Market and competitive intelligence challenges

An M&CI program is an amalgamation of two similar processes, namely the market intelligence process and the competitive intelligence process. Following the best practices involved in both these processes can yield a robust M&CI program. A well-thought-out M&CI program consists of three main processes.

- Collection: You gather information on the market, customers and competition.

- Processing: Insights are gleaned from this aggregated information by your analysts, which are then used to answer specific business questions or challenges.

- Distribution: The strategies are communicated to everyone involved in their execution, and then actions are taken based on them.

However, the M&CI program at organizations is often less than ideal due to a lack of understanding of M&CI best practices, outdated M&CI strategies, a lack of M&CI tools or software, or unwillingness to invest in one.

Some key factors contributing to inefficiencies across all three phases are:

- Collection: Information is distributed across multiple sources on the Internet – news websites, company websites, social posts, job boards, customer review sites, regulators, government websites, etc. It is inefficient to check and collate information on a regular basis manually.

- Processing: Manually reviewing unstructured information to identify patterns and storing them in folders makes it difficult for users to find information, and manual report creation leads to inefficiency. Besides, M&CI professionals are inundated with ad-hoc requests from different stakeholders, some of which don’t merit their involvement.

- Distribution: The intelligence must be distributed according to the business context and stakeholders’ roles, functions, and objectives. M&CI professionals are responsible for ensuring their colleagues have access to the right data at the right time. Without a tool, it is difficult to package the intelligence according to the stakeholders’ context. This results in stakeholders receiving intelligence that is either not appropriately packaged for their context or completely irrelevant to their role or function. This adds inefficiency not just for the M&CI teams but for all the stakeholders.

This blog will explore in detail the reasons for inefficiencies and some of the best practices to eliminate them so that you and your stakeholders can get the most out of your M&CI program. Let’s start by understanding the four leading causes of inefficiencies:

Reasons for Inefficiencies in M&CI Programs

The inefficiencies can be attributed to only one external reason but three internal ones.

1. Inefficient Data Collection Process

The data or information you collect will determine the effectiveness of your M&CI program, which is why it is imperative that you gather high-quality data from a variety of sources. However, collecting information on markets, competitors, and customers is where a number of organizations face challenges.

The reason for challenges is that digital (internet) has become the primary source of market & competitive intelligence. However, the medium’s distributed nature forces M&CI professionals to collect information by manually visiting multiple sources.

Manual data collection at the internet scale is not only humanly impossible but also a highly inefficient use of your time and resources. Technology has advanced a lot since the days of traditional intelligence gathering, and modern organizations use competitive intelligence software to collect data.

Additionally, the credibility of online information sources needs to be manually authenticated for data quality. Inaccurate or outdated information can lead to flawed decision-making.

