In an era where disruptions are happening overnight and customer expectations are constantly evolving, relying on outdated and incomplete information is no longer an option. Companies, especially in the B2B space, need a reliable tool that helps them provide the necessary competitive intelligence to navigate today’s hyper-competitive and rapidly changing landscape. In this comprehensive guide, we’ll explore,

- Why CI matters more than ever

- For whom it is most beneficial in the organization

- What are its key benefits, frameworks, and best practices

- How AI, especially Generative AI (GenAI) and Large Language Models (LLMs), are reshaping the CI landscape.

What is competitive intelligence? Why it matters for B2B companies?

Competitive intelligence is a systematic process of collecting, analyzing, and using information about market trends, customer behavior, and competitors to make better business decisions. It involves tracking external sources such as product launches, new market entrants, leadership movements, pricing changes, and customer reviews to stay ahead of the competition.

Over the last two decades, competition in the B2B space has dramatically intensified, driven by digital transformation, low entry barriers, and globalization. Innovations are getting copied faster than ever and disruptions have become the new normal. In such an environment, B2B organizations, especially those with high-value and complex sales cycles, need every advantage that can find to stay competitive. That’s where CI comes in.

According to a report published by Gartner, nearly 74% of business leaders acknowledge the need for a sophisticated market and competitive intelligence tool. In fact, a benchmark report also found that 52% of organizations saw revenue growth directly attributable to CI, which is up from 47% in the previous year.

Yet many teams, especially marketing, product, sales, and strategy teams, still spend countless hour manually sifting through the internet collecting competitor insights from press releases, news, and other sources to build marketing messages, sales battle cards, and strategic business plans.

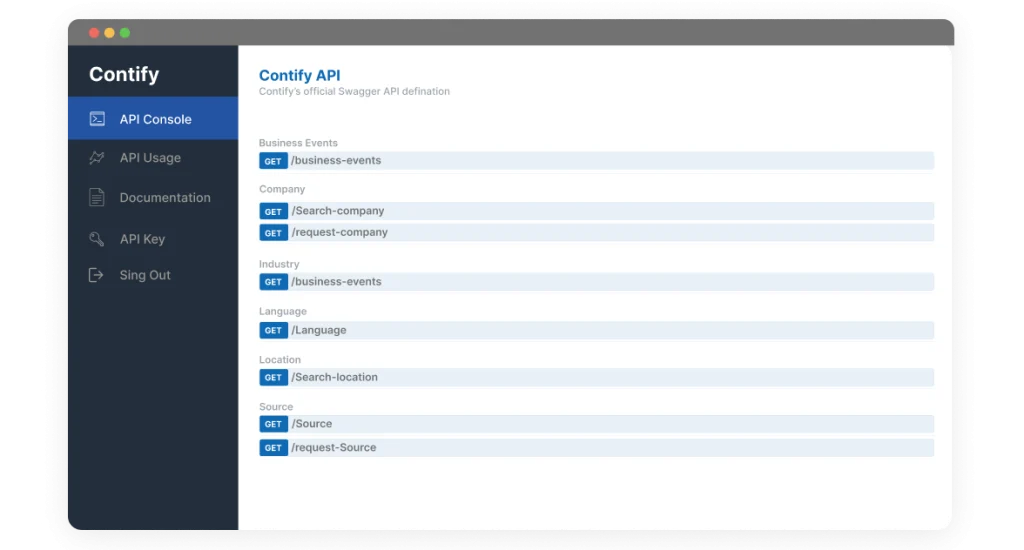

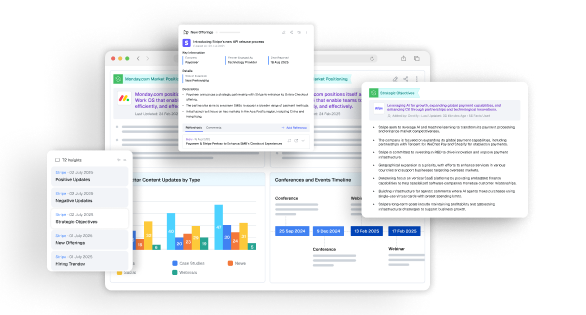

Competitive intelligence platforms like Contify simplify this by automating the process. It delivers timely and relevant intelligence in an organized and actionable format. When done right, CI has the prowess to help organizations anticipate competitive moves, understand customer choices, and sharpen their positioning in the market.

