Competitive monitoring isn’t something new, organizations have been keeping track of their competitors’ moves since time immemorial. However, with the evolving market landscape, competitive monitoring has become more sophisticated. According to Forbes, monitoring your competitors is a great way to understand why they’re outperforming you in some areas, and what gets them results. In some cases, it’s even a way to find out what you’re doing better than your competitors – so you can keep improving.

In this article, we’ll discuss what competitive monitoring is, its importance, methods of performing it, and how monitoring competition can help you stay ahead. By the end, you’ll have a clear understanding of how and why you should be monitoring your competitors. Let’s begin.

What is competitive monitoring?

Competitive monitoring can be defined as the continuous tracking of your competitors, including both established players and emerging competitors, as well as the market and business environment in order to collect information on the competition, competitive products and services, and market trends. Usually, the goal of competitive monitoring is to define your own market position, but it is a process that can be used to make a number of strategic business decisions.

Information collected during competitive monitoring, when analyzed and found relevant and actionable, is called competitive intelligence. Competitive intelligence can be (and should be) a predominant basis for taking strategic and tactical decisions that offer your organization a competitive advantage.

This competitive intelligence gained through competitive monitoring can also be used to carry out a competitive intelligence analysis (or competitive analysis), which can furnish you with a comprehensive understanding of a competitor’s products, services, value proposition, capabilities, and weaknesses.

The importance of competitive monitoring

Competitive monitoring is important for all organizations, whether small, medium, or large. As mentioned before, the analysis of the data gathered in the process allows organizations to understand their competitors’ products, pricing, marketing, and sales strategies, which can help inform their own business strategies. Regular competitive monitoring provides benefits such as:

1. Relevant and timely business information – Intelligence is no good if it isn’t timely. In order to be actionable, intelligence should be collected before your competitors make a move, which is why regular competitive monitoring is essential.

2. Better knowledge of market developments and potential threats – Monitoring competition provides preliminary knowledge about market developments and potential threats, helping an organization stay prepared for competitors’ moves, formulate a counter-strategy, discover untapped market avenues, and minimize potential losses.

3. Improved business responsiveness – Business responsiveness can be measured by asking a simple question – “How much time does it take for your organization to answer a business question?” For example, “when did our competitor start offering this particular feature?” But, this is a reactive approach. With regular competitive intelligence, the question would be “we know our competitor is about to launch this new feature, what can we do to counteract this move?”

Download M&CI Process Template

What should you be monitoring?

Competitive monitoring will give you an edge over competitors, but not unless you know what you should be monitoring. What are the exact data points you should be looking for? Here’s the answer:

1. Competitors’ websites

When it comes to competitive monitoring, a competitor’s website is a veritable gold-mine of information. The intelligence gleaned from competitors’ websites includes a lot of information that can give you insight into their key investment areas, marketing strategy, product strategy, sales strategy, and overall business growth. You can also find information about their executives, investors, news, events, products, pricing and packaging, thought leadership, etc., which will provide you with a competitive advantage.

In particular, knowing the company’s key personnel helps you determine what your competitors really look like, i.e. the actual people that are driving their business.

When your sales team is on a call with a potential customer, knowing exactly how your competitor is positioning themselves and what their prices and features are, arms them with the actionable information needed to close a competitive deal.

2. News mention

News mentions are an essential part of competitive monitoring, as knowing what is being said about your competitors in the media is an important source of insights into their business. News mentions can reveal things like market positioning, popularity, direction, changes at the C-suite level and product changes, which can inform your own business strategies. A company’s press release page is a strong indicator of what they want current and potential customers to care about, and thus, is an important data point to monitor. Similarly, being aware of awards and recognitions that are being presented to your competitor is another way to understand their strengths.

News also helps ascertain which angle and stories they’re pitching, and to which media outlets, to ascertain if they can be convinced to write about you too. Knowing how your competitors are positioning themselves can help you think of a unique angle to differentiate your own organization or brand.

3. Social media

Social media presence is a great deal these days. Companies put up a lot of information on social media to promote upcoming events, thought leadership, product updates, employee updates, support, etc. It is advisable to monitor the social media platforms that your competitors get the most engagement on, the kind of conversations that they are having there, and the content they share online. This can help you formulate your own social media strategy, discover questions that are being asked in your field, and connect with the thought leaders who are providing engaging insights on related topics.

It is thus, an avenue of information that can help closely monitor both the current and future activities of their business and how they are engaging with their customers/clients. This can help you determine the different elements of your overall business strategy, and make your next move with informed confidence.

4. Review Websites

Review websites such as G2, Capterra are another source of information you should definitely be monitoring. In addition to gauging your own customer satisfaction, it helps a lot to understand what your competitors’ customers think of their products and services. This can provide valuable insights into what your competitors strengths and weaknesses are, which can be used to improve your own product or service.

Review websites can also reveal what the former or present employees have to say about an organization. Whether good or bad, this information can be used by your sales teams as ammunition to position your organization in front of clients by portraying their weaknesses as your strengths. Recruitment teams can also use it to better position your company’s culture in front of prospective employees.

5. Marketing Emails

What’s better than letting your competitors tell you what’s going out at their organization? By subscribing to your competitors’ marketing emails, you guarantee that you have a steady flow of actionable information about the type of content they’re sharing, what events they’re planning to attend or sponsor, their news mentions, and the webinars they’ve got coming up, which can be attended to gain extra insights.