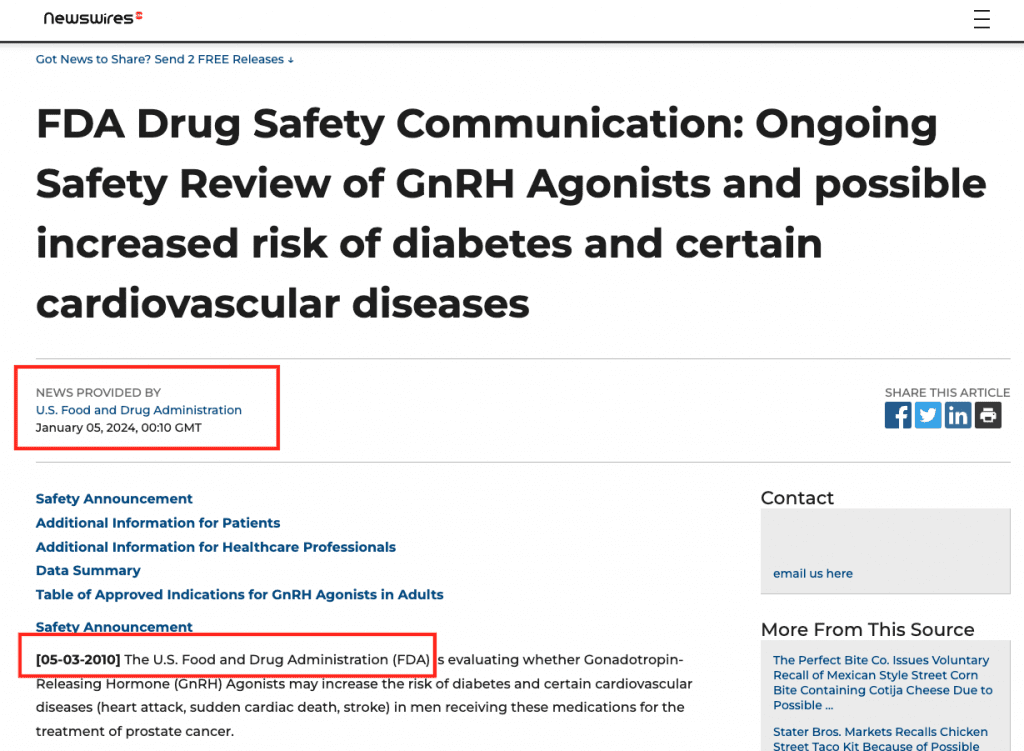

For example, a reputed press release agency recently published an important announcement from the FDA. The announcement was about the FDA reviewing certain prostate cancer medications for increased risk of diabetes and heart attacks. This was a serious update for pharma companies producing prostate cancer drugs. After careful manual review, it was realized that the announcement was fourteen years old. Maybe because of some technical issue, the announcement was republished by mistake.

Due to manual processes, M&CI teams face increasing inefficiency, as the bulk of their time is spent finding and processing data. This leaves insufficient time to analyze data, limiting the depth of value and breadth of coverage. As the volume of global data is expected to escalate to over 180 zettabytes by 2025, manual information collection and verification inefficiencies are set to continue reducing the effectiveness of M&CI programs.

Sometimes, problems in your M&CI process regarding data collection might not be as apparent. Here are some signs which indicate that you need to improve your data collection efforts.

- There isn’t a fixed process or time to collect intel. It is collected infrequently or on an “as-and-when-needed” basis.

- Poorly defined market segments, competitors, products, or topics of interest (to track)

- Major updates from the competition and the market are frequently missed or reported too late to take action.

- Insights on significant industry news, trends, and innovations are missed or overlooked.

- Emerging competitors or potential adversaries go unnoticed until they make major news.

If any of these signs seem familiar, your M&CI program suffers from a huge gap regarding data collection, and you need to invest in a market and competitive intelligence tool or software that automates the collection of actionable information.

2. Lack of Clearly Defined Objectives

Without clearly defined goals and objectives, M&CI teams collect everything on all competitors without any criteria for filtering and analysis. The indiscriminate data collection results in information overload and hinders the team’s ability to prioritize information for analysis.

The lack of clear goals also makes it difficult for the team to package insights with the appropriate context, limiting their ability to deliver actionable intelligence to their stakeholders.

Most M&CI programs fail because their objectives are unclear. If appropriately used, M&CI programs lead to strategic agility, which is the organization’s ability to make strategic decisions with confidence and adapt to changing market conditions with minimal disruptions.

However, there is a reason stakeholders find it difficult to set clear objectives for their M&CI program. John Horn, author of the book “Inside the Competitor’s Mindset,” says, “As business leaders, we’re taught to control things we can control. We can control internal operations, marketing plans, and what we do as a company, but we can’t control competitors. It is scary for business leaders to think about something out of their control or influence. That is why it is hard for them to think about competitors.”

This could be one of the reasons it is difficult for business leaders to define clear goals and objectives for their M&CI program.

3. Lack of Resources

M&CI programs often suffer from inefficiency due to a lack of appropriate resources. An effective program requires resources with specialized skills and expertise in market research methodologies, competitive analysis, and the latest tools and technologies. The resources need appropriate investment in ongoing training of best practices, tools, and technologies.

However, even with a team of qualified professionals, the absence of modern tools can cripple the program’s effectiveness. Without M&CI software, the program will struggle to achieve efficiencies, leading to valuable data being underutilized. This underutilization directly impacts the program’s ability to support decision-making processes.

4. No Internal Champion

M&CI teams must collaborate with other departments, such as marketing, sales, and product development, to ensure intelligence initiatives align with the overall business strategy. If the team operates in isolation, valuable insights may not be communicated clearly and promptly to decision-makers. Timely and effective communication is vital for turning intelligence into actionable strategies, ensuring the efficiency of M&CI programs.

An internal champion or executive sponsor of the M&CI program from among the ranks of senior management ensures appropriate resource allocation, collaboration, and consistency in reporting format and frequency. The internal champion promotes the role of the M&CI team in the organization, ensuring insights are effectively utilized. Without an internal champion, the enabling factors for an effective M&CI program are missing, leading to inefficiencies.