In short, CI gives B2B companies a decision-making edge. It offers clarity and agility needed to capture market opportunities and take quick actions against threats in today’s fast-changing market landscape.

Who uses competitive intelligence?

Competitive intelligence delivers valuable insights across an organization. Any customer facing or strategic team involved in winning deals, retaining customers or creating business-related assets for stakeholders and external audience can benefit from CI.

Let’s take a look at some key functions and how they leverage competitive intelligence.

Marketing and Sales

Sales Teams

Sales team are often the front-line users of competitive intelligence as they directly face prospects and competitors. For them, CI acts as weapon that gives them necessary edge to win deals. It also helps them stay updated on competitor moves, pricing changes, features launched/upgraded, and recent expansions so that they’re ready to handle objections as well as position their offerings effectively in the market.

Moreover, competitive intelligence tools provide real-time sales triggers, battlecards, and account-level insights. For instance, if a competitor launches a new feature or reduces the price of one of its offerings, your reps will be the first to know giving them the necessary leverage to set your solution apart.

| “Organizations that use competitive intelligence in sales consistently see higher win rates.” |

Marketing & Product Marketing Teams

Marketing teams can use CI tools to improve messaging, campaign targeting and brand positioning in the market. They can also track competitor websites, content being published, press coverage, and customer reviews on sites like G2, Reddit, etc., to identify gaps and opportunities. This helps marketers shape their campaigns smartly, highlighting strengths and addressing competitor claims.

Additionally, with regular competitive intelligence updates via newsletters, alerts, or dashboards, marketing teams can equickly adjust their go-to-marketing (GTM) strategies. Whether it’s promoting a product rivals don’t offer or targeting an underserved prospect segment, CI keeps marketing responsive and sharp.

Product Marketing Teams

Product marketing teams, often serving as a bridge between the product and marketing teams, use CI to create sales enablement assets like battlecards that show how your solution stacks against competitors. Platforms like Contify automatically generate these insights by pulling the latest competitor updates, ensuring consistency and saving time.

| “When aligned with CI, sales and marketing teams work as a powerful force to win business and stay ahead in the market.” |

Strategy and Leadership

Competitive intelligence plays a vital role at the strategic level helping C-level executives and strategy leaders make informed, and long-term decisons. CI tools help them monitor market shifts, assess emerging trends and threats, and guide overall business direction.

For instance, business leaders need timely, summarized insights on competitor moves, new players entered in the market, industry trends, and disruptive technologies to decide where to invest or when to pivot. Competitive intelligence provides this bigger picture by tracking external developments such as mergers & acquisitions, customer behavior, partnerships, regulatory changes, and much more.

Moreover, since time is of essence for top executives, they prefer insights delivered in concise formats like as executive briefings, monthly competitive intelligence newsletters, or real-time alerts about critical events happening in their industries. A reliable competitive intelligence process or platform like Contify, ensures that leaders stay ahead of market shifts, and enables them to take smarter, faster strategic decisions.

Product Teams

For product teams, competitive intelligence serves as a guide to product innovation and building a solid roadmap. In today’s tech-driven market, they need stay update don what competitors are developing or launching, which features are gaining maximum traction, and where do opporunities exist for the product teams to explore and take advantage of.

With CI, teams can,

- Track competitor feature releases, patents, pricing changes, and user feedback

- Receive regular updates on product innovations, customer demands, UX changes, and hiring trends

- Identify gaps in competitor offerings versus one’s own and spot opportunities to differentiate

- Make informed decisions on whether to improve one’s product(s) or promote an alternative approach in the market to increase adoption

A strong competitive intelligence program directly supports product decisions. It helps them design superior products that are well-through-through, and compliant with market and customer requirements.

Customer Success

Customer success and account management teams are increasingly turning to competitive intelligence (CI) to retain and grow their client base. Winning a customer is just the start—retaining them is the real challenge, especially when competitors are actively trying to lure them away.

