In the ever-evolving world of banking, financial services, and insurance (BFSI), hiring is more than just a human resources activity, it’s a strategic direction hidden in plain sight. From job postings to recruitment campaigns, it all reflects a firm’s shifting priorities, emerging focus areas, and underlying growth strategy.

For professionals in the BFSI sector, hiring trends offer a largely untapped and immensely valuable source of insight. From learning where competitors are investing, to identifying emerging technologies or regional expansions, talent acquisition patterns can be mined for intelligence that goes far beyond HR metrics.

When analyzed properly, these trends enable organizations to track emerging priorities in real-time, often faster than earnings reports or media announcements.

This blog explores how hiring intelligence can be transformed into a core component of a modern BFSI competitive intelligence program.

Why is it crucial to keep track of your competitors in BFSI?

In a sector marked by intense competition, regulatory complexity, and digital disruption, BFSI firms are continually adapting. Hiring data provides an insider view into how these adaptations surface within organizations.

Some key reasons why your competitor’s job postings can be a vital intelligence source include:

1. Early Indicator of Strategic Shifts

When a competitor begins hiring heavily for data scientists or AI engineers, it signals a shift toward automation or predictive analytics. Similarly, hiring sustainability officers or ESG analysts often reflects evolving risk management frameworks or compliance commitments.

Keeping an eye out for such updates can be critical in the BFSI sector.

2. Reveals Investment in New Geographies or Business Lines

Job openings filtered by location can highlight where a bank or insurer is expanding operations.

A sudden hiring spike in Southeast Asia could mean market entry, a new compliance regime, or regional innovation labs.

3. Signals Partnership or Product Launch Readiness

Roles such as product managers, alliance leads, or go-to-market strategists hint at impending product rollouts, fintech partnerships, or infrastructure upgrades.

This insight can be used to predict customer acquisition strategies.

4. Supports risk and compliance monitoring

For risk intelligence teams, observing regulatory, legal, or cyber security hiring trends across peers helps benchmark readiness and identify shifts in regulatory focus.

For example, you’ll get answers to crucial questions like “Are my competitors preparing for new anti-money laundering (AML) requirements or tightening cybersecurity frameworks?”

Turning hiring data into actionable intelligence

While job postings are publicly available, most organizations fail to extract their true value that remains hidden in plain sight, in the form of small details. For BFSI organizations to operationalize hiring trends effectively, they must adopt a structured M&CI approach that filters noise, identifies patterns, and translates them into intelligence to drive decision-making.

Step 1: Aggregate from Diverse, Reliable Sources

A holistic view of hiring activity requires pulling in data from:

- Company career pages and job portals like LinkedIn, Glassdoor, and Indeed

- Press releases and industry publications

- Staffing firm announcements

- Public regulatory filings mentioning hiring mandates

This ensures you’re capturing both direct job listings and indirect talent strategies.

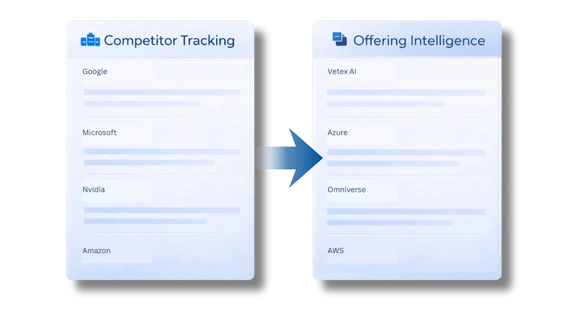

Step 2: Tag and Classify by Strategic Relevance

Use a defined taxonomy to categorize roles by:

- Function (Technology, Product, Risk, Compliance, Operations)

- Strategic Theme (ESG, Open Banking, AI/ML, Cybersecurity)

- Region (APAC, North America, Europe, etc.)

- Seniority (Entry, Mid, Senior Leadership)

Tagging by theme and geography enables easy mapping according to business priorities and competitive strategies.