How to Fix Inefficiencies in The M&CI Program

Inefficiencies in the M&CI program originate from not setting the expectations and defining goals for the program. An M&CI program has multiple stakeholders across the organization. M&CI teams and stakeholders are collectively responsible for setting clear goals for their M&CI program. But it is easier said than done.

How can stakeholders define goals when they prefer not to think about competitors they don’t control, they don’t know the sources M&CI teams have access to, what information exists at them, or what could be available in the future? Stakeholders cannot help define the information the M&CI team should look for. But they are absolutely clear about their objectives — because their bonuses depend on them. These objectives hold the key to eliminating inefficiencies in your M&CI program.

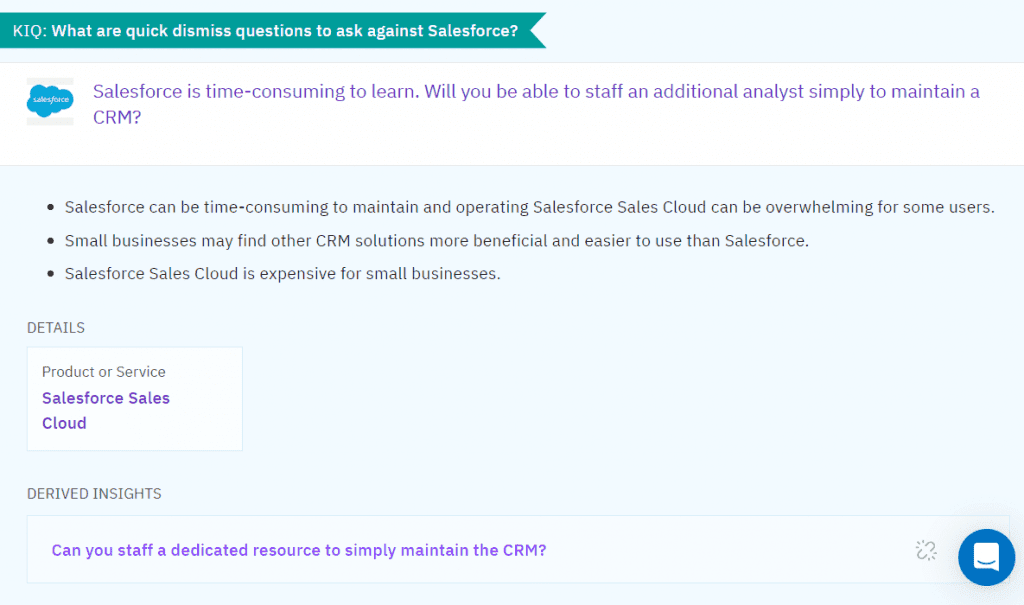

The M&CI team should be able to reframe the stakeholders’ objectives as questions. What information is required to support those decisions? What questions do you need answered to find that information? The answer to eliminating inefficiencies lies in these questions – the key intelligence questions (KIQs).

Align M&CI and Stakeholders With KIQs

Innovation expert Warren Berger says, “We know that the art of asking questions is at the heart of discovery in science, philosophy, medicine—so why don’t we extend that power to all areas of our lives?” He adds, “One of the most powerful forces for igniting change in business and our daily lives is a simple tool – Questioning.”

The alignment between the M&CI teams and Stakeholders starts with developing intelligence questions. The most important thing to eliminate inefficiencies in M&CI programs is to develop good KIQs.

These KIQs are fundamental to aligning the M&CI program with stakeholders’ goals and priorities, ensuring the program addresses specific business objectives. KIQs serve as the compass for M&CI programs, guiding efforts toward collecting pertinent data, analyzing it purposefully, and ultimately contributing to informed decision-making.

KIQs require effective stakeholder interaction, an understanding of the competitive landscape, and key assumptions of our stakeholders. M&CI teams should engage stakeholders through interviews and joint sessions to define KIQs and identify strategically relevant topics and sources to monitor.

Successful M&CI professionals are clear about the KIQs of their stakeholders. On the other hand, the lack of KIQs limits the program’s ability to deliver actionable intelligence.

Collect Data Efficiently

M&CI professionals are challenged with constantly evolving information sources on the internet. KIQs help them select the right sources, filter out irrelevant information, and maintain the program focus. They need to update their data collection methodology and tools periodically. Because their existing tools might not be able to fetch data from modern websites such as user reviews or job boards. Using outdated tools or failing to leverage the latest technologies for information collection and analysis limits the efficiency of their M&CI program.