CI tools like Contify give these teams a clear edge by delivering timely insights into competitor moves, industry trends, and customer pain points. With this intelligence, Customer Success Managers (CSMs) can proactively address concerns, reinforce the value of their product, and spot upsell opportunities.

CI also helps CSMs speak their customer’s language—tracking key industry buzzwords, forum discussions, and evolving expectations – so they can engage in more consultative, relevant conversations.

For example, a tech company’s customer success team used CI to learn that a competitor was retiring a popular feature. They acted quickly to highlight their own equivalent offering, reassuring customers and creating an upsell opportunity in the process.

| “With competitive intelligence, customer success has become a competitive differentiator in its own right.” |

What are the benefits of competitive intelligence?

When implemented effectively, competitive intelligence provides multiple benefits to B2B organizations. Here are some of the top advantages and outcomes bsuinesses see from a strong CI program:

1. Informed executive decision-making

For C-level executives, CI delivers situational awareness that helps them to make better business decisions. Leadership can confidently craft strategies when they know how competitors are moving, how the industry is evolving, and where new opportunities or threats lie.

For instance, if competitive intelligence shows that multiple competitors are investing in artificial intelligence (AI) tools, the leadership can decide whether to accelerate their own AI investments or find an alternative niche to stay competitive. By leveraging curated competitive intelligence (often as monthly briefings or newsletters), decision-makers can avoid blind spots and plan a roadmap based on actual evidence.

2. Sharpening go-to-market (GTM) strategies

Competitive intelligence offers a continuous feed of market and competitor insights that help companies refine their GTM strategies. By understanding competitor positioning, market movements, and other essential dynamics, organizations can adjust their marketing and sales strategies to hit the right market segments with the right messaging at the right time and win deals.

CI also offers data-based information on which customer segments to target, which channels to prioritize and in which geographic regions, and how to differentiate one’s offerings to stay ahead. In practice, this often means reallocating budget to a region where a competitor is failing, or timing a product launch when a rival is working on building their brand reputation. The result is a GTM strategy that’s agile and tuned to the market reality rather than static or assumption-based.

3. Improving win rates

This is perhaps the most immediate and tangible benefit of CI, boosting sales win rates. When sales and customer success teams area armed with the right intel, they are far better prepared to win deals. Competitive battlecards, pricing comparisons, and objection-handing also becomes easy with competitive intelligence in one’s arsenal.

Organizations with a strong competitive intelligence culture also report that sales teams achieve higher win rates and close more deals than yesteryears when they depended on secondary information. With CI, reps can anticipate competitor tactics in sales cycles and counter them more effectively.

4. Enabling product innovation

Competitive intelligence drives product development with outside-in thinking. By calling attention to competitor product announcements and unserved customer demand, CI enables product managers to innovate where it matters most. Product teams leverage CI to make improved roadmap choices and develop better products, being better aware of market and competitor conditions.

For example, CI may uncover that all leading competitors are missing a specific integration, which customers are requesting, a golden opportunity for your product to pave the way. Or, CI may indicate that a competitor‘s new feature is not taking off in the market, meaning your money is being wasted elsewhere. This proof avoids wild goose chases and helps R&D investments return differentiators. CI also spurs innovation at a quicker pace – by monitoring tech trends and upstart startups, your firm can implement beneficial innovations ahead of time.

The benefit is a product roadmap that’s both responsive to the competitive environment and aligned with future market direction. In essence, CI guides your product strategy so you’re building for where the market will be, not just where it is today.

5. Strengthening brand positioning

In today’s crowded B2B market, a strong, distinctive brand positioning is critical. CI helps fortify your brand by shedding light on how competitors frame themselves and where there is white space for your messaging. By observing competitors‘ marketing terminology, value propositions, and customer attitudes, your marketing team can develop messaging that differentiates. Competitive intelligence enables marketers to develop more compelling messaging and campaigns that differentiate your brand from the competition contify.com. It keeps you from repeating a competitor’s message but instead emphasizing value differentiators that competitors can‘t legitimately provide.