Step 3: Trend Analysis Over Time

Point-in-time job postings are helpful, but patterns over time reveal much more. Track:

- Hiring volume growth across functions

- Fluctuations in hiring by geography

- The emergence of new roles

Use dashboards and time-series visualizations to detect acceleration, slowdowns, or emerging focus areas.

Step 4: Correlate with External Signals

To validate your insights, correlate hiring trends with other intelligence layers, such as:

- Product or partnership announcements

- Regulatory news

- Financial disclosures

- M&A activity

This triangulation sharpens competitive assessments and increases confidence in your conclusions.

Talent signals you should be tracking

Let’s check out some examples of specific hiring patterns that provide strategic clues:

| Hiring Signal | What It Could Indicate |

| Surge in AI/ML engineer roles | Investment in predictive analytics, automation, or fraud detection platforms |

| ESG and sustainability job postings | A shift in regulatory positioning or impact-focused investment strategies |

| Product or partnership manager roles | Upcoming product launches or fintech/InsurTech integrations |

| Regulatory compliance & AML positions | Preparing for new local/global regulatory frameworks |

| Cybersecurity and risk hiring | Heightened threat response or digital transformation readiness |

| Claims, underwriting, and actuarial roles | Adjustments to capacity, pricing models, or geographic underwriting shifts |

Monitoring these patterns can help identify what is happening with your competitors, and even understand why it matters in the broader competitive landscape.

How BFSI teams can operationalize hiring intelligence

To embed hiring trend analysis into your M&CI strategy, consider these practical applications across key departments:

Strategy & Corporate Planning

- Use hiring data to benchmark investment areas across competitors

- Detect emerging technologies or product categories to watch

- Validate hypotheses around strategic shifts

Risk & Compliance

- Spot rising focus on AML, data privacy, and governance roles

- Identify gaps in your readiness vs. competitors

- Track early signs of regulatory shifts by watching peer movements

Product & Innovation

- Use product and UX hiring patterns to predict competitive product rollouts

- Assess if competitors are building in-house capabilities or relying on vendors

- Align internal roadmaps based on external hiring trends

HR & Talent Strategy

- Benchmark in-demand skills across regions or domains

- Spot competitors’ talent acquisition hot spots to inform sourcing strategy

- Build employer brand positioning around insights from competitor hiring narratives

Turn competitor job postings into valuable data today

If you wish to get started with hiring intelligence, the best approach involves:

- Identify Key Competitors and Peer Groups: Focus on 5–10 direct competitors or relevant benchmarks based on geography or size. Manual tracking will likely be burdensome if you track too many competitors.

- Define Key Hiring Themes: Align hiring categories with strategic priorities: e.g., AI, ESG, Open Banking, and Cybersecurity.

- Build a Central Hiring Feed: Use a 360-degree market intelligence platform to aggregate and tag job data from key sources. Contify is already configured to fetch your competitors’ hiring data.

- Visualize and Monitor Trends: Set up dashboards and alerts to detect volume spikes, new job roles, and regional shifts.

- Share Insights Across Teams: Push actionable summaries to strategy, risk, product, and HR teams regularly.

Final Thoughts: Your Competitor’s Talent Strategy is Your Strategic Advantage

Hiring intelligence is one of the most forward-looking competitive signals available to BFSI organizations. Unlike financial disclosures or product announcements, which reveal what has already happened, hiring tells you what’s coming next.

When monitored consistently and analyzed within a structured M&CI framework, hiring data becomes a powerful indicator of where the market is heading, what technologies your peers are betting on, and how prepared they are for the future.

Turning job postings into strategic foresight is an added advantage for BFSI firms. Start today with Contify’s 7-day free trial.

Frequently asked questions

How can BFSI hiring data provide competitive insights?

Job postings often reveal strategic initiatives like tech investments, new product areas, or market expansions, offering early visibility into competitors’ moves.

Can job postings reveal competitors’ growth strategies?

Yes. Hiring in specific locations, functions, or in bulk can indicate expansion plans, product development, or scaling operations.

What tools are useful for analyzing BFSI hiring trends?

Platforms like Contify, job scraping tools, and analytics dashboards help collect, organize, and analyze hiring data across competitors.