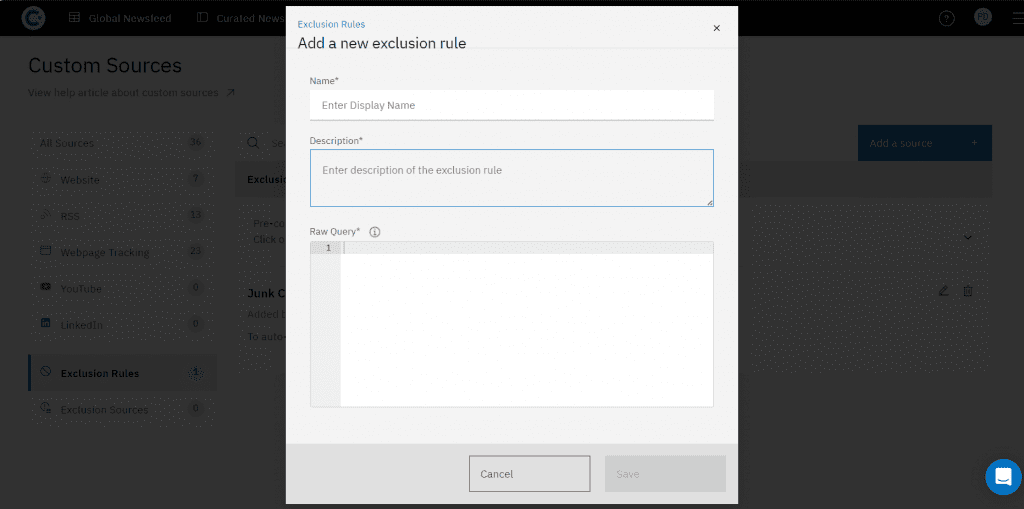

The tools that M&CI professionals use must be able to add new sources, exclude sources, and allow them to write specific rules (advanced queries) to exclude certain kinds of information.

Moreover, the tools should capture both primary and secondary intelligence to provide comprehensive insights. Primary intelligence collection enables organizations to collect real-time information from customer-facing teams such as sales reps, trade show attendees, and customer support executives.

Users should be able to add primary intelligence directly through traditional emails and modern communication platforms such as Slack or MS Teams. The primary intelligence must integrate seamlessly with the existing repository of secondary intelligence, providing users with a centralized single source of truth for all their intelligence needs.

Process Intelligence Efficiently

KIQs, the cornerstones in the M&CI program, play a central role in processing intelligence. They enable the M&CI team to align their intelligence processing efforts to the objectives of their stakeholders.

The central M&CI repository primarily includes unstructured data, which must be organized to enable stakeholders to derive actionable insights in the right format at the right time. The applications of the science of taxonomy in the M&CI platform are essential for storing, indexing, and retrieving intelligence. The platform should systematically organize intelligence according to relevant categories based on the KIQs for easy search and retrieval.

Therefore, the M&CI platform should allow organizations to build a custom taxonomy that reflects their organizational structure, strategic objectives, and KIQs. In addition, it should be easy to make changes because the competitive landscape evolves continuously.

The system should allow the normalization of the information collected across different sources and formats—for example, varying product names, features, business segments, etc. The system should use ML (machine learning) to auto-tag the information with related companies, topics, industries, locations, etc.

The platform should leverage LLM (Large Language Models) for efficient qualitative analysis of unstructured data. For example, it can help organizations analyze customer reviews of their competitors and present the insights as a consolidated battle card that saves their M&CI team significant time and effort.

Distribute Intelligence Efficiently

Again, KIQs, the cornerstones in the M&CI program, play a central role not only in collecting and processing but also in packaging and distributing intelligence. A piece of intelligence is actionable when stakeholders can use it to answer their KIQs.

The platform protects stakeholders from information overload from news, blogs, reviews, social posts, and more, guiding their decision-making with relevant insights based on their KIQs.

It is important the platform should integrate with popular communication & collaboration tools like Slack and MS Teams to make insights and analysis accessible to stakeholders where they work. For example, the integration with Slack enables intelligence professionals to share their work and inspire collaboration across marketing, sales, customer success, product, and leadership teams.

The platform should provide automated instant alerts based on the user preferences and taxonomy configuration.