CI on customer sentiment (for example, via review sites or social media) also allows you to align your brand with what customers really care about. It all adds up to improved market positioning and that makes it simpler for prospects to get why you‘re different and superior. Through time, a CI-driven brand can establish itself as a market leader, as it constantly refines its story to stay ahead of competitors. Consider how Microsoft has shifted its cloud offerings compared to Amazon AWS over the years by focusing on enterprise issues, definitely a product of customer and competitor narrative intelligence.

Defining the competitive intelligence framework

To realise the benefits mentioned above, organizations need a structured approach to build an effective CI program. One of the best ways to understand the CI process is through the Intelligence Cycle, a continuous process of planning, collection, analysis, dissemination, and feedback. Let’s look at this cycle and other key framework elements.

The Intelligence Cycle: Planning → Collection → Analysis → Dissemination → Feedback

Competitive intelligence is an on-going activity that turns raw data into actionable insights, Here’s how the five stages of intelligence cycle work in the business context.

1. Planning and Direction

The first step in any CI process is to define what insights your organization needs and how can it gather them. This involves setting clear objectives with broader business goals and identifying the “known unknown” factors. For instance, your organization may choose to monitor its top five competitors, emerging disruptors, and key industry trends. At this stage, it’s essential to define the scope of competitors and topics to track. You can define key intelligence questions or high-priority questions stakeholders need answers for, such as “What products are our rivals promoting or planning to launch in this quarter?”

A good CI planning ensures that your efforts are focused and relevant by asking: What business decisions are we supporting, and who will use this intelligence? This clarity helps set the necessary directions for the CI process.

2. Collection

At this stage, you gather information as de

In this phase, you gather information as defined in your CI plan. Secondary research, like monitoring news sites, social media, company websites, and regulatory filings—provides broad, ongoing awareness. It acts as an “early warning system” by surfacing potential threats and opportunities. Primary research, such as interviews with industry experts or insights from the sales team, delivers deeper, firsthand intelligence. Both approaches are essential: secondary offers scale, while primary adds depth. Modern CI tools like Contify automate secondary collection by aggregating and filtering updates from thousands of sources—building a comprehensive repository of relevant market and competitor signals.

3. Analysis

Raw data becomes valuable only when analyzed. In this stage, CI professionals (often with AI assistance) interpret the collected information to uncover insights and connect patterns. For instance, multiple competitors hiring for the same role could indicate a strategic shift. Techniques like SWOT or trend analysis help structure findings. Crucially, all insights should tie back to the Key Intelligence Questions (KIQs) set during planning. Deliverables may include competitor profiles or executive briefs. Effective analysis blends human judgment with automation—balancing scale and context to produce actionable intelligence.

4. Dissemination

The value of intelligence depends on how well it’s shared. Dissemination ensures insights reach the right people, in the right format, at the right time. This could mean newsletters for sales, battlecards via CRM, or real-time alerts on Slack. Tailoring content to stakeholder roles is key, executives need summaries, while product teams may require deeper dives. CI platforms like Contify enable automated, role-specific distribution across tools people already use. The goal is to push intelligence directly into workflows so it informs decisions without effort from the end-user.

5. Feedback (and Action)

The final phase closes the loop. Stakeholders provide feedback on whether the intelligence was useful and how it was used. This input helps refine future CI efforts and measure impact, whether it’s influencing a product roadmap or supporting a successful sales pitch. Feedback also reveals gaps: if stakeholders feel overwhelmed or underinformed, the CI team can recalibrate. Some teams build feedback into their regular updates, but it’s best treated as a formal step. Ongoing feedback drives continuous improvement and ensures the CI function remains aligned with evolving business needs.

What are the goals of competitive intelligence?

The ultimate goal of competitive intelligence is to empower your organization to make more informed and strategic decisions, thereby enhancing your overall business performance. This can be easily achieved by proactively identifying potential risks and uncovering emerging trends and opportunities before they become common and widely apparent.

| “Fundamentally, competitive intelligence aims to protect your business from being caught off guard by forces that could pose a threat to your success. “ |

CI serves as a critical component or tool for organizations to easily understand how their industry counterparts fit into the broader context of their organizational goals. This aids in achieving these objectives.

