How AI-enabled competitive intelligence solutions can drive informational advantage

What is an informational advantage?

Having an informational advantage means you have access to data that your competitors don’t have. It means you are leveraging a differentiated dataset of information to make inferences that your competitors may not. This is easier said than done! One way to develop such an information advantage is by integrating information from all possible sources.

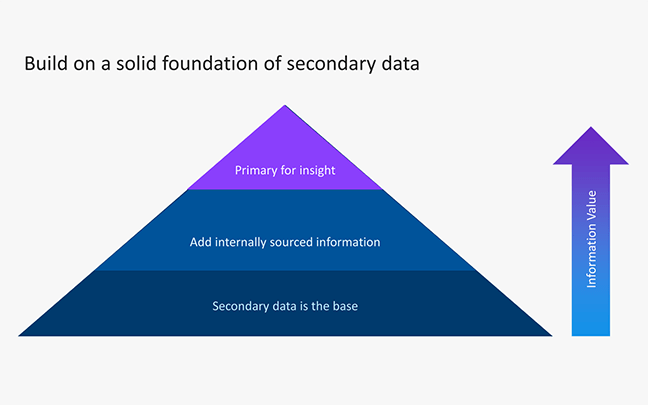

In our experience, effective competitive intelligence integrates information from both primary research and secondary monitoring. The secondary monitoring provides a comprehensive overview of the market and competitive landscape. It works as an early warning system and surfaces signals that indicate potential threats or new opportunities. Result-oriented competitive intelligence teams discover these signals from secondary monitoring and then validate their credibility using primary research.

This process gives a holistic view of the competitive landscape from a broad level (secondary) down to a narrow level (primary). It creates a gap between the information that is available with the effective competitive intelligence teams and those who rely only on either primary research or secondary monitoring, or those who don’t integrate them. Using informational advantage, competitive intelligence practitioners can not only identify but also recommend an effective strategic response to potential competitive threats.

What type of information is available from primary research and secondary monitoring?

It’s important to note that the information that you can find through one is often not directly available through the other. Each type of information has unique advantages and purposes.

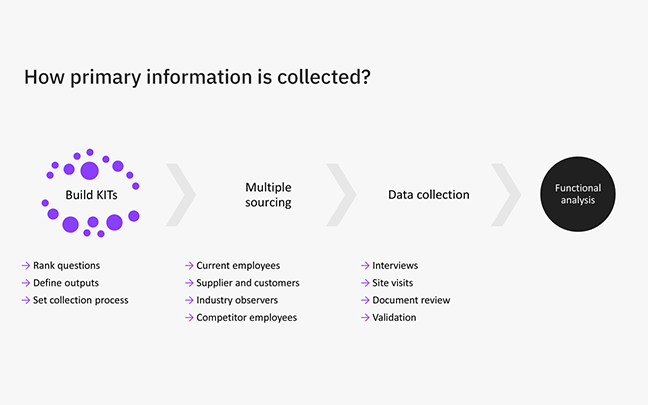

Information from Primary Research

Information from primary research is targeted. That is, the collection strategy and methods for primary information are designed to answer specific questions. These specific questions are sometimes called ‘Key Intelligence Questions’ (KIQs) or ‘Key Intelligence Topics’ (KITs). Primary information is collected through direct interaction (interviews, telephone calls, in-person meetings, surveys, focus groups, and tradeshows) with the persons who have the information. These could be your suppliers, customers, current or former employees, subject matter experts, or analysts. These could also be your internal employees. If you search your employee database, you might find employees who have worked in the past with one or more of your competitors.

Information from Secondary Monitoring

Secondary information collection is broad. Usually, the purpose of secondary monitoring is to develop awareness about the competitive landscape, not answer any specific question. This information is collected from open sources such as news/company/government/regulatory websites, job portals, trade publications, review sites, discussion forums, social media, and more. This information is used for developing intelligence newsletters for the management teams and also for trend analysis.

What are the challenges of collecting and using primary information?

Collecting primary is often time-consuming and difficult as compared to secondary information collection. It requires a planned, systematic approach and needs an aggressive, process-driven outreach approach, to identify the right contacts and secure the interviews. Not enough interviews, lack of corroboration, paying sources ethically, inconsistent data collection standards, the context of data collection, lack of quality assurance processes, changes to definitions and policies, and maintaining data comparability are some of the key challenges of collecting primary information. One of the challenges in using primary data is that it is often difficult to validate the information from multiple sources.

What are the challenges of collecting and using secondary information?

