others’ mistakes and improve their decisions.

Can M&CI help smaller pharma companies or only large enterprises?

M&CI platforms like Contify are scalable and can be tailored to the needs of both large enterprises and smaller biotech or pharma companies, helping them stay competitive with better insights.