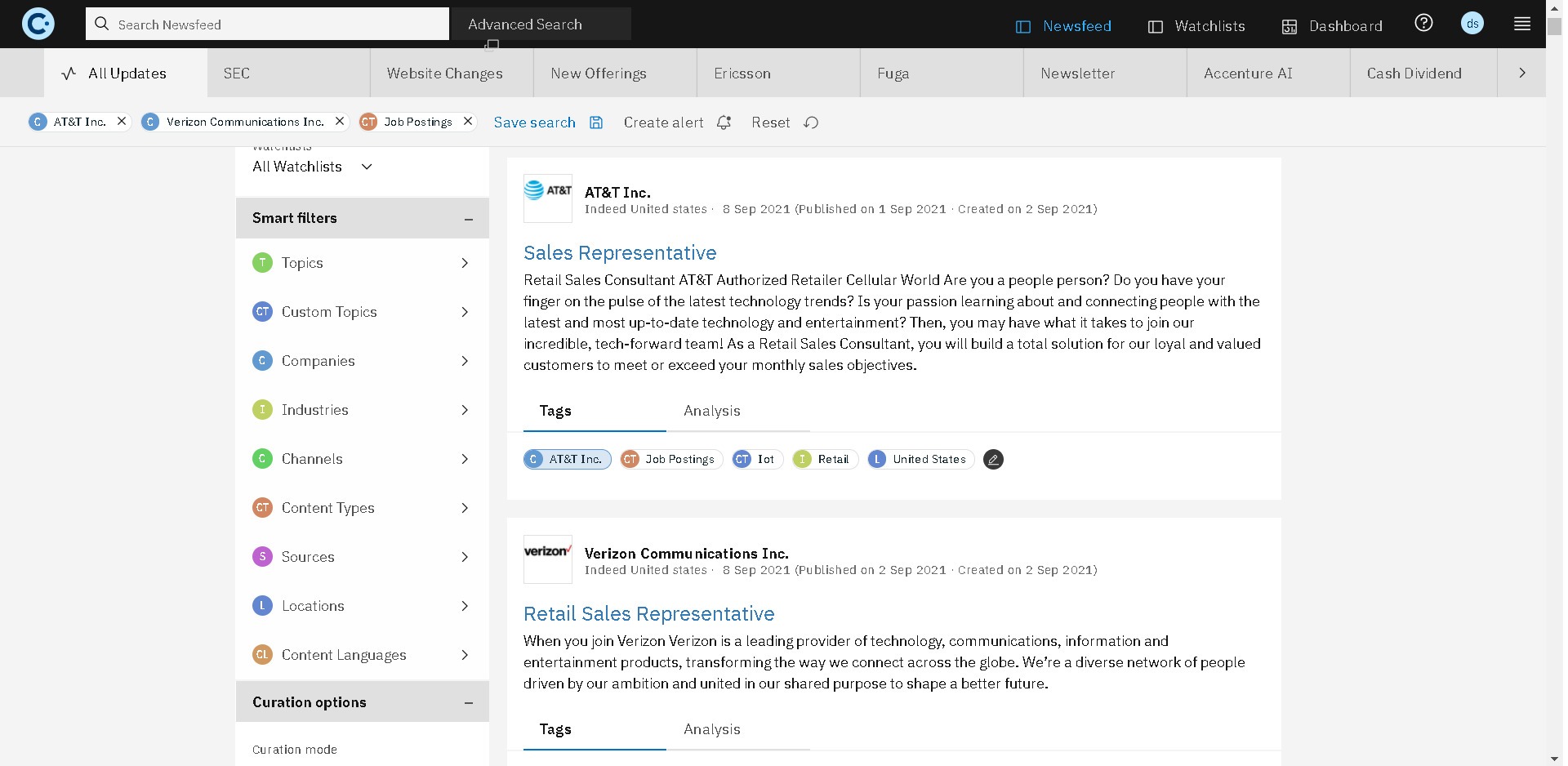

6. Job Postings

Your competitors’ hiring activities can tell you a lot about what their organization is focusing on at the moment. Monitoring the location of the posting, the number of openings, roles, and the duration the posting has been online, can provide insights into your competitor’s direction, growth and future strategic plans. Try to find trends in job posting activity, for example, if you observe an increase in job postings for product and sales-related roles in a specific location, it is likely that your competitor is working on developing a new product, and close to launching it.

How to monitor your competitors?

The internet is your own number one source of information when it comes to undertake competitive monitoring and gather competitive intelligence. However, if you try to gather competitive intelligence on your competitors and the market manually, you’ll soon be lost in a sea of information and overwhelmed by the number of challenges it poses.

For example, even if you somehow manage to filter out some information through meticulous internet research, the process is highly time-consuming. How will you ensure your data is reliable and complete? Not everything on the web is real or accurate, and you could find yourself with dated information, waste time analyzing the wrong data, or even miss new businesses trying to enter your industry. How would you know if you’ve missed something?

It is for these reasons that you need a market and competitive intelligence tool or software that can identify your competitors, collect reliable data, and then analyze and visualize that information to help you make informed, actionable decisions about refining your business strategies.

An organization should spend no more than 5 percent of their time monitoring the competition, which is what a market and competitive intelligence tool like Contify does. It takes care of intelligence gathering and analysis, so that you can focus on actually using the intelligence to help your organization make informed decisions. Take a free trial of Contify’s Market and Competitive Intelligence Platform.

Conclusion

Competitive monitoring is just the initial step towards making your organization competitively intelligent. Make sure you use the intelligence you collect to its fullest potential, i.e. use it to create competitive analysis, share it with your key stakeholders, use it in your sales enablement and/or marketing collateral, and employ other ways to transform it into action. Hope this article has provided you with some illumination on the subject of competitive monitoring, which will help you chart your organization’s journey to success.