Competitive intelligence helps:

- Make strategic decisions that are backed by necessary evidence rather than conjecture

- Isolate and thoroughly analyze the industry trends that have a direct impact on one’s activity planning.

- Gather critical information around customer expectations alongside ongoing technological developments.

Ultimately, one of the key objectives of CI is to provide your business with the ability to study the strategic moves of their competitors and anticipate the future.

Strategic vs tactical goals of competitive intelligence

Competitive Intelligence operates at both strategic and tactical levels, each addressing different organizational needs and time horizons.

Strategic competitive intelligence is designed to help your company comprehend and respond effectively to long-term challenges. These could include significant technological shifts, broader marketplace dynamics, and unforeseen environmental shocks. It primarily focuses on providing a foundational understanding of the competitive environment to do high-level strategic planning.

Tactical competitive intelligence, on the other hand, is a more immediate and short-term process. It addresses the current needs and facilitates quick actions. It focuses on gathering information on the immediate activities of competitors, including recent product launches, ongoing marketing campaigns, adjustments in pricing strategies, and changes in operational decisions.

| Goal Type | Time Horizon | Focus | Examples |

| Strategic | Long-term | Broader trends, future opportunities/threats | Technological changes, market shifts |

| Tactical | Short-term | Immediate activities, current actions | Product launches, marketing campaigns, pricing changes |

While the two CI goals may serve different purposes, they ultimately highlight the versatility of competitive intelligence, giving organizations a 360-degree view of market and competitive intelligence.

Industry-wise examples of competitive intelligence

1. IT/ITes and Technology

Market and competitive intelligence play an important role in helping IT/ITeS and technology companies in shaping their product and service offerings. They rely heavily on product benchmarking to compare features, pricing and innovations across the offerings of their rivals. It helps them in refining their own product roadmaps. Furthermore, tracking patents and emerging technologies across the industry ensures they’re already aware of disruptive trends and adapt themselves accordingly.

Example in Action:

One of the leading global IT services companies leveraged Contify’s M&CI platform to monitor the marketing activities of its competitor. This enabled them to make smarter and faster strategic decisions in terms of informed content creation and identifying market gaps. The IT company saves nearly 12 hours weekly by automating manual tracking, leveraging the time to better market itself in the industry. Contify’s customized dashboards further provided real-time insights, helping the organization stay proactive and gain a competitive edge.

Read the complete case study: Global Leader In IT And Consulting Services Drives Its Marketing Decisions By Tracking Competitors’ Content Strategies

2. BFSI (Banking, Financial Services, and Insurance)

In the BFSI sector, companies leverage competitive intelligence primarily to monitor market shifts, track mergers and acquisitions, and anticipate changes in the competitive landscape. They also use CI platforms for generating leads and running sales enablement by monitoring competitors’ key account movements and product launches and enhance their sales strategies and customer engagement efforts accordingly.

Example in Action:

A California-based bank implemented Contify’s competitive intelligence solution to consolidate its intelligence feeds, resulting in a 35% reduction in manual research time and a 20% increase in qualified leads, empowering their sales team with timely, actionable data. (contify.com)

Read the complete case study: California-Based Bank Boosts Strategic Decision-Making using Contify

3. Marketing & Digital

Marketing teams too greatly benefit from M&CI tools like Contify. They can use it for content and digital benchmarking by monitoring the digital footprints of competitors, including website updates, social media activities, and online reviews. This helps them refine their own marketing activities and campaigns.

Most marketing teams also use M&CI for competitive positioning, understanding event participations, and customer engagements. This aids in analysing areas where they lag, where they can tap into, and adjust their brand communications for better audience resonance.

Example in Action:

An Illinois-based market research and consulting juggernaut improved its newsletter engagement by 74% after using Contify’s insights. It leveraged the platform to track competitor content and digital initiatives, and fine-tuned its messaging and campaigns to serve the needs and demands of its target audience.