Users’ personalized dashboards should get auto-updated as new intelligence is collected and processed. It should offer unified access to insights to everyone across the organization, enabling them to efficiently bring themselves up to speed on the market and competitors.

M&CI platforms like Contify serve stakeholders across all business functions, so integration with other platforms is central to their product strategy. It provides stakeholders insights relevant to their business function, such as tactical information and intel to the sales team that help them win new clients. Similarly, marketing needs to know competitors’ positioning, while the product team needs strategic market intel to help them develop their product roadmap.

Allocate Appropriate Resources

It would be unfair to expect the M&CI program to deliver results without providing the necessary resources. You need to have a well-trained team based on the scope and expectations of your M&CI program. They must leverage innovative technologies such as Generative Artificial Intelligence (Gen AI) and advanced analytics platforms. It is essential for an organization to staff its M&CI program with qualified resources and invest in talent development through continuous learning for long-term success.

It is not possible to run an efficient M&CI program without modern software designed specifically for M&CI. Therefore, it is essential for an organization to staff its M&CI program with qualified resources and invest in talent development through continuous learning for long-term success.

The modern M&CI platforms have intuitive UI and are easy to use, enabling stakeholders to access the platform directly and self-serve basic intelligence needs, such as an updated competitor profile or product benchmarking,

The modern M&CI platform leverages advanced Artificial Intelligence (AI) to filter out the noise and ensure only the relevant information enters the platform and is appropriately categorized. Automated data collection, monitoring, analytics, and sharing features are table stakes in modern CI platforms. It uses Gen AI to generate automated qualitative insights.

The organization should hold a workshop for their users to get familiarized with the platform so that they can self-serve.

Conclusion

Organizations must clearly define their M&CI program’s scope and role to become more agile. With the right M&CI platform and strategy, your M&CI program can eliminate inefficiencies so that you can focus on the analysis, impact, and implications of the new information. AI-enabled market and competitive intelligence platform Contify make your M&CI program efficient across the value chain from intelligence collection to distribution.

Contify democratizes intelligence from analysts to business users via an intuitive self-service portal. It boasts a range of capabilities that empower businesses across various industries.

For more information on how Contify can revolutionize your business intelligence strategies, contact us today!

Frequently Asked Questions

What are the biggest challenges in market & competitive intelligence?

Businesses often struggle with fragmented data, outdated insights, and difficulties with integrating intelligence into decision-making. These challenges can lead to ineffective strategies and missed opportunities. Contify, a market and competitive intelligence platform, addresses these pain points by aggregating data from multiple sources, delivering real-time insights, and fostering collaboration across teams. With a centralized intelligence platform, businesses can make faster, more informed decisions and maintain a competitive edge.

How can businesses overcome data overload in competitive intelligence?

With the vast amount of market data available, filtering relevant insights can be overwhelming. The best way to manage this is by leveraging AI-driven platforms that can automatically analyze, prioritize, and extract critical insights. Contify’s AI-powered platform cuts through the noise, delivering the most relevant and contextual intelligence. This saves countless businesses hours and enables them to focus on strategy rather than sifting through excessive information.

What role does AI play in solving competitive intelligence challenges?

AI enhances intelligence by automating data collection, improving accuracy, and generating actionable insights.

AI transforms competitive intelligence by automating data collection, enhancing accuracy, and providing deeper insights. It enables businesses to track competitors, monitor industry trends, and predict market shifts with greater efficiency. AI-driven platforms like Contify are adept at aggregating and analyzing vast amounts of data and ensuring that only actionable, timely, and relevant intelligence reaches businesses to stay agile in dynamic markets.

How can businesses convert competitive intelligence into actionable strategies?

To maximize the value of competitive intelligence, businesses must align insights with strategic goals and integrate them into their decision-making processes. Platforms like Contify facilitate this by offering custom dashboards, automated reports, and seamless integration with business systems, ensuring that intelligence is both accessible and actionable. By using real-time insights, companies can refine pricing, adjust marketing campaigns, and anticipate competitor moves effectively.

What industries benefit the most from market & competitive intelligence platforms?

Industries with rapidly evolving landscapes, such as product marketing, banking & financial services (BFSI), IT, and manufacturing, benefit the most from Market and Competitive Intelligence (MCI) platforms like Contify. These sectors face constant innovation, regulatory changes, and shifting customer demands, making real-time market awareness essential. Any industry that relies on timely, data-driven decision-making will see substantial value from a robust intelligence platform.