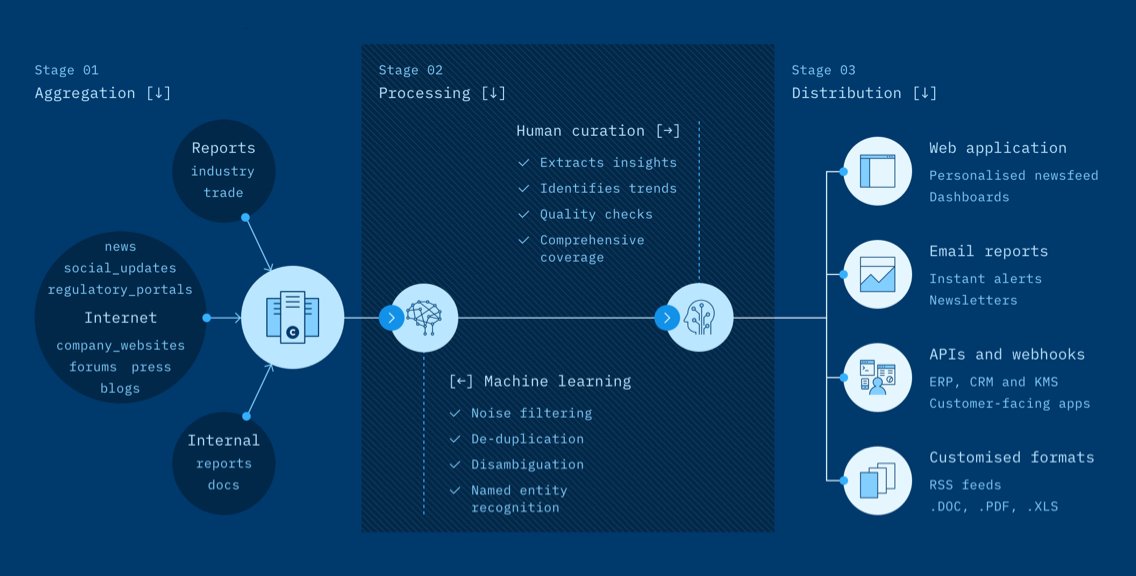

The Internet has a plethora of secondary information but, unfortunately, useful intelligence is buried under the ocean of irrelevant and duplicate information. It requires extensive internet crawling infrastructure to detect changes and aggregate updates across hundreds of thousands of websites. Even after collecting secondary information, it’s impossible to review it manually. It requires a sophisticated AI-enabled competitive intelligence tool that can understand the subjective context of the information by leveraging advanced machine learning and also need contextual noise-filtering algorithms to deliver high-precision market and competitive intelligence.

Read our blog on ‘Behind the scenes of a market and competitive intelligence platform,’ to understand how an AI-enabled market and competitive intelligence platform works to aggregate information and extract relevant secondary information including the subjective context of the data.

Though Artificial Intelligence helps in capturing the competitive intelligence that matters most, it is not always accurate in understanding the subjective context. Therefore, in our experience, the best approach for competitive intelligence secondary monitoring is a hybrid system, where information collated by the AI-enabled market intelligence platform is curated by human analysts to check its relevancy. The idea is to use machines where they are good at, which is processing a large amount of information, and use the human mind where we excel, which is understanding the subjective context of information.

How to integrate primary research with secondary monitoring?

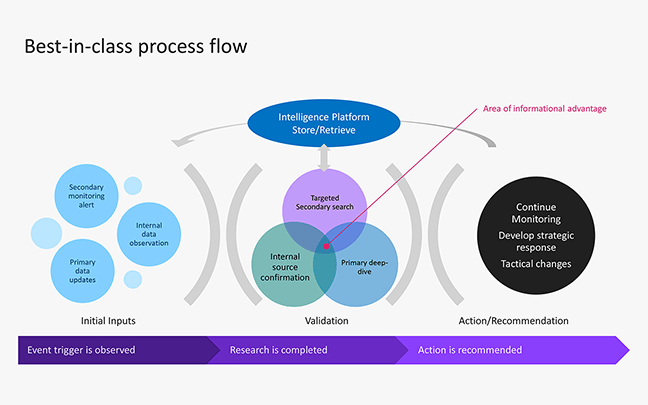

Best in class competitive intelligence teams integrate primary research with secondary monitoring to create an informational advantage.

The process starts with a trigger event, which can come from any source such as secondary monitoring (press announcement by a competitor); or from an internal source (your sales teams); or a primary source (trade show). This trigger event initiates the best-in-class competitive intelligence workflow. Typically this starts with the targeted secondary research. If the trigger event is validated as a potential threat or an opportunity, this leads to the deep dive primary research. The data set that is aggregated from secondary and primary sources gives that unique information advantage that enables competitive intelligence teams to generate unique insights, better analysis, and stronger recommendations.

Encapsulating all this intelligence, it’s important to have a technology platform that makes it available to the user at the right time.

This process is iterative. At the end of the investigation of the trigger event, there will be new inputs for the next round of the process flow. It could be a refinement of the information or identification of new trigger events. Therefore, the market and competitive intelligence platform is essential to enable centralized storage and retrieving intelligence.

Download M&CI Process Template

Conclusion

Secondary monitoring is ongoing. It answers three key questions: Who’s doing it? What are they doing? Where are they doing it? It’s an important part of understanding what’s going on in the market? Whereas, primary research gets information that’s not available through secondary. So, while secondary does get at the ‘who’, ‘what’, ‘where’, primary answers the ‘how’ and the ‘why’ of competitive intelligence, that is the strategic drivers of the developments in that market landscape.

The combination of primary research and secondary monitoring synthesizes competitive intelligence to support strategic planning and business development initiatives. The integrated insights generated enable businesses to make informed decisions leading to outcomes such as increased market share, awareness of competitor strategies, and quick response to competitive threats. Technology-based market intelligence platforms such as Contify helps in creating institutional memory. It ensures that what is learned in the previous months doesn’t have to be re-learned in the coming months.

This blog is co-authored by Mohit Bhakuni, CEO at Contiy, and Erik Glitman CEO at Fletcher/CSI.