Read the complete case study: How Contify’s Competitive Intelligence Solution Enables A Leading Market Research Firm To Improve Newsletter Engagement By 74%

4. Management Consulting

Most consulting firms need a market and competitive intelligence (M&CI) like Contify to continuously monitor competitor websites, including non-English sources and industry publications. This enables them to quickly identify new product or service offerings, shifts in market positioning, and track emerging trends. Moreover, they leverage the gathered intelligence to make smart custom reports and dashboard, further enabling consultants to advise their clients on best practices, identify competitive gaps, and make strategic pivots.

Example in Action:

A leading management consulting firm leverages Contify to automate the competitor tracking process across geographies and languages. It streamlines research and reduces manual analysis, thereby freeing the time of analysts and leveraging them for more critical work. This also allows it to accelerate decision-making and improve the overall quality of their client recommendations.

Read the complete case study: Management Consulting Firm Tracks Company Websites and Non-English Intelligence Sources To Maintain Competitive Advantage

5. Telecom

Staying agile is not a choice but a necessity for organizations operating in the telecom industry today. New technologies, partnerships, and pricing models emerge constantly and telecom companies ought to stay up-to-date. M&CI platforms like Contify provide real-time insights that help telecom companies remain informed, make faster, data-driven decisions, and maintain a competitive edge.

Example in Action:

One of the leading global aerospace and satellite technology companies wanted to speed up their technological innovations, improve their strategic decision support system, and plan better for the future. They utilized Contify’s tailored solutions, especially real-time alerts, to enhance business strategies and tactics, save time spent on manual information gathering, and help various departments to make calculated decisions. This ultimately enabled the company to improve its market responsiveness.

Read the complete case study: Satellite and Aerospace Company Elevates Strategic Intelligence with Contify M&CI Platform

6. Healthcare & Pharmaceuticals

Healthcare and pharmaceuticals are two of the most critical sectors of all. Companies leverage competitive intelligence to monitor competitors’ drug launches, clinical trial updates, regulatory filings, and patent activities, enabling timely adjustments in R&D and strategic planning. They also need such a tool to track government policies, safety protocols, and new treatment guidelines to ensure regulatory compliance and identify emerging market opportunities.

Example in Action:

A pharmaceutical company uses Contify to monitor competitors’ developments in rare disease portfolios, receiving real-time alerts on clinical trial updates and regulatory changes, which enhances its ability to strategically plan new product developments.

Read the complete case study: Pharma Company Monitors Competitors’ Rare Disease Portfolio Developments to Identify Opportunities and Threats Using Contify

Additional industry applications are as follows:

- Manufacturing & Energy: Businesses in these sectors use M&CI to monitor supply chain disruptions, new regulatory challenges, and technological innovations to ensure agility in product launches and production.

- Legal & Business Strategy: Firms in this sector primarily use M&CI to study competitor activities and benchmark performance metrics to draft strategic decisions, negotiate partnerships, and even manage risks.

- Retail & E-commerce: Retailers often use M&CI to monitor product launches, consumer feedback, competitor promotions, and pricing changes. This helps them optimize their merchandising strategies and respond faster to the market shifts.

- Energy & Utilities: M&CI solutions enable energy companies to keep an eye on competitor innovations in rthe enewable space, track regulatory updates, and what’s happening in the global market. This allows them to make better strategic plans.

- Logistics & Supply Chain: M&CI helps logistics companies to closely monitor global disruptions, analyze cost drivers, track competitor service innovations, and much more. This allows them to become more resilient, plan operations properly and maintain a competitive edge.

Conclusion: Embracing competitive intelligence for sustained growth

Competitive intelligence is a critical, multifaceted discipline. When combined with ongoing market assessment, it becomes a powerful strategic asset that every organization should have in its arsenal.

The benefits of a robust Market and Competitive Intelligence (M&CI) program are far-reaching. They enhance strategic planning, accelerate product development, improve marketing effectiveness, and elevate overall organizational performance.

In today’s highly competitive landscape, building a culture of intelligence, where understanding the market and competition becomes part of everyday decision-making, is not just beneficial, it’s essential.

By integrating market and competitive intelligence into your strategic framework, your organization can unlock sustained growth, foster innovation, and secure long-term success in a constantly evolving market landscape.